Forex Traders’ Viewpoint

Online broker Pepperstone provides an exceptional service to traders across the globe. It’s incredibly well-regarded in the trading community and has a loyal and growing client-base.

The way that everything ‘just fits’ and to such a high level, makes it worth taking a few minutes to visit the broker and set up a Demo account – just to find out how good the trading experience can be.

The secret of the firm’s success might come down to its Australian roots, headquartered in Melbourne, the firm has certainly brought a ‘can-do’ attitude to trading the markets.

Or it could be the professional and client-focussed customer services team which frequently sweeps up trophies at industry awards ceremonies. The staff who are available 24/5 continue to be the benchmark by which other firms are measured.

The fact that there are three top-grade trading platforms to choose from completes a highly impressive range client facing features. But it is possibly the behind-the-scenes work that Pepperstone commits to, which makes the difference.

The broker has developed a trade processing infrastructure which results in their clients getting access into the heart of the global financial markets.

Their clever positioning in the markets translates as better liquidity. This results in faster and more reliable trade execution, which means better prices and more certainty for Pepperstone clients.

The final confirmation of the set up being ‘spot-on’ is the regulatory framework. Pepperstone is authorised by a range of Tier-1 authorities across the globe. This adds one more very important reason to try a Demo account at Pepperstone and see why they have such a loyal following.

Pepperstone are worthy of inclusion in any short-list of brokers. Everywhere you look there’s a sense that Pepperstone has been set up by people who know what they are doing. They’re particularly strong in the forex markets but have over recent years done a good job of adding additional asset groups to the list of markets they offer.

Pepperstone Rating Overview

| FEATURE | Pepperstone |

|---|---|

| Overall | ⭐⭐⭐⭐⭐ |

| Education | ⭐⭐⭐⭐⭐ |

| Market Research | ⭐⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐ |

| Deposits & Withdrawals | ⭐⭐⭐⭐⭐ |

About Pepperstone

Pepperstone Limited is a global forex, and CFD broker authorised and regulated by Tier-1 authorities across the globe. Financial authorities which oversee its activities are the Australian Securities and Investment Commission (ASIC) and the Financial Conduct Authority (FCA) as well as CySEC, DFSA, BaFIN, SCB and CMA regulations.

Headquartered in Sydney, Australia, it has been operating since 2010 and opened a London office in 2015. The firm was founded by market professionals and carries the hallmarks of an operation designed by traders, for traders.

The firm is now in the sweet-spot of being a well-established name with an ambitious outlook. Its continuing success can be measured by it collecting industry rewards such as the 2020 Professional Traders awards for Best Tailored Professional Trading Conditions and Best Trading Performance Tools.

Pepperstone’s client base reflects an appeal to quality rather than quantity. It boasts 57,000 active accounts which is a relatively small number compared to the peer group but still manages to process an average of US$12.55bn of trades every day, making Pepperstone Group one of the world’s largest forex brokers.

The London office is sited at 70 Gracechurch St, London, United Kingdom EC3V 0HR and is contactable via [email protected] and +44 (800) 0465473.

The Melbourne office is sited at Level 16, Tower One, 727 Collins St, Melbourne VIC 3008, Australia and is contactable via [email protected] and +61 3 9020 0155.

Who does Pepperstone appeal to?

Pepperstone has a keen focus on delivering the best trading experience for their clients and key to that is ensuring they benefit from tight spreads and excellent trade flow. Pepperstone is in the group of mainstream brokers which lead the market in terms of costs and volumes.

The additional stand-out feature for Pepperstone is the platform which supports the trade execution which is of the highest quality. The server hosting locations and trade-processing architecture being institutional grade. This benefits all traders, but is something which is particularly appealing to those looking to run their own systematic models and program trades in the forex markets.

Pepperstone also offer more than just tight spreads and great execution. The quantity and quality of research and learning materials is above average for the sector. The customer service is highly regarded by the trading community and the regulatory structure is as good as they get.

