Both the Australian Dollar and New Zealand Dollar have reinforced their underlying positive outlooks versus the US currency in June and continue to point higher into the key Referendum on EU Membership in the UK on Thursday 23rd June 2016.

Whilst AUDUSD continues to display a bull bias in a broader non-trend environment, NZDUSD has maintained a bullish trend from early June, which has reinforced the 2015-2016 up trend.

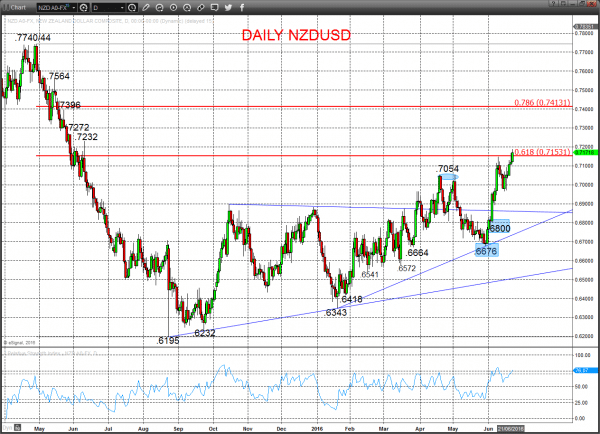

NZDUSD

A further rally Wednesday (as we had indicated) through the new .7169 peak to reinforce the Tuesday break above key resistance targets at .7148/53, to keep a bull bias for Thursday.

Furthermore, the previous surging rally above .7054, in reaction to the 09/06 RBNZ announcement, produced a shift to an intermediate-term bullish view.

For Thursday:

- We see an upside bias for .7188; break here aims through .7200 for .7232.

- But below .7145 aims for .7116 and opens risk down to .7097.

Short/ Intermediate-term Outlook – Upside Risks: A shift to an intermediate-term bullish tone above .7054.

- We see a positive tone with the bullish threat to 7232/72.

- Above here targets 7396/7413 and .7564.

Daily NZDUSD Chart

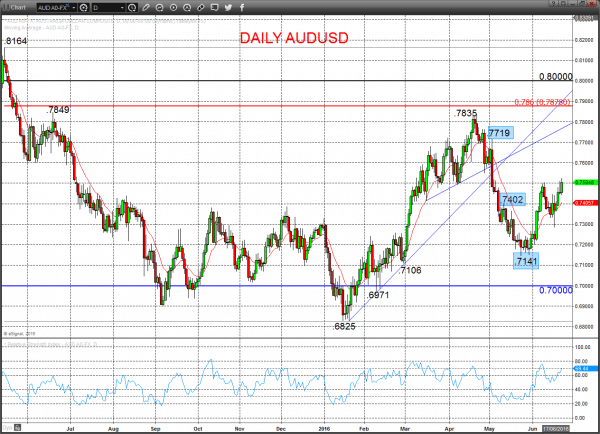

AUDUSD

Another push higher Wednesday to probe above .7513/17 resistances and to defend .7435 support (as we had anticipated), to reinforce the Tuesday break above an important .7504 peak from early June and the rebound effort from late last week, to once again set an upside bias for Thursday.

For Thursday:

- We see an upside bias for .7526; break here aims for .7550/60.

- But below .7475 aims for .7439/35 and opens risk down to .7406/00.

Short/ Intermediate-term Range Parameters: We see the range defined by .7719 and .7141.

Range Breakout Challenge:

- Upside: Above .7719 aims higher for .7835/49/78 and .8000.

- Downside: Below .7141 sees risk lower for .7106/.7000/.6971 and .6825.

Daily AUDUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.