TRADER’S VIEWPOINT

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. Being based in New Zealand explains why the broker has flown under the radar for a few years, but it is a great broker building a global following.

The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners. However, the trading experience is supported by an impressive technological infrastructure that ensures high-quality trade execution that will also impress more experienced traders.

The registration process at BlackBull is straightforward, and one neat feature is that the deposits and withdrawals process has been simplified, a move some other brokers might want to consider following.

A staggering 26,000 different markets are on offer at BlackBull, which puts the broker at the top end of the range regarding available instruments. The key asset groups include more than 60 major, minor and exotic currency pairs, six index-based CFDs, gold, silver, energy commodities, stocks and crypto.

Another positive feature is that BlackBull Markets offers a greater-than-average range of account types. There are six options to ensure you get the best fit for your purposes.

More experienced traders will note the potential to take advantage of very generous margin terms. A leverage of 1:500 is possible, and execution spreads can be as low as zero pips.

BlackBull is a well-thought-out platform, as demonstrated by its choice of providing MetaTrader4 and MetaTrader5. They are available for desktop, WebTrader and as a mobile app, compatible with Android and iOS operating systems.

BlackBull is an excellent pick for your shortlist of candidate brokers if you’re just starting trading. If you’re more experienced and looking to switch from another broker, then a quick scan of the list of the add-ons found at BlackBull will grab your attention:

- Equinix Data Centre

- FIX API

- NYC servers

- Beeks FX

- CPA Affiliates

- Myfxbook

- White Labels

- VPS

- ECN

- SwipeStoc

- PsyQuation

- MAM/PAMM

BlackBull Markets Rating Overview

| FEATURE | BlackBull Markets |

|---|---|

| Overall | ⭐⭐⭐⭐⭐ |

| Education | ⭐⭐⭐⭐⭐ |

| Market Research | ⭐⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐ |

| Deposits & Withdrawals | ⭐⭐⭐⭐⭐ |

ABOUT BLACKBULL MARKETS

The New Zealand-based operation has developed a passionate following in the trading community since its launch in 2014. Forums and message boards are rife with raving reviews from actual users.

BlackBull Markets is a true ECN, no-dealing-desk broker. Founded by a team of seasoned and successful professionals, it has all the hallmarks of being run by traders, for traders.

There is also a fintech twist with the firm tapping into New Zealand tech firms’ world-renowned ‘can-do’ attitude. The premium trading tools and services offered have, in turn, driven rapid growth in what is an ultra-competitive sector.

Regulatory compliance is among the brokerage’s top priorities, but it has also ranked on Deloitte’s ‘Fast 50’ index for the past five years for its overall evolution.

The company behind the BlackBull Markets brand is Black Bull Trade Limited, a New Zealand limited liability company incorporated and registered under the laws of New Zealand, with NZBN 9429049891041 and a registered address of Floor 20, 188 Quay Street, Auckland Central, Auckland 1010, New Zealand. Black Bull Trade is registered FSP1002113.

BBG Limited, trading as BlackBull Markets, is a limited liability company incorporated and registered under the laws of Seychelles, with company number 857010-1 and a registered address at JUC Building, Office F7B, Providence Zone 18, Mahe, Seychelles. The Company is authorised and regulated by the Financial Services Authority in Seychelles (“FSA”) under licence number SD045 to provide investment services.

WHO DOES BLACKBULL MARKETS APPEAL TO?

One of the reasons for BlackBull’s strong reputation among traders is that the broker offers superb ECN execution, MT4 and MT5 platforms, and access to outstanding liquidity provided by some of the world’s top banks.

The broker is an NDD (No Dealing Desk) operation, meaning that it does not alter traders’ orders in any shape or form. STP (Straight Through Processing) is also part of the BlackBull Markets package.

BlackBull shines yet again market coverage-wise. Not only does it offer access to a staggering range of FX pairs, but it can also provide exotics/crosses on request. Such flexibility is a neat additional feature.

In addition to the above, BlackBull features cutting-edge Equinix NY4 Servers and segregated client accounts (required by its regulatory obligations).