Trading is a business where the adage ‘buyer beware’ is particularly pertinent. Some of the risk features found at other brokers are not offered by Pepperstone. This is a compromise associated with getting the most direct access to the markets. Beginners would benefit from using a top-tier platform but would just have to make sure they manage their risk limits appropriately.

Demonstrating extreme confidence in its own ability, he firm has even taken to providing a rolling newsfeed of client comments. Following this for a while highlights that most clients appear more than happy with the service. Its also apparent that Pepperstone appeals to beginners as well as intermediate and advanced traders.

Online broker Pepperstone provides an exceptional service to traders across the globe. It’s incredibly well-regarded in the trading community and has a loyal and growing client-base. The way that everything ‘just fits’ and to such a high level, makes it worth taking a few minutes to visit the broker and set up a Demo account – just to find out how good the trading experience can be.

Pepperstone is recommended for - Traders of all levelsForex Account Types

Pepperstone offer two main accounts, Standard and Razor. It is possible for those with sufficient funds and experience to upgrade to the next tier of accounts but both Standard and Razor offer fairly impressive terms.

- To open a live account, Standard or Razor, a minimum deposit of $200 (or equivalent) is required. All client funds are segregated in trust accounts with custodian banks, including National Australia Bank (Australia) and Barclays (UK).

- You will need a scanned copy of your passport or other photo ID, and a recent utility bill/bank statement in order to open an account.

It takes moments to open the free Demo account facility to help familiarise yourself with the Pepperstone platform. The account can be set up a choice of ten different base currencies.

Two neat plus points for clients is that there are no Deposit and Withdrawal fees for Australian and European nationals. There is also no inactivity or account administration fees which gives Pepperstone an edge over some of their peers.

Markets and Territories

Pepperstone offer over 170 different instruments to trade. There are over 61 currency pairs, 12 commodity CFDs, 60 Index & Stock CFDs and a limited selection of four major cryptocurrencies.

Clients are provided with access to the global markets. There is an Australia – UK/EU focus, but the broker’s client base is made up of traders from a wide range of countries. The service is currently not available in some domiciles including the USA and New Zealand.

Instruments and Spreads

In line with standard market practise Pepperstone generate most of their revenue from the difference between bid and offer prices on markets. Here we find that Pepperstone is competitive on a number of forex pairs, like EUR/USD and GBP/USD.

Pepperstone has clearly positioned itself as a very competitively priced online broker since its arrival on the market in 2010. The Razor, over the Standard, account enjoys the tightest spreads with, for example, an average 0.09 pips on the EUR/USD. These are attractive terms but are sometimes improved on with the broker at times offering spreads of 0.0 pips.

Whilst not offering the thousands of instruments which some brokers do the 150+ markets available is still an offering designed to meet the needs of the majority of traders. There is a weighting towards Forex with over 61 currency pairs available to trade meaning that Major, Minor and Exotic markets are on offer.

Other asset classes include Indices, Commodities and Crypto. The 14 Indices markets cover global stock markets ranging from China (CN50) through to the S&P500 (US500). Commodity markets include 3 Energy, 6 Metals and 5 Soft commodity markets, meaning that the major markets such as gold and oil are covered but also orange juice and palladium. They trade on a 24-hour basis and whilst traders who specialise in these assets may find themselves restricted by choice of instruments available there is undoubtedly enough capacity for those looking to take proprietary or hedging positions.

There are over 50 stocks to trade though only via the MT5 platform. They are all US-listed names and come with a 20% margin rate. Whilst this might not appeal to specialist stock traders, one particularly interesting feature is that Pepperstone facilitate trading out-of-hours. This is somewhat unusual and means traders can work the markets when earnings reports are released and price volatility at high levels.

Currency Index CFDs have become more popular as the level of global geopolitical risk has risen.

