When it comes to the forex market, there is a lot of specialised terminology that can be difficult for beginner traders to wrap their heads around. Taking the time to understand key forex concepts is essential and will help novice traders to make better-informed trading decisions.

The purpose of this article is to discuss one specific yet important term used when buying a currency pair as a retail trader, namely the ask price definition.

Understanding How Forex Pairs Are Quoted

Unlike a stock or commodity, trading in the forex market is done in pairs. This is where some confusion can set in for a novice trader, because two different currencies are traded at the same time.

Understanding the ‘mechanics’ of what happens to each individual currency in a pair when a trader decides to open a long position (buying a forex pair) is important to understand.

So, before we look at the ask price definition, we first need to discuss how forex pairs are quoted.

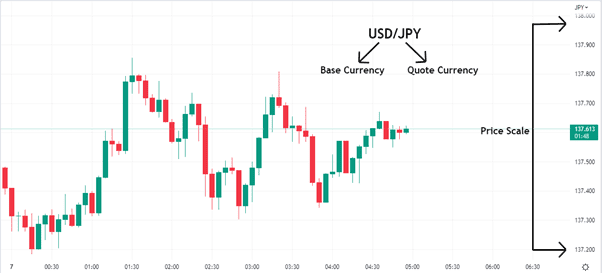

Image for illustration purposes only

The image above shows the USD/JPY on a trading chart, which is one of the major forex pairs in the world of currency trading.

Most trading platforms will refer to each available forex pair as a symbol. In this case, the symbol USD/JPY is an abbreviation of the US dollar and Japanese yen currencies paired together.

In forex terms, the currency on the left is called the base currency, while the currency on the right is called the quote currency. When a forex pair is loaded onto a chart, the price that appears on the right-hand scale shows how much of the quote currency will be needed in exchange for the base currency.

With this example, the USD/JPY was trading at a price of 137.613 at the time, meaning that it would have cost 137.613 Japanese yen in exchange for 1 US dollar.

If the price of the USD/JPY moves higher, it simply means that the US dollar will gain in value versus the Japanese yen, while a decline in price will result in the US dollar depreciating in value versus the Japanese yen.

Price movement in one currency relative to the other currency forms the basic foundation of understanding forex pricing. This is especially important if a trader wants to formulate an opinion about whether they should be buying or selling a forex pair.

For example, let’s say that the Federal Reserve in the US decides to raise its interest rates. This decision could impact the US dollar. Should a forex trader then believe that the US dollar will strengthen following such an important economic decision, they may decide to buy the USD/JPY as a whole.

Buying At the Ask Price

Now that we have discussed how currency pairs are quoted and how price fluctuations impact each currency in a pair, it is time to move on to the ask price definition.

As a retail trader, there are always two parties involved with every trading transaction: yourself and your forex broker. Understanding what an ask price is will be easier if you know what happens from both your perspective and your broker’s perspective during a trading transaction.

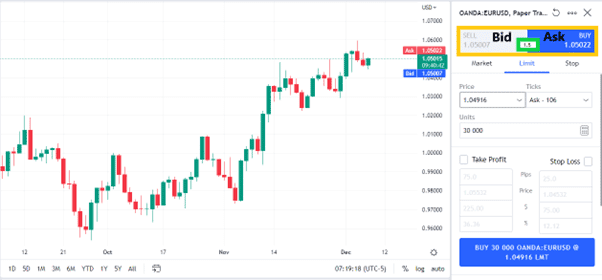

Image for illustration purposes only

The ask price displayed on your trading platform’s order window is the price at which you can buy a forex pair when you believe that the pair will move higher.

As your broker will also be involved in the transaction, your broker sells at the ask price. Remember that for every buyer, there needs to be a willing seller and vice versa.

In a nutshell, the ask price is the price at which your forex broker will be willing to sell the base currency in exchange for the quote currency.

Our next chart example above shows the quoted bid and ask prices for the EUR/USD forex pair on both the price scale and the order window on the far right.

If you were to buy the EUR/USD, you would need to click on the ask price in the order window, select your order type, determine your position size, and place your take-profit and stop-loss orders.

Once your order has been accepted and executed, the EUR/USD must move higher for your position to become profitable, or, as we stated previously, the euro will need to appreciate in value versus the US dollar.

Referencing the same chart image above, you will notice that the ask price on the price scale is a fraction higher than the current price of 1.05015 (also known as the market price). So, if you decided to buy the EUR/USD forex pair, you would receive the ask price of 1.05022 from the broker at a slightly higher price than the market price.

The difference between the bid price and the ask price is called the spread (green box in order window) in forex trading terms, and it can be seen as the commission that brokers charge for their services.

Ask Price Example

As a novice forex trader, it can be challenging to determine which currency pairs are the best to begin with, but as a rule of thumb, the major forex pairs are a good place to start.

The major forex pairs offer the tightest spreads because they account for most of the volume traded in the forex market on a daily basis. This generally means that major forex pairs have more stable price movements, making them less volatile and easier to get in and out of trading positions fast.

This is why it’s important to take note of the bid and ask spread. Major forex pairs typically have very tight spreads, meaning that if you were to place a buy order at the ask price, your long position should be executed very close to the market price.

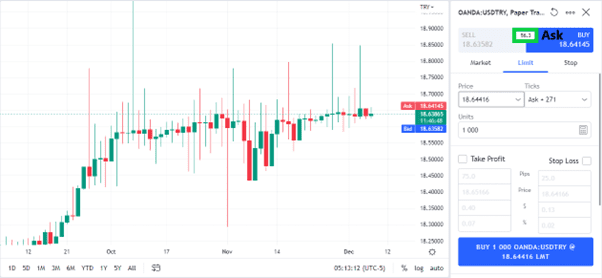

Image for illustration purposes only

On the other hand, if you were to trade an exotic currency pair, such as the USD/TRY (US dollar/Turkish lira), referencing the chart example above, then you will likely be presented with a much larger spread.

With this example, the USD/TRY had a spread of 56.3, which is much wider compared to the EUR/USD example we showed earlier.

This is an important concept to understand. If you were to buy the USD/TRY at the ask price, you would get a far worse price than the current market price and it would result in a higher brokerage commission.

Although the ask price definition and the ‘mechanics’ of what happens to either the base or quote currency when buying a forex pair might sound complex at first, all trading platforms make the process of entering a buy order pretty straightforward and the rest is automatically taken care of by your broker.

Related Articles

Conclusion

The ask price definition is pretty straightforward once you take the time to understand what happens to each currency in a pair from the perspective of the two parties involved in a forex transaction.

As forex trading involves currency pairs, it is understandable that beginner traders might find some concepts or terms confusing at first, but hopefully this article helped to explain what an ask price is so that you can make better-informed trading decisions.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.