BlackBull is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. Being based in New Zealand explains why the broker has flown under the radar for a few years, but it is a great broker building a global following.

Intermediate traders familiar with Metatrader

ACCOUNT TYPES

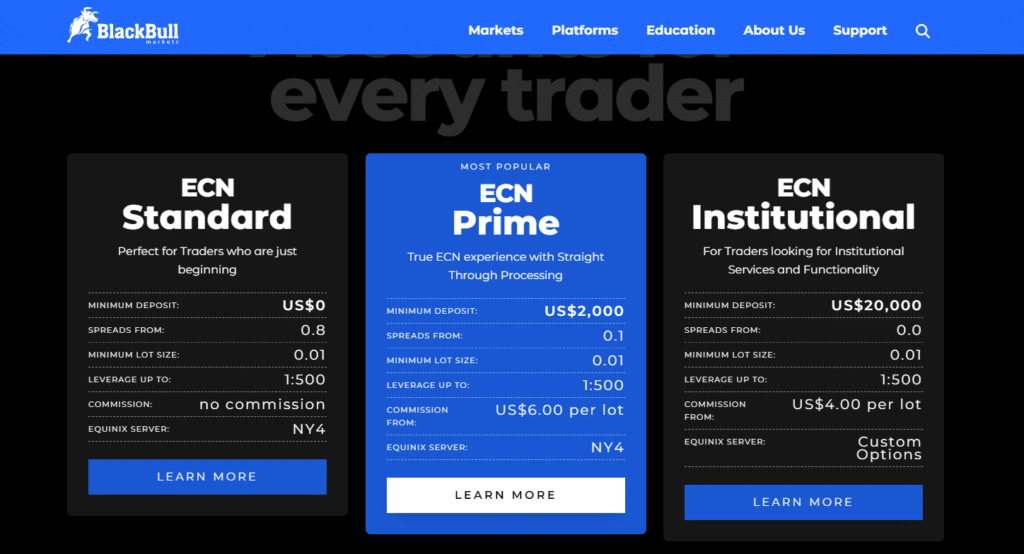

There are five different accounts to choose from, which ensures clients can opt for the T&Cs that are right for them.

Standard account

There is no minimum deposit. Spreads on this account start from just 0.8 pips, and no commission is charged. The maximum available leverage is a massive 1:500. Micro-lot trading is also available, making it an outstanding option for beginners.

Prime account

Minimum deposit requirement of $2,000 with high-quality execution and spreads starting from just 0.1 pips. It is BlackBull’s most popular account.

Institutional account

Minimum deposit requirement of $20,000 with super-tight spreads, commissions from $4 per lot, 0.00 spreads, and VPS, White Label and MAM/PAMM trading options.

Islamic account

Shariah-compliant, this swap-free setup can be accessed through the Standard and the Prime accounts.

Demo account

Free and easy to set up.

MARKETS AND TERRITORIES

Interestingly, despite being based in New Zealand and regulated by the local authorities, BlackBull Markets does not accept local clients, nor those in the US, France, or Belgium. However, its global reach is still impressive, with the firm developing a global client base, including Canada.

INSTRUMENTS AND SPREADS

Offering a default package of more than 70 currency pairs is impressive enough, but BlackBull takes things further. Utilising their tech infrastructure’s potential, they allow forex-orientated clients to set up bespoke crosses and exotics.

The number of equity markets available is equally impressive, with more than 26,000 stocks on offer, ensuring traders can find the ideal candidate stock for their portfolio. There are nine metal commodities, six soft commodities, five energy markets, and ten indices at the time of writing this review. Rounding off an impressive array of markets on offer are the nine crypto markets, including big names such as Bitcoin, Ethereum, LiteCoin, Chainlink, and Doge.

The broker operates using variable spreads, which means the gap between bid and offer prices will fluctuate according to market conditions. To ensure clients can monitor and compare pricing T&Cs, a neat spread checker tool is built into the site allowing clients to stay on top of their trading P&L.

