Candlestick charts are a technical tool that allows traders to better visualise the trading data present over a specified timeframe. This makes them more useful than bar or line charts because it is easier to spot repeatable candlestick patterns that tend to forecast price direction when they complete.

There are many different candlestick patterns, which can consist of multiple or singular price bars, and traders have been incorporating these patterns in their trading strategies for a long time.

In this article, we will explore one such important candlestick pattern – the dark cloud cover forex pattern – what it means when you see it on your chart, and how to trade it.

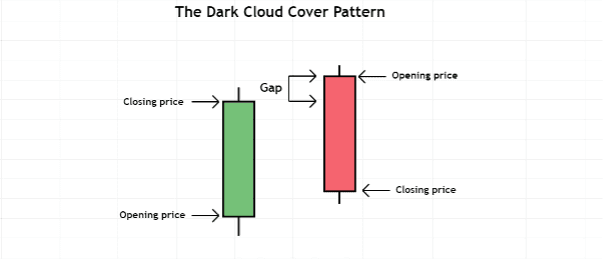

What Is the Dark Cloud Cover Forex Pattern?

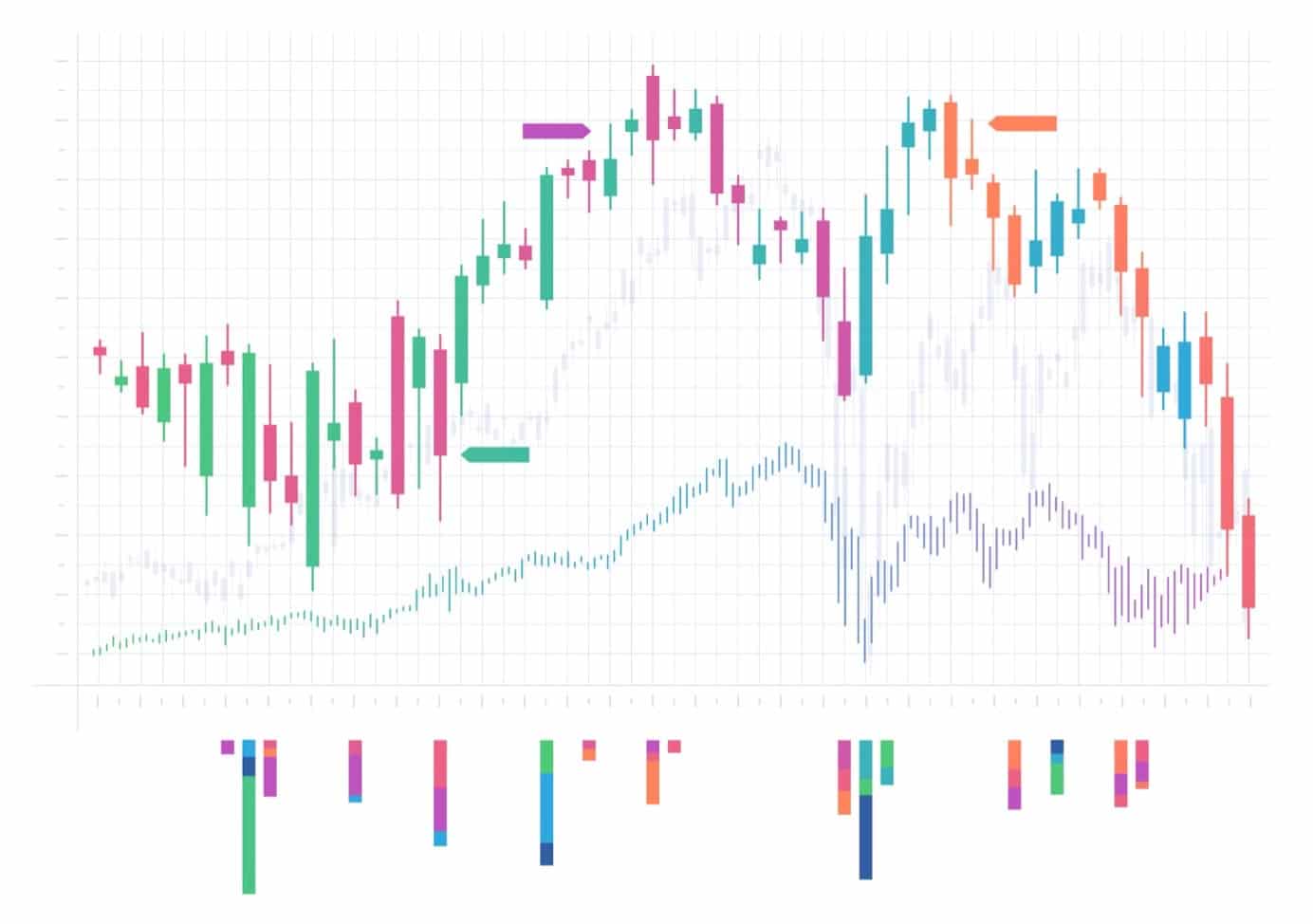

Image for illustration purposes only

The dark cloud cover forex pattern consists of two candlesticks where the first candlestick creates a bullish green candle that is immediately followed by a second red reversal candlestick.

There are two notable characteristics of this pattern that need to occur for it to be classified as a valid dark cloud cover forex pattern. Firstly, the second red candlestick of the pattern should open at a higher price than the close of the first green candlestick, creating what is called an opening gap in trading terms.

Secondly, the bearish reversal candlestick should close below the midpoint of the previous bullish candle and above the lowest point of the green candle.

Some traders may also want to see large body sizes for both of the patterns’ candlesticks because this often indicates strong participation by traders. Candlesticks with small bodies, on the other hand, indicate periods of indecision, which can reduce the probability of a bearish reversal.

A dark cloud cover candlestick forex pattern is, therefore, a bearish reversal pattern and can form either after a bullish trend or at the end of counter-trend correction within a bearish trend.

What Does the Dark Cloud Cover Forex Pattern Mean?