Traditional currency pairs are open to the risk that shock events impact both side of the pairing which can lead to traders not realising the gains they envisaged. The use of Forex indices allows a single currency to be traded against a basket of other currencies rather than just one. This diversification can help traders pinpoint moves in one currency and its a plus point for Pepperstone that they offer the USDX US Dollar (Dixie) index to its clients.

Given how competitive the spreads are it’s unsurprising that Pepperstone provides a particularly transparent breakdown of the fees-and-charges. Full details can be found here: https://pepperstone.com/en/forex-trading/spreads. But the headline rates are certainly eye-catching enough.

- Edge Standard – $0 commissions and interbank spreads from 0.6 pip

- Edge Razor – AUD $3.5 per 100k traded. With Raw Interbank Direct Pricing and spreads starting at 0.0 pips

- Edge Swap Free – $0 commissions, STP processing and spreads from 0.6 pip (Islamic account)

- Edge Active Trader – Bespoke terms available for high volume and institutional traders

Slippage is another factor to consider. cTrader fills orders using VWAP (Volume Weighted Average Price) which means Market Orders may not necessarily be filled using the top of book price which is shown on-screen. Slippage is entirely possible and comes hand in hand with the market conditions associated with trading in a true STP environment. Those looking to avoid slippage can use Market Range Orders or Limit Orders.

cTrader is a non-dealing desk platform which means it is impossible for Pepperstone to manipulate pricing, charts and historical data.

Fees and Commissions

Pepperstone brokerage and financing fees are not quite as user-friendly as the trading commissions, but they are still better than the market average. The schedule is relatively transparent, and as the firm focuses on forex markets, it’s relatively easy to run a cross-analysis.

There is, of course, a need to consider the variations between the cTrader and two MetaTrader platforms which all come with their own T&Cs. Whilst this necessitates more time being spent on due diligence it is ultimately preferable to have a range of platforms and accounts to choose from.

Some clients, particularly those with larger cash balances may consider the Edge Active account. Traders who pass the application process will experience an upgrade to institutional grade terms and conditions regarding pricing and market flow.

Forex Trading Platform Review

Pepperstone utilises the widely used, third party MetaTrader MT4, cTrader, WebTrader and MetaTrader MT5. These are all available in mobile App format for iPhone and Android devices.

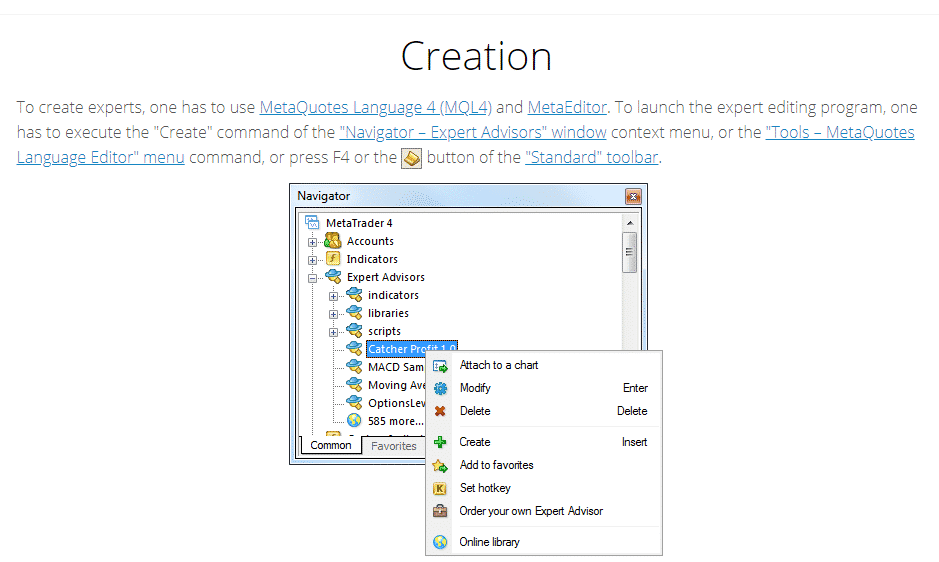

The MetaTrader suite of services form the world’s most widely used forex trading platform. They feature trader-focused functionality, are highly customisable and available in a range of languages. Of equal importance is they are particularlyrobust and reliable having been developed and enhanced over many years.