During our testing, the spread on EURUSD started at 0.01197, GBPUSD from 0.01209, and AUDUSD from 0.02420. Spreads on equity instruments were also highly competitive, with the range on Apple stock (AAPL) starting at 0.03.

FEES AND COMMISSIONS

BlackBull Markets also deserve recognition for not charging additional administrative fees. There are no account inactivity fees or charges on deposits and withdrawals. Overnight financing charges are applied on CFD positions, in line with standard market practice, and those looking to upgrade their price data feed to professional levels will be charged for that service.

Trading commissions vary across the accounts. The ECN Standard account is commission free, whereas the Prime and Institutional accounts charge $6 and $4 per lot, respectively.

PLATFORM REVIEW

The award-winning MetaTrader4 (MT4) trading platform has several versions, covering Windows, Mac and mobile platforms.

There is also the option to use the WebTrader format of MT4, which ensures you can access the markets via any internet browser.

Even the Demo account has no fewer than 85 technical indicators pre-installed. It’s also possible to tap into the global MT4/MQL5 community and bolt on the customised indicators developed by other traders or the world-renowned Expert Advisors (EA) service.

MT4 supports multiple order types, scores of different chart types, time frames and setups, which can be saved for later use.

For high-volume traders, automated trading is a genuine and helpful possibility due to the availability of a free VPS service.

Though MT4 is indeed just one platform variant, it is an all-in-one solution that works very well.

MetaTrader5 (MT5) offers even faster processing times than MT4 and the ability to hedge positions. The upgrade to pending order functionality and additional tools and indicators are also excellent additions.

- +20 timeframes

- +30 built-in indicators

- Integrated economic calendar

MOBILE TRADING

The BlackBull Markets mobile app is free and compatible with iPhones, Android, iPad and tablets.

The mobile desktop’s feel and touch are the same as the desktop version. Considering the incredible range of powerful software tools included in the MetaTrader package, the app does an outstanding job of crossing nearly all those indicators over to a small screen format.

SOCIAL TRADING AND COPY TRADING

Social and copy trading is increasingly popular due to the ability of clients to gain exposure to markets without having to invest hours in research.

- Expert Advisors offers a form of copy trading, which is still the benchmark for the sector.

- ZuluTrade, which is also on offer, offers a next-generation approach and slightly more user-friendly functionality.

- Myfxbook allows users to share, analyse, track and compare their trading activities with friends.

Being packed with innovative high-tech features, the recently added BlackBull CopyTrader service ensures that low-latency trading is possible on high-frequency strategies. That is a welcome addition to the suite of services offered and tackles the problem of it being difficult to copy some trading styles effectively.