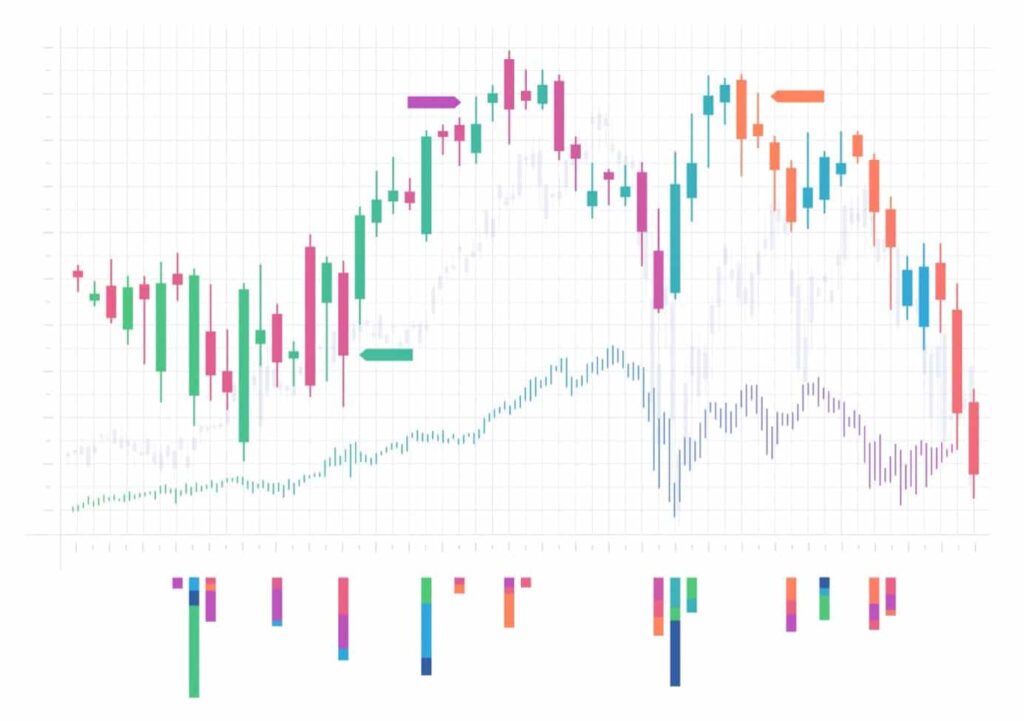

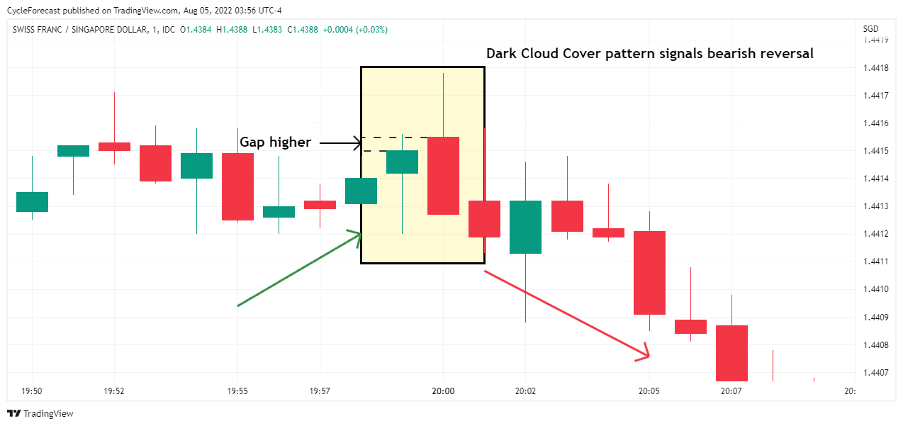

Image for illustration purposes only

The chart example above shows a dark cloud cover forex pattern (marked by the yellow square) that formed at the end of a bullish phase before a strong reversal lower followed. When this pattern appears on a chart, it typically indicates a shift in momentum from a bullish to a bearish sentiment.

Traders who follow this pattern will often also wait for another bearish candle that breaks below the second red candlestick to confirm that prices are indeed getting ready to decline further and that they need to start planning their trade entries.

Although this pattern might lead to a reversal, it is considered a rare pattern that does not often appear in markets that have a lot of liquidity and that are open 24 hours a day. The chart