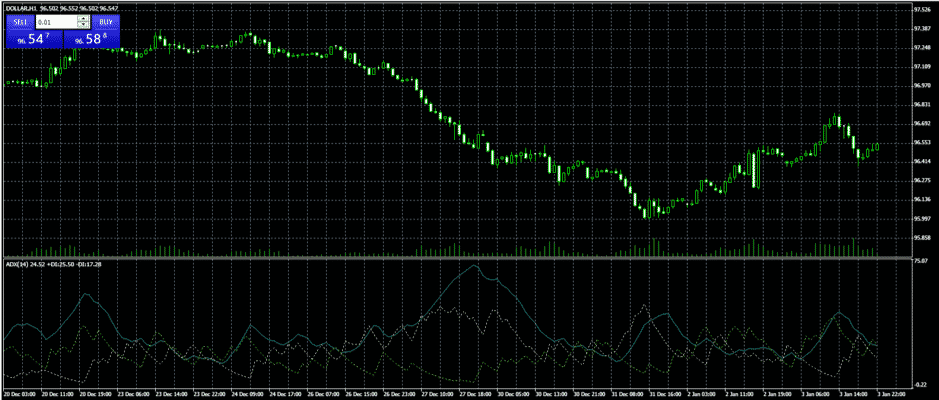

The MT dashboards is packed full of powerful charts and indicators. The extensive standard range of indicators can also be supplemented by third party tools which are available to users.

It also fully supports systematic trading, the MQL language allows traders to create their own automated trading programs. There is also the option of bolting on programs developed by others and which are available under the Expert Advisors (EAs) area of the site.

The cTrader platform, which comes in a downloadable desktop format, has a different look but is as equally powerful as the MetaTrader platforms. The cTrader execution interface includes a wider range of order type settings which aids risk management. It is worth noting, however, that the direct nature of market access means that, as with other brokers, it is not possible for the broker to offer the option of applying guaranteed stop losses.

Digging into the detail of the trading architecture reveals that Pepperstone has set up their trading platforms to provide top grade market access. Some of the technical specifications are institutional grade. Items such as optical fibre cross-connects, VPS co-location, and hosting at the Equinix (NY4) facility all standout. The end result for Pepperstone clients is trade execution with latency as low as 50ms and the ability to access pricing from 22 banks and liquidity providers and also access to dark pool liquidity.

The direct access offered might mean guaranteed stop losses are not an option, but the trade-off is that clients benefit from tighter spreads, fewer delays, fewer rejects and re-quotes.

Mobile Forex Trading

Pepperstone score strongly in this category. The MetaTrader and cTrader mobile apps both offer a trading experience which is similar in quality to the desktop version. The number of indicators and charting tools available is notably high. Chart metrics can be finetuned and trade execution can be set at one-click.

Our testers reported that when using the cTrader execution GUI, it proved difficult to access the stop loss / limit order area of the dashboard.

Account administration is performed using Pepperstone’s proprietary app. This is where clients can manage the day to tasks associated with account management whilst on the go.

Having a range of up to 4 apps to consider didn’t prove to be too much of a distraction during testing. Whilst it did at times require some flicking between screens the overriding benefit was that those apps associated with actual trading (cTrader and MetaTrader) were dedicated trading portal. They hold everything required for successful trading.

Social Trading and Copy Trading

Clients of Pepperstone looking to Copy Trade can access to the Mirror Trader service. It is only available to clients with live (not demo) accounts and the Mirror Trader platform is renowned as one of the best marketplaces to evaluate and trade up to 3,000 global, verified and tested algos.