CRYPTO

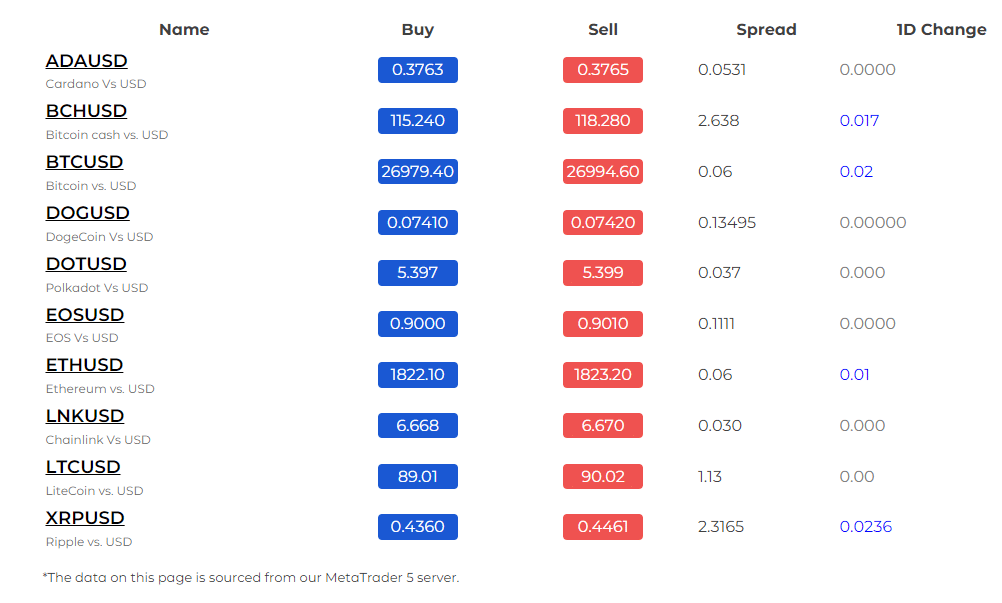

BlackBull provides clients with the opportunity to trade cryptocurrencies using CFDs. This simplifies the process, as there is no need for specialist wallets or to pay block-chain based fees charged by specialist crypto platforms. It also opens the door to trading crypto assets using leverage, with a margin of 1:5 offered.

Markets are available in major cryptos and Altcoins, including Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Ripple, Dogecoin, Cardano, Polkadot, Chainlink, EOS, and Stellar. Trading spreads are competitive with that on Bitcoin (BTCUSD) starting from 0.06, and the spread on Doge (DOGUSD) being anything upward of 0.13495.

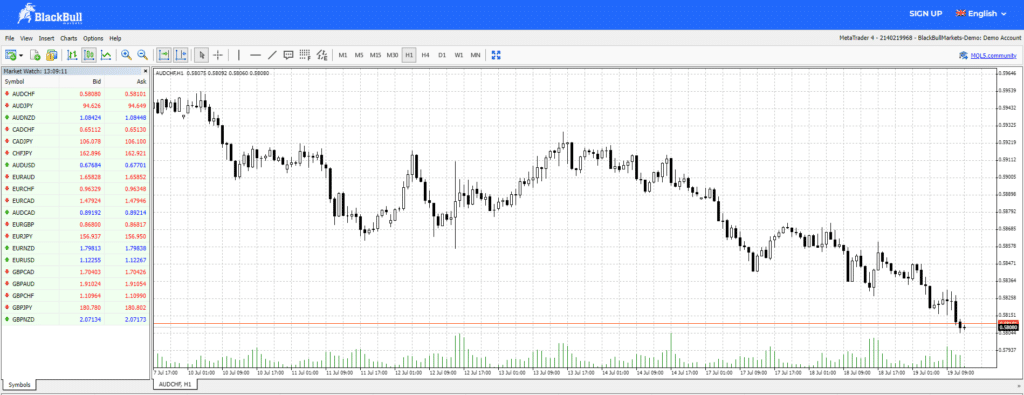

CHARTING AND TOOLS

MetaTrader’s MT4 and MT5 platforms are the best options for those using technical analysis tools to trade the markets. The clean appearance of the price charts backs up the charting package. To examine market activity, an array of extra tools can be drawn upon by users, but they never get in the way of trading.

The third-party Trading View platform is offered to BlackBull clients free of charge. It is ad-free and helps users take their trading to the next level. It has advanced charting tools, including additional indicators per chart, the ability to view multiple charts and server-side alerts.

To ensure trade execution is reliable and super-fast, BlackBull offers clients the ability to hook up to high-grade VPN networks. That ensures trading is done at the heart of the market rather than being subject to the risk of opportunities being missed due to time lags.

EDUCATION

BlackBull Market’s educational offerings have historically been regarded as lightweight but have recently improved. The education section has trading training videos, guides, webinars, and a glossary. They are all broken down by asset types, so whether you’re trading forex or crypto, the supporting research material is targeted at that market.

The ‘Market Reviews’ section provides expert commentary on upcoming high-impact events, with in-house analysts offering takes on what trading opportunities might arise.

TRADER PROTECTIONS BY TERRITORY

Trading activity at BlackBull Markets is conducted under the regulatory umbrella of the Financial Services Authority in Seychelles (FSA). The FSA is regarded as a medium-grade regulator, so clients based in some countries may not benefit from the same levels of protection as if they were trading with an FCA or ASIC-regulated broker. The flip side is that the FSA has a less rigorous approach to some elements of trading activity, such as leverage, which means BlackBull can offer margin terms of up to 1:500.