examples used for the trade setups that follow were taken from a one-minute timeframe and an exotic currency pair that has a large bid/ask spread. Finding a dark cloud cover pattern on a major currency pair might be harder, but is not impossible.

How to Trade the Dark Cloud Cover Forex Pattern

Next, we will discuss a simple strategy to help you trade this pattern with the addition of a volume indicator to spot the highest-probability dark cloud cover forex patterns.

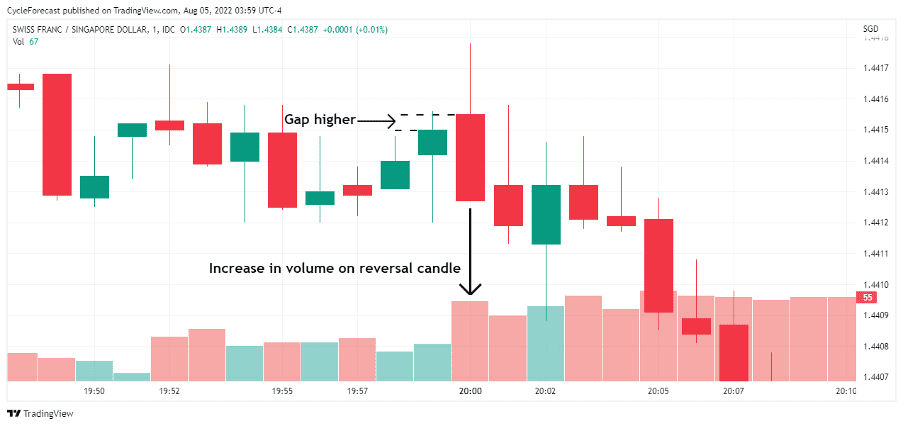

Image for illustration purposes only

Our next chart example shows the same dark cloud cover forex pattern as before with a volume indicator added on the lower panel of the chart. With this strategy, the volume indicator plays an important part in detecting whether selling pressure is increasing and acts as another reversal confirmation signal.

