Disclaimer: Binary options are not available to European traders

Interested in binary options trading? Want to learn more about it? Want to know how to get started? Want to know about the risks and the strategies? Want to know about binary options trading platforms. Then, this article is exactly right for you!

One of the most popular investment arenas in recent years has been trading the world’s currencies, due primarily to its flexibility, ease of access, and trading software that assimilates mountains of data to guide your every move in the market. Casualty rates for beginners, however, have been high and for good reason. Trading forex is very high risk. A great deal of preparation and practice trading are necessary if one wants to win in this genre. Most newcomers grow impatient, resort to “gut” gambling, and soon lose.

Learning and applying prudent risk and money management principles can be difficult, but the forex market has responded to these issues by offering “binary options”, a new way to play the game with currencies, as well as with stocks, commodities, and indexes. Trading binary options requires an entirely different approach, where much of the “headache” has been removed so that an investor can focus on the moment and directly on the price behavior for his chosen investment vehicle. Your downside risk exposure is “fixed” up front, as well as the amount of your position and your potential payoff.

What are Binary Options?

Binary options are now gaining in popularity more quickly than nearly any other area due to their simplicity. They may go by many names – barrier options, digital options, two-way-options, all-or-nothing options, and fixed-return options, to name a few. A basic definition from Investopedia.com follows:

“A type of option in which the payoff is structured to be either a fixed amount of compensation if the option expires in the money, or nothing at all if the option expires out of the money.”

These options allow the investor an opportunity for instant gains of from 70% to 85%, depending on the investment type offered and the marketing bias of the broker. Investors need only guess the correct direction of the market within a defined time period to cash in, or retain anywhere from zero to 15% of his capital at risk. The simplest form is a pure “high/low” or “Call/Put” bet, but “one-touch”, “no-touch”, and “double-touch” options allow for typical trending and ranging strategies, where technical competence may provide the trader with a competitive edge if he can use his charts and indicators prudently to support his decision making.

For a simple “high/low” example, the guesswork of making a trade has been taken care of for you. You are offered a special screen view of the pricing behavior for your chosen asset for the recent past and asked to predict where it will be at the end of a specified time limit, the “expiration point”. The potential “payoff” is stated on the screen, say 85% for example, and you decide the amount of your position. If you wagered $100 and the price finished in line with your prediction, you win $85 plus your $100 investment. If not, then you may lose $100 or, in some cases, you may receive as much as $15 back.

The other types mentioned above allow for some variation on this basic theme, but you can never lose more than you specify. There is no need for complicated risk management strategies or worries about leverage and its financial implications. There are no margin calls or fees, either. The rules are simple and straightforward, the reason why this type of investing is gaining widespread popularity.

How Do You Execute a Trade?

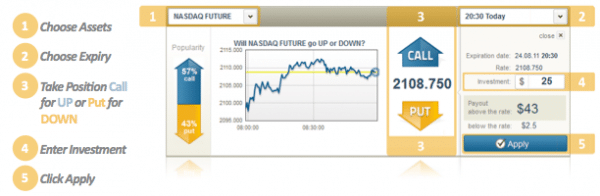

Binary options require a customized approach, quite unlike the typical Metatrader4 platform or any other general trading support software. Not all brokers offer these instruments because they must first develop a proprietary trading system that has been customized just for this primary task. Thankfully, most binary option brokers have followed a similar theme. Your trading “dashboard” will typically resemble the diagram presented below:

The five steps have been added for clarification purposes to illustrate how easy it is to execute a trade. In this example, the position is for $25, and the potential payoff is $43, the sum of $25 plus $18, or 72%. If you are wrong, then $2.5, or 10%, will be returned to your account. The two arrows on the left give you some sense of what others have predicted, and the pricing behavior chart gives you a basis for making your own prediction of what will transpire by the expiration time chosen in “Step 2”.

Is It a Good Time to Consider Binary Options Trading?

The reason for the apparent popularity of this genre is due to its inherent simplicity. Risk and reward variables are fixed at the outset. There is no need to set protective stop-loss orders or worry about margin calls. Your downside risk is known, based on the amount you choose to wager, and your potential return is also defined when the order is executed. For investment beginners, many of the complexities of risk and money management principles are removed from the investment decision upon execution.

Is now the time to jump in with both feet? As always, the answer to this question depends on your personal tolerance level for risk and your appraisal of the state of this industry. With each passing month, the number of new broker offerings hitting the market continues to soar. Competition is a good thing since it will improve payout criteria and your odds for winning, but you must educate yourself first and perform the necessary due diligence before choosing your specialized broker. There are many websites that can assist you with this task, and be sure to take a “test run” first by practicing with “free” broker demo systems before risking your personal capital. On this page we give you our list of trusted brokers where you can start binary trading with a demo account.

What Are the Key Factors for Success When Trading Binary Options?

Like any other investment medium, the key factors for success are three in number –

- Knowledge

- Experience

- Emotional control

Newcomers typically fail in the trading arena primary due to the last factor, emotional control. It can be easy to establish a position in the market, but then waver when it comes time to close it, whether it is a winner or loser. The goal is to maximize your “winners” and minimize your “losers”, but, unfortunately, beginners tend to get it the other way around.

Basic binary options remove the threats of emotional intervention, so to speak. The expiration time fixes the endpoint. There is no decision to make. For traders that desire more flexibility, brokers often offer “Rollover” or “Double-Down” features that allow the trader to extend time periods or increase his position if it appears to be a winner, but these decisions require an action on your part. You have time to think about the actions you might take, without changing a thing. You are in control of your position. Your risks only grow if you decide to allow them to do so.

The first two factors can be easily addressed. There are many tutorials, trading guides, and information available on the Internet today to acquire the knowledge necessary to understand and win with binary options. Most brokers take a great deal of pride in the instructional materials that they provide. With competition running so high, every broker wants to provide the best trading experience around, supplying all manner of tools to assist you in the process. Market data, commentaries, and fundamental event calendars are standard offerings in today’s market.

The “middle” key to winning is experience. Seasoned veterans generally swear by their practice regimens. Trading binary options is not the latest form of Internet “gambling” or an amusing video game. You must develop a disciplined approach to the market, utilizing the same analytical skills required in any trading market. Never risk any funds in this market that you cannot afford to lose. Your position sizes should never exceed 2% to 3% of your account value. You will have losing trades. Accept them, and move on. The goal is consistency with “net” gains where winners exceed losers over time.

What Should I Do Now?

If this medium has piqued your interest, then it is time to do some homework. Read up on the topic. Read our article about binary options trading strategy and signals. Study the various offerings of various firms and be sure to perform your own due diligence before selecting one for initial testing. Trading platforms are often proprietary, but easy to understand with online access from the Internet. Brokers tend to be offshore, but there are a few with offices in the United States.

Ever since this OTC mode of investing acquired SEC approval in 2008, brokers and investors have literally leapt into the space, leading to increasing popularity that has only continued without abatement into the current year. A few leaders have emerged, and many firms have added unique “twists” to differentiate themselves from their competitors, but caution is the watchword to keep in mind at all times. Stay focused on your personal objectives. Invest the time practicing with “demo” systems, and, when you feel ready, go slowly at first. No reason to rush, and enjoy the process, too.

Good Luck!