BBG Limited, trading as BlackBull Markets, is a limited liability company incorporated and registered under the laws of Seychelles, with company number 857010-1 and a registered address at JUC Building, Office F7B, Providence Zone 18, Mahe, Seychelles. The Company is authorised and regulated by the Financial Services Authority in Seychelles (“FSA”) under licence number SD045 to provide investment services.

In addition, BlackBull maintains a strict Anti-Money Laundering (AML) / Counter Financing of Terrorism (CFT) policy to ensure the firm runs above board and ethical business practices.

Compare BlackBull with other approved brokers

|  |  |  | |

| Education | educational content, market analysis | courses, market analysis | courses, webinars, market analysis | educational articles, market analysis |

| Customer Support | email, phone, live chat | email, phone, live chat | email, phone | email, live chat |

| Minimum Deposit | $0 | $100 | 50$ | €100 |

| Total Markets | 180+ | 1260 | 2000+ | 2800+ CFDs (shares, ETFs, crypto, forex, options, indexes, commodities), 2700+ Shares, Futures |

| Total Currency Pairs | 70+ | 55 | 49 | 65 |

| Total Cryptos | 0 | 17 | 37 | 19 (not available to retail clients in the UK) |

| Total CFDs | 60+ | 626 | 2000+ | 2800+ |

| Trading Platforms | MT4 | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | eToro Platform | Plus500 |

