As noted in the rules at the beginning of this forex trading tutorial, currency trading is all about improving the “50/50” odds in your favor by finding trends and anticipating when they might repeat a familiar pattern of behavior. When you find one of these high-percentage opportunities, you want to execute your plan quickly. There is no time for studying the situation and developing a new plan on the fly.

Your lot size must be predetermined, place a stop-loss order when you establish your position, and then evaluate when to exit, based on how the market behaves afterwards. If the market reverses, get out and minimize your loss. If it dawdles along or goes as expected, watch for predetermined exit points to decide when to close your position. Forex trading is just that easy!

Some traders even paste their step-by-step plan on their computer screen, so as not to forget any salient point. Let’s start now to develop your first trading plan:

Timing is everything, as we often say about life, but it also applies to forex trading in spades! Your goal is NOT to see how many trades you can do in a day – it is to wait patiently for your optimum times for entry, and then strike while the iron is hot. Do not get impatient! Failure waits for those that rush. Opportunities are always forming and changing, just like the weather. The best times to trade are when the ATR and volumes reach higher than average levels, indicating more activity and liquidity.

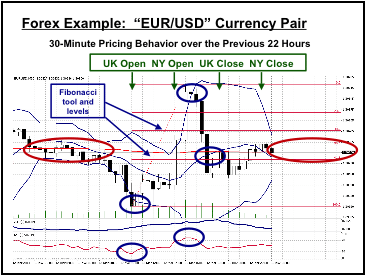

The chart above is a typical day in the forex market and is a perfect example for our initial strategy development. Most of the real action in the market occurs when London and New York are open for business, indicated by the “green” box inserted above the chart. Our strategy is a popular one referred to as the “Range Expansion Reversal Strategy”, essentially an expectation that wave movements eventually revert back to their mean average after the impact of an external force has dissipated.

Observe the candlesticks in the above chart – notice how they resemble a rope that you may have jerked. The wave moves from left to right, then reverts back to the mean, a process known in science as damped oscillation. Technical analysts have applied these principles to market theory with great success.

From a fundamental perspective, the European Central Bank was to make an interest rate decision two days hence. Under these conditions, markets tend to expect the worst and react wildly to leaks to the press. There is opportunity in chaos! When you see a long period of cautiousness, noted by the “red” oval on the left, followed by a dip that is your signal to get ready. The market sold off, creating an “oversold” condition on the RSI, a signal that a Long-Euro entry position was warranted.

When London opened, a positive leak sent the market into a frenzy. With a forceful move like this, momentum will always carry prices beyond the mean average, usually denoted by the value of the 100-EMA, the curving “red” line in the middle of the chart. At some point, the market might reverse, as it did here, and move back down to the mean. It is very helpful to apply the Fibonacci tool to the rise, as shown, to determine expected support and resistance levels down the road.

Traders and software robots take note of these levels as potential guideposts. You also need to be aware of where they fall. These levels suggest where you will want to exit the market and book your gain. The pricing behavior, this go round, reacted again as expected, passing the mean, but then reverting back towards it in anticipation of the New York close.

This action happened over one 12-hour period and offered two excellent opportunities for an individual trader to profit from its predictable movements during the day. The next lesson will focus on how to execute your disciplined plan of attack.

More Free Forex Lessons

subscribe to get a FREE BONUS LESSON, plus course updates, trade ideas and market news - straight to your inbox

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.