Note how volume showed a clear increase during the formation of the second red reversal candlestick of the pattern. This was a clear indication that sellers were starting to gain the upper hand and that a high probability reversal was imminent. Traders will often use additional confirmation methods, such as indicators, to help them spot the forex candlestick patterns with the highest-probability setups.

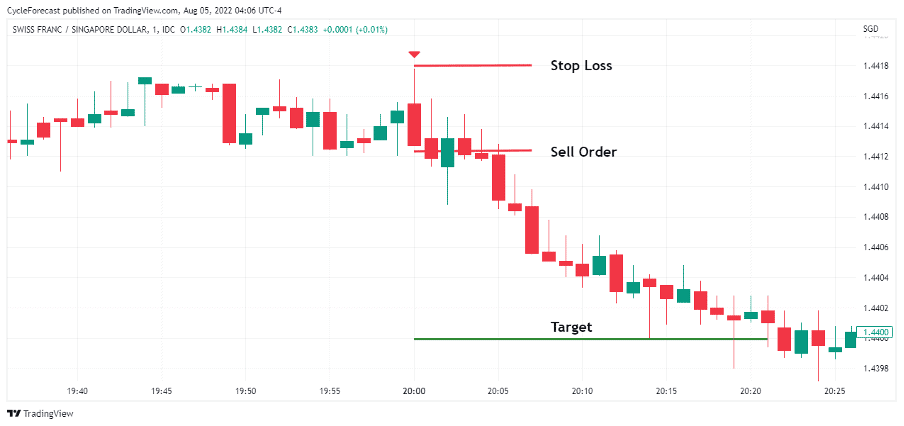

Image for illustration purposes only

As soon as they confirm a dark cloud cover pattern, forex traders can place a sell order a few pips below the red reversal candlestick (marked with red arrow), with a stop-loss order a few pips above the same red candle.

With this easy strategy, a target can be placed at a level that would allow you to profit twice as much than what you are willing to initially risk on any particular trade.

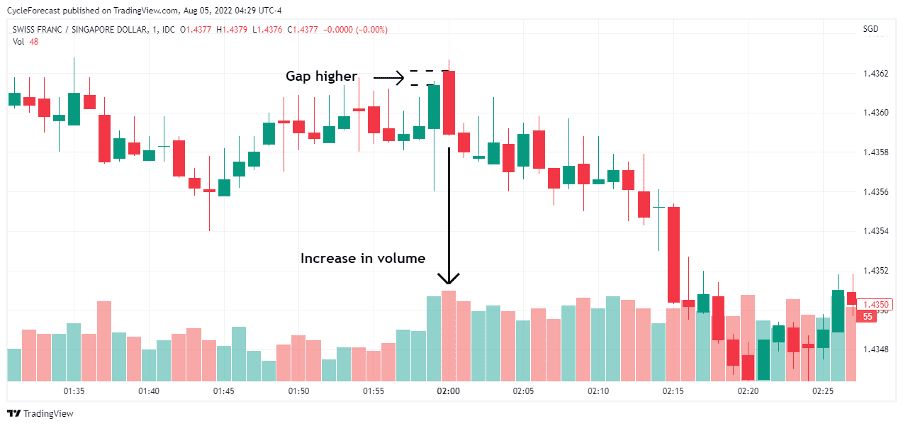

Image for illustration purposes only

Our second entry example shows another instance where a dark cloud cover forex pattern appeared that also led to a strong reversal. All of the valid characteristics of this pattern were present together with the additional confirmation from the red entry candle and volume indicator.