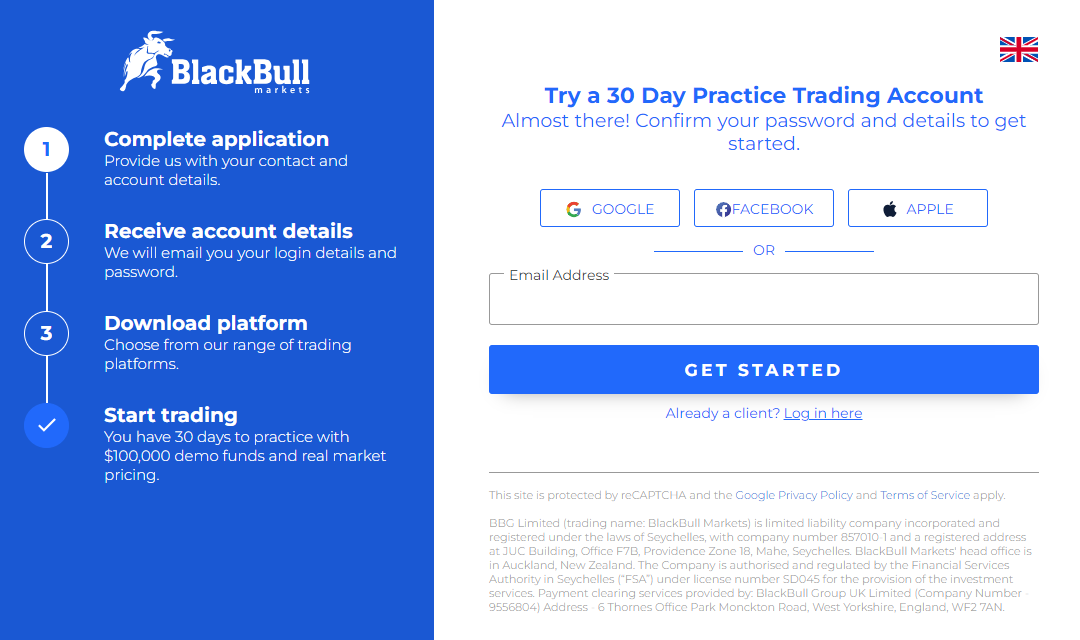

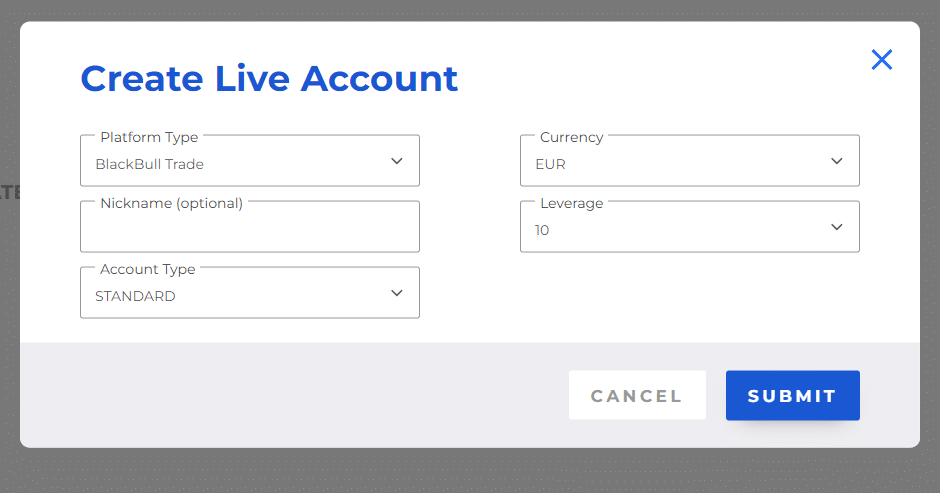

Opening an Account

Clicking the ‘Join Now’ button on the broker’s home page begins the process of opening an account with BlackBull Markets. It’s possible to set up a Demo account or to start trading with a small amount of capital thanks to the broker not applying a minimum initial deposit level. The Demo account takes moments to set up and allows you to try out the BlackBull platform trading with virtual funds.

The first stage of the process includes links which enable you to use already established profiles to speed up the process. You can choose to use personal data associated with Apple, Google, or Facebook accounts. Alternatively, enter your email address to be taken to a section of the site where you are required to input personal information.

The KYC (Know Your Client) information required includes proof of identity and some detail about your trading experience, level of education, market knowledge and source of funds. Brokers require this information to ensure compliance with ‘duty of care’ protocols set out by financial regulators, and the details can play a part in helping establish your investing and trading aims.

Thanks to the user-friendly nature of the BlackBull approach, it is possible to sign up for a new BlackBull Live Account in less than five minutes. However, the documentation needs to be verified by the broker, with the process taking up to 24 hours to complete.

Making a Deposit

Once logged into your new account, you will be taken directly to the Secure Client Area. This dashboard allows you to manage payments and withdrawals of the funds needed to finance your trading activity.

The My Wallet section of the site is dedicated to processing and recording fund transfers, including payments made internally between any accounts you might want to set up.

