With any type of business, there are inevitably costs involved in day-to-day operations. These costs need to be accounted for to determine the profitability of a business. Trading in the forex market also has costs that beginner traders need to be aware of and account for before they start trading.

Businesses outside of trading have different costs they have to deal with, for the retail forex trader the main cost is the commission.

At the airport you would be charged a fee for exchanging your country’s currency for a foreign one. The same principle applies when you are trading in the forex market

In this article we will explain the explain what is a commission. We will also discuss the different types of commissions and fees commonly applied by forex brokers.

The Parties Involved in Forex Trades

Before we discuss what a forex commission is, we first need to define the two parties that are involved when it comes to transacting in the forex market.

The first party involved in a forex trading transaction is you, the retail trader. A retail trader is simply defined as an individual trader who speculates with their own money for personal gain and does not trade on behalf of an institution.

The second party involved in a forex transaction is your broker. A retail forex broker essentially provides a trader with access to a platform for the sole purpose of buying and selling foreign currencies for speculative purposes. Forex brokers therefore act as the middleman between you, the retail trader, and the forex market.

The fees that brokers charge in order for you to trade the currency market are referred to as the forex commission. Without a broker, a retail trader will have no way to trade the foreign exchange market, which is why brokers charge commissions for providing access and the convenience to participate in currency trading.

Forex Commissions Explained

The forex commission is automatically deducted from your trading equity when placing trades via your trading platform. Knowing upfront how much these costs are is an important consideration that might impact your particular trading style.

For example, scalpers generally execute multiple trades a day. It is important for them to make sure that the commissions they pay do not eat into the profitability of this style of trading. It would therefore make sense that a scalper chooses a broker that offers very small commissions.

Swing traders, on the other hand, will typically hold their positions anywhere from a few days to several weeks. This means they will be less worried by trading commissions as they trade less frequently.

In the end, forex commissions can be compared to your business ‘overheads’. Make sure to factor in these costs when determining your overall strategy.

The Bid-Ask Spread

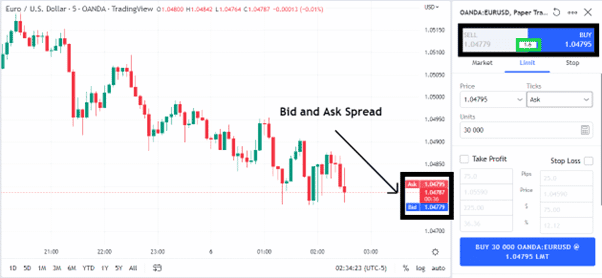

Before we take a closer look at the different forex commission types that brokers may charge, we first need to recap what a spread is. The spread refers to the difference between the bid and ask price of a forex pair.

Let’s say that you see the following quote on your trading platform: ‘EUR/USD – 1.0525 – 1.0527.’ The difference between the two quotes (the bid and ask price) represents the spread, which in this example will be two pips.

Image for illustration purposes only

The bid and ask spread are the two quotes provided by your broker for selling or buying a currency pair. The chart image above shows the quoted bid and ask prices for the EUR/USD forex pair on the price scale, and in the order window on the far right.

In this example, the difference between the bid and ask prices was 1.6 pips, as marked with the green box in the order window.

Forex brokers make their money by either charging a commission or a spread for each trade in return for executing your buy and sell orders.

Fixed, variable and Percentage-Based Spreads

Not all forex brokers have the same commission structure and can charge their fees in one of three ways: a fixed spread, a variable spread, or a commission based on a percentage of the spread.

A fixed spread is the simplest type of forex commission to understand. The broker quotes a bid and ask price for a currency pair, and its commission is the difference between those two prices. For example, if the EUR/USD bid price is 1.1050 and the ask price is 1.1051, the spread would be 1 pip and the broker’s commission would be $0.10 (1 pip x $0.10 per pip).

A variable spread is similar to a fixed spread, but the bid and ask prices can vary depending on market conditions. Lets look at the EUR/GBP, and say the bid price is 0.8590 and the ask price is 0.8591 in normal market conditions. The bid and ask prices spike to 0.8650 and 0.8660 respectively during a period of high volatility. This means the spread would be 10 pips and the broker’s commission would be $1 (10 pips x $0.10 per pip).

The third type of forex commission is based on a percentage of the total trade value. For example, if you’re buying €100,000 worth of EUR/USD at 1.1000 with a 0.1% commission rate, then your broker’s commission would be €100 (100,000 euros x 0.001).

Please note that the above commission amounts were used for explanation purposes only and can vary from broker to broker.

Additional Fees

As well as the spreads and commissions discussed above, forex brokers may also charge additional fees. These can cover things like payment processing fees for deposits and withdrawals, fees for account inactivity, margin calls etc.

While some forex brokers may charge for some or all of the above mentioned fees, others may not charge these fees at all. Always check the ‘small print’ with regard to broker fees and forex commission before you sign up and start trading.

Related Articles

Conclusion

Whichever type of commission is applied by your broker, these costs should be accounted for in your overall strategy. Think of this as the cost of doing business as a forex trader.

It is advisable that a novice trader takes the time to research different brokers so that the commissions and/or additional fees are known before opening a forex trading account.

Not all brokers are created equal, which is why it is best to sign up with a reputable and regulated broker. Should anything be unclear with regard to a broker’s exact commission structure and fees, reach out to its support team for clarity. This way, you should be able to avoid any nasty surprises.

Don’t Trade Before you see this!

We consulted our team of experts and put together 10 tips to help improve your trading.

These tips could help make you a better trader – and we’re giving them away for free!

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.