The Great British Pound/Canadian Dollar currency pair (also referred to as GBPCAD and GBP/CAD) is one of the most actively traded in the world. In this article we will examine how GBPCAD is performing.

GBP/CAD Key Stats

- 2021 high: 1.7886

- 2021 low: 1.6638

- YTD high: 1.7377

- YTD low: 1.5681

- YTD % change: -7.9%

GBPCAD Forecast

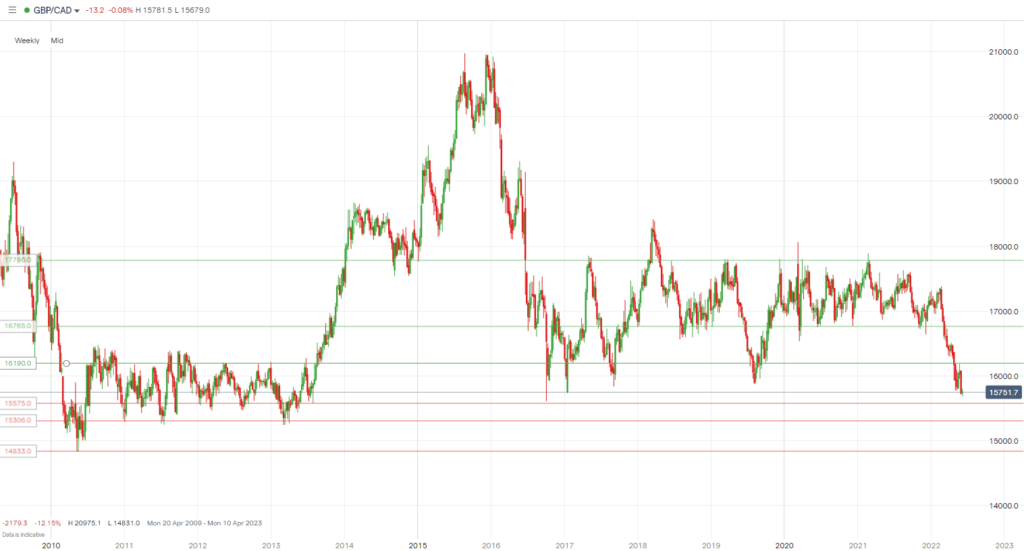

There’s only one direction for the GBP/CAD at the moment, and that is down. The pair, after ranging for much of 2020 and 2021, finally broke lower in March, and since then it has continued on its downward trajectory. In the near term, we expect a pullback, targeting the 1.5961 level, before price then continues on its current path. Key areas we are targeting to the downside include 1.5621 and 1.5500.

The recent vulnerability in the pair has seen it fall to lows seen not long after the Brexit vote. It has been fuelled by the rise in oil prices and more recently, a more hawkish stance by the Bank of Canada (BoC).

GBPCAD Fundamental Analysis

The majority, if not all major currencies are impacted by the general state of the economy and economic characteristics such as employment, GDP, monetary policy, and inflation. These factors can cause major swings in prices.

The GBP has confronted several challenges over the last few years and Brexit caused a significant decline in the pound. Despite a deal between the UK and the European Union, disputes have emerged over the trade agreement and border controls. Furthermore, GBP investors are yet to be convinced of the success of leaving the European Union and issues remain in the long term.

The CAD can often be correlated to the price of oil as Canada earns the majority of its earnings from the sale of crude oil. It is the fifth-largest producer and exporter. Crude oil has made significant gains this year due to increases in economic activity and the Ukraine-Russia war, causing a higher demand for oil and resulting in a stronger Canadian dollar. A recent hawkish turn by the Bank of Canada has also boosted the currency.

Related Articles

- GBPSGD Forecast and Live Chart

- CADJPY Forecast and Live Chart

- What are Commodity Forex Pairs?

- Forex Charts

GBPCAD Technical Analysis

Support Levels

- 1.5575

- 1.5306

- 1.4833

Resistance Levels

- 7786

- 6765

- 6190

Focusing on support levels, or in a bearish investor’s case, potential targets are essential at current levels with the pair trading at its lowest levels since 2013. Level 1.5575 has acted as a strong support level over the years. Meanwhile, 1.5306 will be one to watch as the CAD continues its bullish run. If the GBPCAD reaches 1.4833, it will be at its lowest level in two decades.

The GBP/CAD fluctuated significantly between late 2019 and early 2022, with no clear direction. Looking over the long-term, we can see a key resistance level at 1.7786 which was only broken once since 2016 despite being tested multiple times, although, we are far from another potential test at the moment. Level 1.6765 has provided support for the pair since 2020. However, strength in the CAD in 2022 caused a break and has since become a potentially strong resistance level. In addition, 1.6190 has recently shown itself to be a strong resistance level, and a potential move and close above will almost certainly offer signal a bullish move.

Trade GBPCAD with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

73% of retail CFD accounts lose money

Founded: 2014 73% of retail CFD accounts lose money

Founded: 201473% of retail C... |

|

FSA SC | MT4, MT5 | ||

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

77% of CFD traders lose

Founded: 2007 77% of CFD traders lose

Founded: 200777 % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.