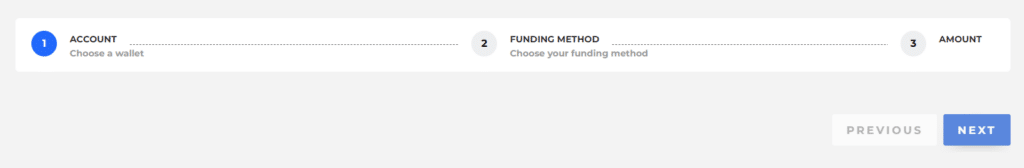

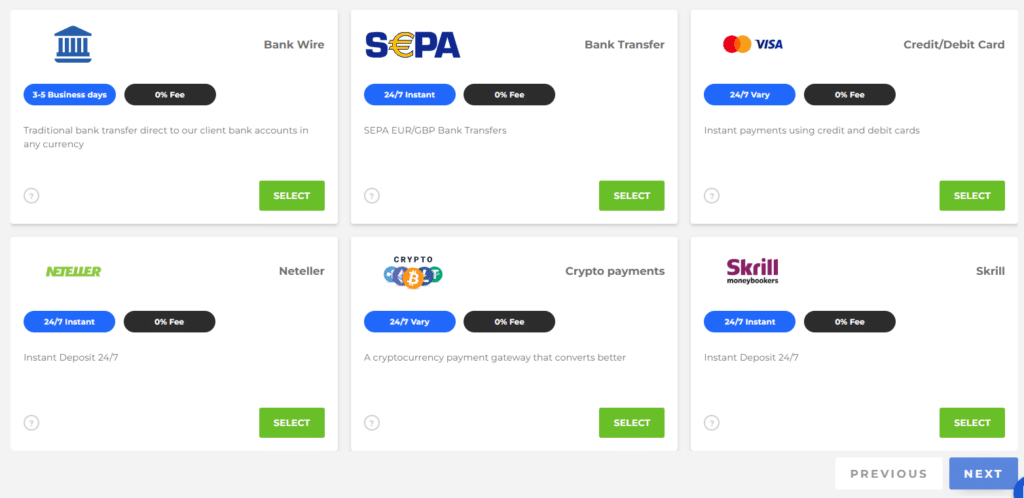

Depositing funds is a three-stage process. Select the account to which you want to send money, the payment method, and the amount you wish to deposit.

One of the most popular funding methods is by credit or debit card. The cash is instantly credited to your broker account, and no fees are charged. Bank wire transfers can take three to five days to process, but an interesting feature of the BlackBull setup is the presence of payment options not available at some other brokers.

The e-payment services SEPA, Neteller, and Skrill can all be used, and accounts can also be funded using cryptocurrencies, including Bitcoin, Litecoin and Tether. These next-generation payment options operate 24/7, with processing times varying from service to service.

Placing a Trade

It’s possible to choose from TradingView, MT4, MT5, or the in-house developed BlackBull Trade platforms. Third-party providers manage some of these platforms, and once you have selected which one you want to use, log-in details to the trading dashboard are sent in a separate email.

Given the high-tech pedigree of the firm, our testing focussed on the proprietary and unique BlackBull Trade platform. This web-based platform can be accessed wherever there is an internet connection, allowing you to keep on top of your trading positions. It can also be downloaded to handheld devices in app form. The neat functionality of the site didn’t disappoint, and test trades booked in the Demo account were executed efficiently and securely.

Source: Blackbull Markets

The high-tech trading infrastructure of BlackBull Markets allows fans of MT4 and MT5 to get the most out of whichever of the MetaTrader platforms they choose to use. It is possible to set up your account to use a VPS (Virtual Private Server), which locates your trading models geographically close to the main trading exchanges, which results in lower latency on trade execution. Those taking a more ‘hands-on’ approach can take advantage of the ways in which the dashboard can be personalised. A range of screen settings allows you to book trades using the graphics that best suit your approach. Our trades in GBPCAD were executed immediately, with no repricing issues, and were reported in the Portfolio section of the platform so that we could track P&L moves in real-time.