Account holders still maintain control and responsibility over their account but take on automated instructions from other traders. The relationship with the ‘Copied’ trader can be ended at any time and profit taking and stop loss overrides are available.

DupliTrade is available to those using the MT4 platform to trade and with cash balances in excess of AUD$ 5,000. This service is similar to the Mirror Trader offering and can be tested in the Demo environment.

The ‘MetaTrader Signals’ service is also worth considering. Whilst not Copy Trading in the strictest sense of the term it does allow traders to draw on the input of others and comes with relatively low fees. In fact, some of the Signals are provided free of charge.

Myfxbook’s AutoTrade is a Copy Trading service that allows clients to copy trades from top successful forex trading systems. There are no performance or management fees and the service is hosted remotely by Myfxbook.

Pepperstone Social Trading Platforms

ZuluTrade is one of the leading Social Trading platforms and comes as part of the Pepperstone package. As with AutoTrade, there are no management / performance fees and ZuluTrade provides traders with a true Social Trading experience. Users are able to share and discuss trading ideas or general market conditions.

Having a variety of Social/Copy Trading platforms is something of a plus-point for Pepperstone. Some brokers don’t offer the service at all. Being able to operate with different third parties doesn’t negate the risks involved and Pepperstone score highly by offering a selection of providers to choose from.

Crypto Trading with Pepperstone

Pepperstone offer very user-friendly access to the cryptocurrency markets. There is no need for specialist crypto wallets and traders can take short as well as long positions in efforts to benefit from the significant price moves associated with the crypto markets.

Crypto can be traded over all platforms and leverage varies from 1:2 to 1:5. The instruments available are Bitcoin, Bitcoin Cash, Ethereum, Dash and Litecoin. There are no commissions, and the spreads and execution are as competitive for crypto as they are for other types of assets.

Forex Charting and Tools

The cTrader, and the MT4 and MT5 MetaTrader platforms provide market leading charting functionality. They each have distinctive aesthetics which will go a long way to helping traders select the one that matches their personal preference. MetaTrader offers surgically sharp visuals whilst cTrader allows easier access to Indicators. Each come with a very long list of indicators which would meet the requirements of even the most advanced trading strategies.

Learn Forex Trading with Pepperstone

Pepperstone provide a comprehensive range of resources designed to cater to traders with all levels of experience. From a comprehensive Glossary through to more detailed and technical subjects, the material is well laid out and easy to navigate.

Few of the Educational resources are necessarily ground-breaking but it is noting some brokers don’t even provide this level of support.

Those looking to develop their trading ideas would likely make the step up to some of the other tools which Pepperstone offer. Autochartist, ZuluTrade and the MetaTrader MQL suite are just three of many resources which clients of Pepperstone can access. These third-party services allow clients to test and develop trading ideas in a simulated trading environment.

Forex Trader Protections by Territory

Pepperstone operate under license from two of the most highly regarded regulators in the world the Australian Securities and Investments Commission (ASIC) and Financial Conduct Authority (FCA) in the UK.

Clients will find their particular domicile will determine which framework they fall under. As with all brokers potential users would do well to carry out their own due diligence as the protections offered by the respective bodies are quite different.

EU based traders who hold accounts with Pepperstone Limited (70 Gracechurch St, London, United Kingdom EC3V 0HR) receive protection from the FCA which includes features such as investor protection to a maximum value of £85,000

As well as being regulated by ASIC and FCA the firm segregates client funds with tier 1 banks and offers a variety of fee-free funding methods.

Compare Pepperstone with other approved brokers

|  |  |  | |

| Education | courses, webinars, market analysis | webinars, market analysis | courses, market analysis | courses, webinars, market analysis |

| Customer Support | email, phone, live chat | email, phone, live chat | email, phone, live chat | email, phone |

| Minimum Deposit | $200 | $100 | $100 | $200 |

| Total Markets | 1000+ | 725 | 1260 | 2000+ |

| Total Currency Pairs | 62 | 64 | 55 | 49 |

| Total Cryptos | 12 | 3 | 17 | 37 |

| Total CFDs | 900+ | 725 | 626 | 2000+ |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader | MT4, MT5 | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | eToro Platform |

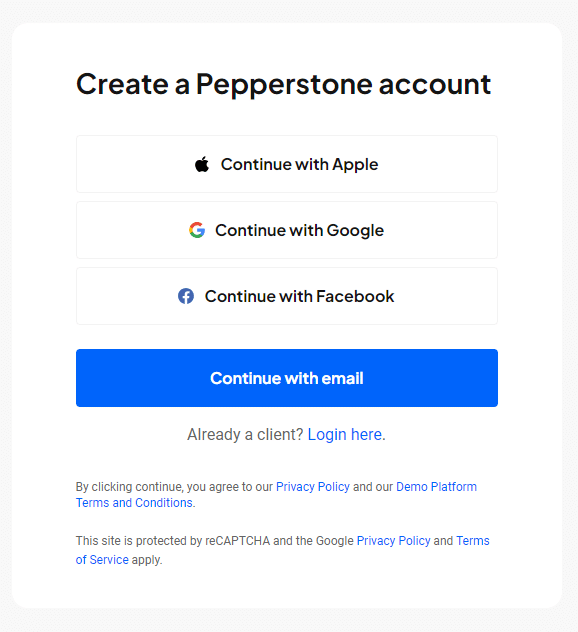

Opening an Account

The onboarding process at Pepperstone has been designed to be as user-friendly as possible. Clicking the ‘Join Now’ button on the broker’s home page takes new clients through to a registration page where it is possible to use details of existing profiles, such as those relating to Google, Facebook and Apple, to fast-track the opening of a new account.

Setting up a new account includes providing recovery email address/telephone contact details, which ensures that you can access your account if you forget some crucial information. It is also possible to set filters determining the amount of contact you have with the firm. Emails about market events can be useful for helping develop strategies and identify trading opportunities.

At this point, it’s possible to set up a Demo account, start trading virtual funds and learn more about the Pepperstone trading experience. Or alternatively complete the KYC (Know Your Client) information required to set up a Live Account. The KYC form filling is completed online and provides information so that the broker can identify you. In line with regulatory procedures, forms of ID need to be uploaded and verified, but during testing, this was completed within 24 hours.

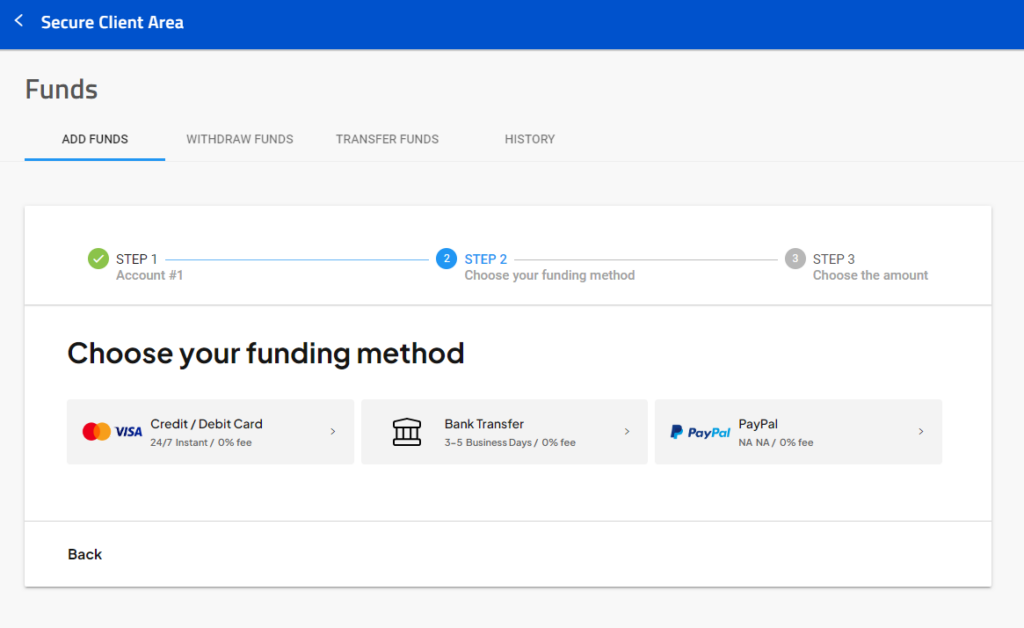

Making a Deposit

Funding of accounts is done through the secure client area. Credit card, debit card, bank transfers and PayPal can be used with the card options having the advantage of being instant. Card and PayPal transactions don’t incur a fee but whilst Pepperstone don’t apply any charges on bank transfers, your bank, or a third party that is part of the process might. Whether or not this is the case comes down to your personal situation and checking the small print can help you avoid unnecessary charges.

The Funds History area of the Pepperstone platform keeps a log of all deposits and withdrawals. Having this information displayed in one place provides a way to keep track of trading profit and loss. The reports are easy to read and can be downloaded as CSV files making it easy to keep a record.

Placing a Trade

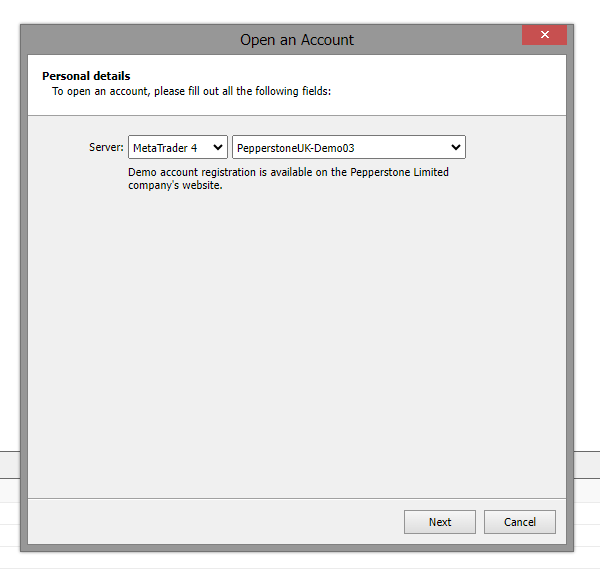

Pepperstone offer four market leading-platforms, TradingView, cTrader, MT4 and MT5. Depending on which one you choose you may have to set up a separate log-in, because the platforms are operated by third parties. This is done by clicking on the ‘Request an Account’ button which appears in the Secure Client Area. These new log-in details will also be sent to your email address so you can keep a record and use them to log-in and book a trade.

Moving through the stages of accessing the platform involves checking log-in details and clicking ‘next’.

During the testing of the MetaTrader MT4 platform, we found that trade execution times were instant, there were no re-order issues, and our currency trades showed up accurately as positions in the portfolio section of the platform.

Contacting Customer Support

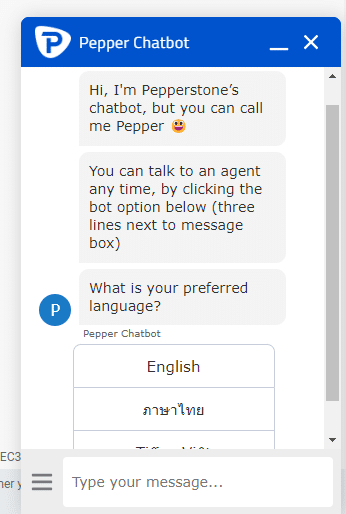

Throughout the onboarding process there is the option to contact Pepperstone support using the Live Chat function which remains in the bottom right-hand corner of the screen. This ensures you can get immediate help in a range of different languages.

An automated messaging system manages the first stage of the Live Chat process. These can at times be frustrating, but the broker makes it clear that you can talk to a human support agent at any time, just by following one link.

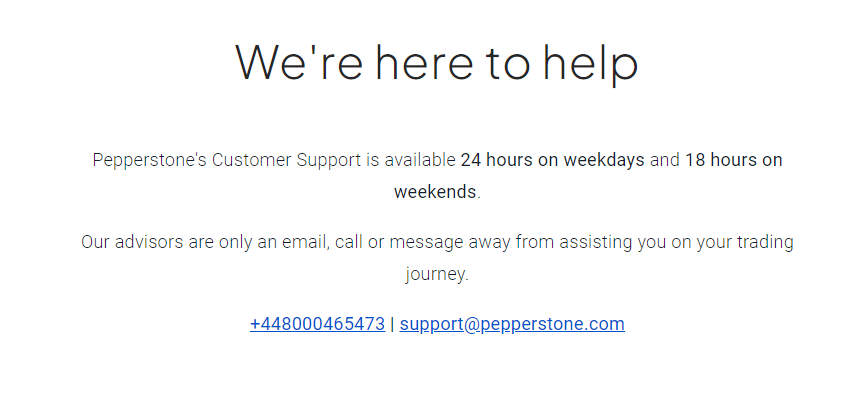

It is also possible to contact the Pepperstone help desk via telephone and email. The team offer 24-hour support on weekdays and 18-hour support at the weekends. That’s an impressive degree of coverage and goes some way to explaining why the response times to our test email queries were so rapid. The standard response time for email queries was impressively short with the Pepperstone team resolving issues within a few hours.

It’s also worth noting that the FAQs section of the Pepperstone site is particularly useful, which can’t be said of all brokers. The questions dealt with typical trading queries that a new trader might face and had the sense of being created by real traders.

The Bottom Line

Pepperstone is obviously focused on ensuring its clients enjoy a trading experience which is as good as it can possibly be. The platform has the feel of having been built by traders.

For starters, execution, trade flow, commissions, trading dashboards and charting tools are all top-grade. The positive features though extend further and deeper than with most other brokers. The tech-heavy theme extends to API connectivity and well thought out server location.

The broker is a market leader in terms of the variety of Copy Trading and Social Trading services on offer, something which will be particularly appealing to those looking for a more hands-off trading experience.

There may not be as many instruments as at some other brokers. Those traders who are happy to accept that compromise, and particularly those who specialise in forex markets, will find the Pepperstone ticks an awful a lot of boxes.

Everything is in the right place, and the broker has focussed its attention on delivering features which improve the trading experience. Testing the platform via a free, no-strings Demo account offers a chance to see quite how good some trading platforms are.

FAQs

How do I open a demo account with Pepperstone?

A Pepperstone demo account can be set up in moments by following this link and filling in the few lines of information needed. It offers access to a range of great trading platforms but is only available for 30 days.

What fees does Pepperstone charge?

This is a bit complicated. The pricing schedules are actually very transparent, but the broker offers a wide range of accounts and platforms in an effort to accommodate all types of traders. The information relating to charges can be found here: https://pepperstone.com/uk/trading/spreads-swaps-commissions

What bonus terms does Pepperstone offer?

This will depend on client domicile but there is some opportunity to hook up to bonuses and secondary income streams. The firms Refer-a-friend https://pepperstone.com/uk/refer-friend and Active Trader Program https://pepperstone.com/uk/why-pepperstone/active-trader-program are both worth looking into.

Please be advised that certain products and/or multiplier levels may not be available for traders from EEA countries due to legal restrictions.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose

Your capital is at risk

Your capital is at risk