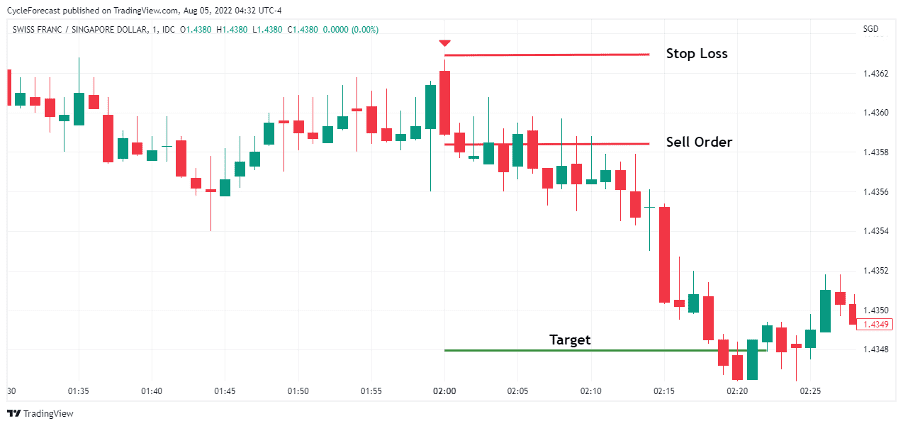

Image for illustration purposes only

Following the same entry procedure as before, a sell order could have been placed a few pips below the red confirmation reversal candlestick (marked with red arrow), and a stop loss a few pips above the hanging man candle.

In this final example, a target was again placed at a level that offered double the reward versus the initial risk.

Conclusion

The appearance of a dark cloud cover forex pattern tends to forecast a bearish reversal after a price advance. Whether this pattern forms at the end of a preceding bullish trend or after a counter-trend reversal within a bearish trend does not matter, as long as you know that it is predicting a potential decline in price.

With the trade examples shown above, we used the volume indicator to help us identify the dark cloud cover forex patterns that may lead to the highest-probability reversals. Other indicators such as the MACD or RSI can also be useful and perhaps motivate you to explore other ways to help you trade this pattern.

Hopefully, this article helped shed some light on this fascinating pattern and offered an easy-to-follow strategy to trade the dark cloud cover forex pattern the next time you spot one on your favourite market.

Trade Candlestick Patterns with Top Forex Brokers

| Broker | Features | Regulator | Platforms | Next Step | |

|---|---|---|---|---|---|

73% of retail CFD accounts lose money

Founded: 2014 73% of retail CFD accounts lose money

Founded: 201473% of retail C... |

|

FSA SC | MT4, MT5 | ||

Your capital is at risk

Founded: 2014 Your capital is at risk

Founded: 2014 |

|

FSPR | MT4 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006Europe* CFDs ar... |

|

ASIC, FSA, FSB, MiFID | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | ||

Between 74-89% of CFD traders lose

Founded: 2010 Between 74-89% of CFD traders lose

Founded: 2010Between 74-89 % of retail investor accounts lose money when trading CFDs |

|

ASIC, FCA | MetaTrader 4, MetaTrader 5, cTrader | ||

77% of CFD traders lose

Founded: 2007 77% of CFD traders lose

Founded: 200777 % of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. |

|

ASIC, CySEC, FCA | eToro Platform | ||

Your capital is at risk

Founded: 2009, 2015, 2017 Your capital is at risk

Founded: 2009, 2015, 2017 |

|

ASIC, CySEC, IFSC | MT4 Terminal, MT4 for Mac, Web Trader, iPhone/iPad Trader, Droid Trader, Mobile Trader, MT5 | ||

Your capital is at risk

Founded: 2006 Your capital is at risk

Founded: 2006 |

|

CySEC, DFSA, FCA, FSB, SIA | MetaTrader4, MetaTrader5, cTrader, FxPro Edge (Beta) | ||

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.