Source: BlackBull Markets

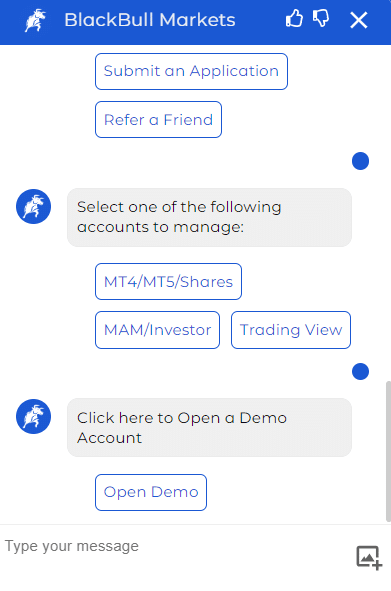

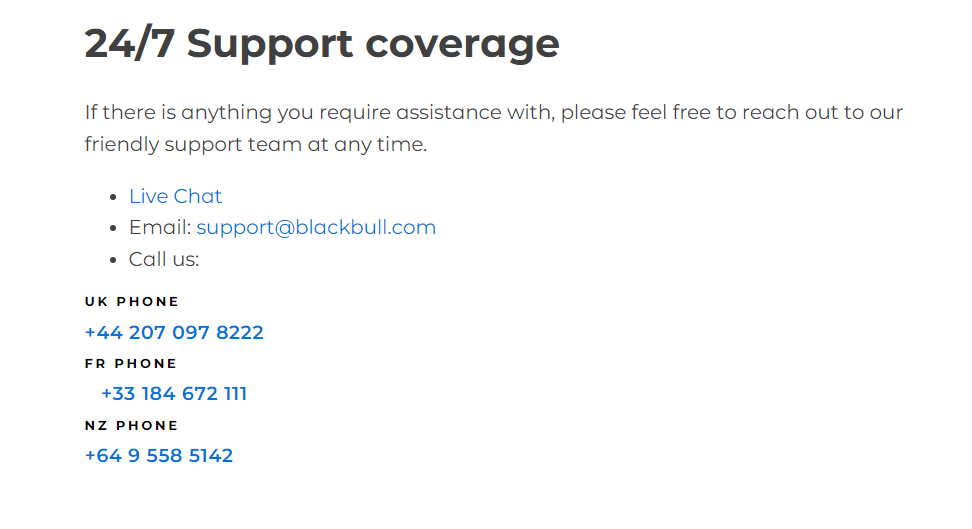

Contacting Customer Support

An automated assistant runs the Live Chat service. There isn’t an option to transfer to a human operator. During our testing, the bot-style assistant asked logical questions to try and guide us to the answer, but we did find the process circuitous and had to resort to other ways of contacting the broker.

Fortunately, the human customer support team offered a much higher level of service. Clients can contact them 24/7 via phone or email, and we were able to resolve all of our test queries. The staff were professional and knowledgeable, and responses to emails were received within hours rather than the ‘up to 24 hours’, a commonly found disclaimer on broker sites.

The broker doesn’t have a dedicated FAQ section but instead takes a different approach to helping clients better understand how the platform works.

Trading platforms, market events, and account management are three features which often raise questions from new users. To help clients get up to speed BlackBull offers detailed support information on these categories. Whether you are wondering how to set up an account on TradingView or establish how long it will take to withdraw funds, the answers are clearly set out.

THE BOTTOM LINE

BlackBull Markets is a relatively new entrant to the sector, but it has moved trading on in quite some way in a short period.

The tech infrastructure the broker operates on is institutional grade, but that doesn’t mean things are complicated. The opposite is true, the site has a straightforward functionality, and the ability to set up bespoke markets is a stand-out feature. As with most tech advances, software upgrades do the heavy lifting, resulting in a pleasing user experience.

This is a great broker for beginners with a market-leading range of add-ons that will allow clients to take their trading experience as far as they want.

FAQS

How can I open an account with BlackBull Markets?

From the broker’s homepage, click on the ‘Join Now’ button to start an account opening process which typically takes less than five minutes to complete. As soon as you start signing up, you’ll notice how BlackBull does things differently. The onboarding process reflects the company’s willingness to take all aspects of trading to the next level, including making signing up as easy a process as possible.

Is BlackBull Markets a regulated broker?

Yes. BlackBull Markets is the brand name of BBG Limited which is a limited liability company incorporated and registered under the laws of Seychelles, with company number 857010-1 and a registered address at JUC Building, Office F7B, Providence Zone 18, Mahe, Seychelles. The Company is authorised and regulated by the Financial Services Authority in Seychelles (“FSA”) under licence number SD045 to provide investment services.

What are the deposit options for BlackBull Markets?

BlackBull Markets scores highly in terms of offering clients a variety of ways to fund their accounts. The standard options of Wire Transfer and credit and debit cards are supported by ePayment systems such as FasaPay, UnionPay, Neteller, and Skrill.

How do I withdraw money from BlackBull Markets?

BlackBull clients are equipped with an online ‘wallet’, which is used to facilitate account management. To withdraw funds, access the wallet, follow the four-step process and then wait up to two days for funds to be returned to your account. The process is clearly outlined in a section of the site to help clients. Graphics and simple language ensure those looking to withdraw funds can do so as easily as possible.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk