The United States Dollar/Norwegian Krone currency pair (also referred to as USDNOK and USD/NOK) is not one of the most actively traded currency pairs. Still, given the USD’s importance and the strength of the Danish economy, it is one to watch. In this article, we will examine how USDNOK is performing.

USDNOK Key Stats

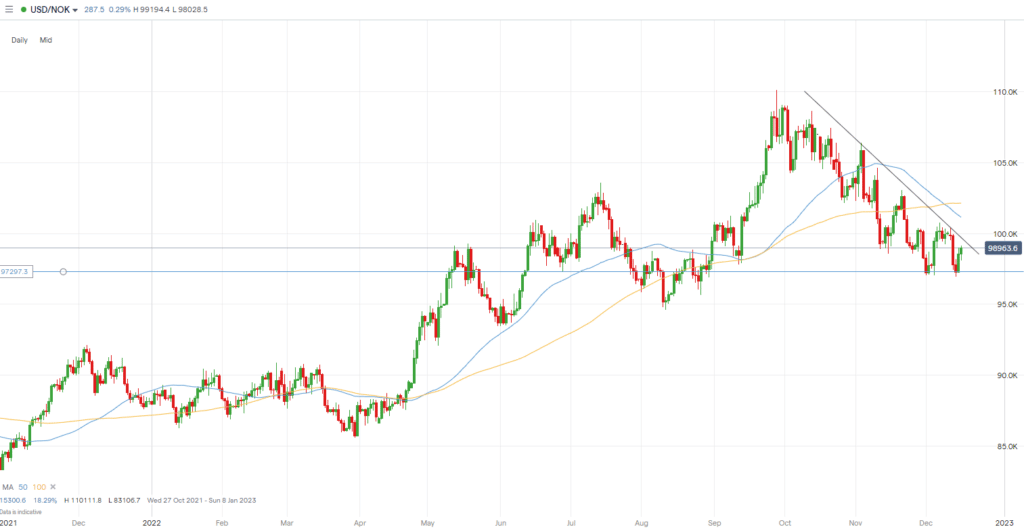

- 2021 high: 9.1940

- 2021 low: 8.1477

- YTD high: 11.0102

- YTD low: 8.5476

- YTD % change: +13.46%

USDNOK Forecast

The USDNOK had a tremendous run higher up until around September, but it has since pulled back. Recent comments from Federal Reserve Chair Powell have resulted in a pullback in the US dollar against most other currencies, however, market participants generally see the rate increase pace continuing on the same path into next year.

Therefore, a lot will depend on the next Fed rate hike and comments. If they begin to slow the pace, we will likely see a move lower in the near term (barring any other macroeconomic or geopolitical headwinds, which are certainly not out of the question). However, if they continue along the same path, or there are comments suggesting that a slowdown is not on the horizon, we will probably see another surge in the US dollar.

USDNOK Fundamental Analysis

Fundamental analysis is a great investment strategy for both long and short-term investors and traders. When analysing the USDNOK, we have to be aware of actions from both the government and central banks, with comments and policy changes potentially causing significant moves and changes in direction, influencing the movement of the pair. In addition, data releases from each country will also affect the currency’s valuation.

The USD is the largest economy in the world, and its strength and stability make the USD attractive to investors, especially during times of global economic uncertainty. In addition, it is the reserve currency for international trade and finance. There are various key data releases each month, including payroll data, GDP, retail sales, nonfarm payrolls, and much more. All these can potentially cause significant price swings for the currency. With inflation surging, the USD has raised interest rates quickly, but recent comments suggesting a potential slowdown have seen a pullback in the US dollar.

A change in the value of crude oil prices impacts the Norwegian Krone as Norway is a significant oil exporter. At the same time, traders and investors should also keep an eye on the country’s shipping, fishing, and manufacturing. Due to Norway being a stable economy, it is generally seen as a solid investment, while it is also one of the wealthiest countries in the world.

Related Articles

- EURNOK Forecast and Live Chart

- EURUSD Forecast and Live Chart

- What Are Minor Forex Pairs?

- Forex Charts

USDNOK Technical Analysis

Much like USDDKK, after a significant rise for most of the year, the USDNOK has now pulled back and is in a downtrend. There is a solid bearish trend line that we can see on the chart (higher up), while the price has recently crossed below the 100 MA on the daily chart, suggesting a further downside move. As the downtrend continues, any pullbacks to the 100 MA could be potential entry points for a further bearish move as it acted as a strong bullish support level during the run higher from April to late September.

Trade USDNOK with our top brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

73% of retail CFD accounts lose money

Founded: 2014 73% of retail CFD accounts lose money

Founded: 201473% of retail C... |

|

FSA SC | MT4, MT5 | ||

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

77% of CFD traders lose

Founded: 2007 77% of CFD traders lose

Founded: 200777 % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.