Forex Traders’ Viewpoint

Since it was founded in 2007, has grown to become the world’s leading social trading network with over 17m registered users in over 140 countries.The company is the pre-eminent broker in the area of Social and Copy Trading but allows clients to also trade their own ideas and self-trade. One neat feature being that both types of trades are held in the same account which makes it exceptionally easy to keep track of your investmentsIn fact, ‘ease’ is very much the buzzword associated with the eToro experience. You can set up a free Demo account within 20 seconds and the process for completing full registration is one of the most user-friendly in the market.Once you’re signed up, you can complete an instant transfer of funds to your trading account and then you’re off. The trading dashboard is eToro’s own design and breaks the markets into easy to find categories. Click through to the one to trade and guess what, the trade execution process is also really straight-forward.eToro leads the way in terms of providing traders and investors with the best aspects of social and copy trading. Social trading on the platform is a significant differentiator, as groups of traders are able to create a trading desk-style environment where ideas and strategies are discussed. This is particularly helpful for those who are new to trading. However, this should not detract from the standardised brokerage offering that is backed by cutting edge technology and enjoys competitive trading costs. The cherry on the cake is the strong regulatory framework and innovative ideas such as client insurance which all add up to make eToro a trusted broker.

eToro Rating Overview

| FEATURE | eToro |

|---|---|

| Overall | ⭐⭐⭐⭐⭐ |

| Education | ⭐⭐⭐⭐⭐ |

| Market Research | ⭐⭐⭐⭐⭐ |

| Range of Markets | ⭐⭐⭐⭐⭐ |

| Deposits & Withdrawals | ⭐⭐⭐⭐ |

About eToro

eToro is one of the key pioneers of the global fintech revolution. It has grown to become the world’s leading social trading network, with millions of registered users and an array of innovative trading and investment tools.

Originally founded in Tel Aviv, Israel by two brothers, Ronen and Yoni Assia and partner David Ring in 2006, eToro began as a vision of a popular financial trading and investment platform suitable for everyone. The company specializes in the field of social trading and has grown considerably since its inception, with eToro currently enjoying a top position among social trading networks and online forex brokers.

eToro’s oversight comes from two agencies in the European Union and the UK. The Cyprus Securities and Exchange Commission or CySEC and the Financial Conduct Authority or FCA.

Currently, eToro has over 15m users who enjoy access to trading in currencies, CFDs, indexes and commodities via the broker. The company’s online platform is as easy to use on a mobile device as it is a desktop machine and attracts thousands of new accounts on a daily basis.

Who Does eToro Appeal To?

The ‘value-added’ from the eToro experience comes from the ability of clients to draw on the comments, thoughts and even trading signals of other traders. The idea-sharing can be done informally (social trading) or more formally (copy trading), but both methods will appeal to those looking for a more ‘hands-off’ trading experience.

It’s also very convenient to be able to manage this kind of trading in the same account as the ‘traditional’ self-trading activity. There’s something for everyone.

Signing up to social and copy trading accounts involves a degree of ‘outsourcing’ of the day-to-day trading processes. Taken to the extreme, this involves giving authority to other traders, ‘Popular Investors’, to book trades directly and automatically to a client account.

For those who prefer to keep a closer eye on things, the social trading features encourage the sharing of ideas, even on live trading scenarios, but rely on the client to execute their own trades.

One feature which will appeal to all is that the Lead Traders have no authority over your account. Their signals can be applied to your cash pot, but only you have control over the money. Thanks to AML regulations eToro can only send money back to the account you used to make the original investment. This differentiation is important as a lot of scammers promise extra-ordinary returns but just run off with your money.

Since the firm’s inception in 2006, it has stuck with the ethos of designing an online trading and investing platform that is accessible to anyone. Its universal appeal comes from maintaining a balance between providing ease of access to beginners and improving upon advanced features for more experienced traders. As the site has developed and grown, so has its client base, and today the firm claims to be the world’s leading social trading platform.

eToro is the pre-eminent broker in the area of Social and Copy Trading. You can set up a free Demo account within 20 seconds and the process for completing full registration is one of the most user-friendly in the market. Once you’re signed up, you can complete an instant transfer of funds to your trading account and then you’re off.

eToro is recommended for - beginners making their first trades61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Forex Account Types

The first sub-division of account types is into Personal (for individuals) and Corporate. The setting up of either account involves an appropriate amount of document processing. Some comfort can be taken from a broker demonstrating full compliance with Know Your Client regulations, even though the onboarding is expensive for the firm to support and also possibly frustrating for clients.

Both Personal and Corporate accounts offer the same general formats of trading, though the Corporate version does require working through a more detailed onboarding process.

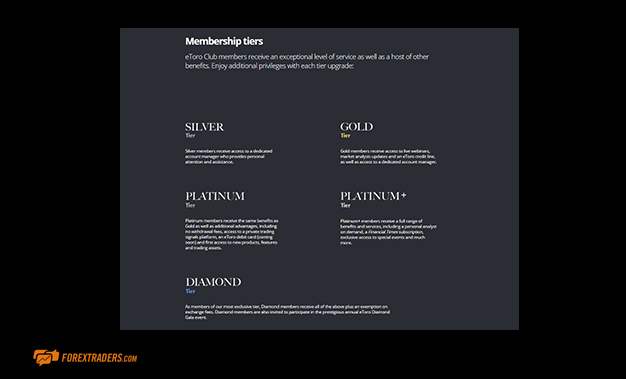

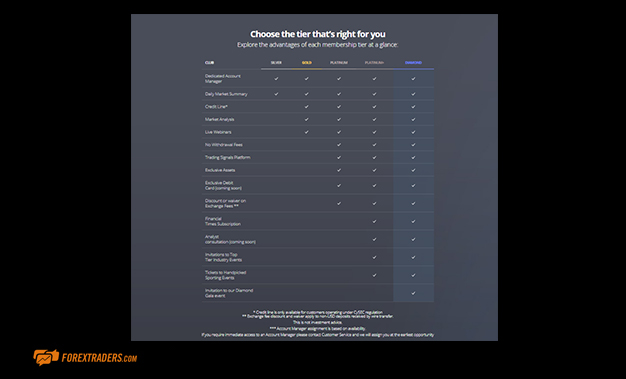

The second filter applied to account types works by considering the size of the deposit made and equity held. As account holders move up through the ranks from Silver to Diamond, they accrue a range of benefits ranging from access to live webinars to an invite to the annual Diamond Gala event.

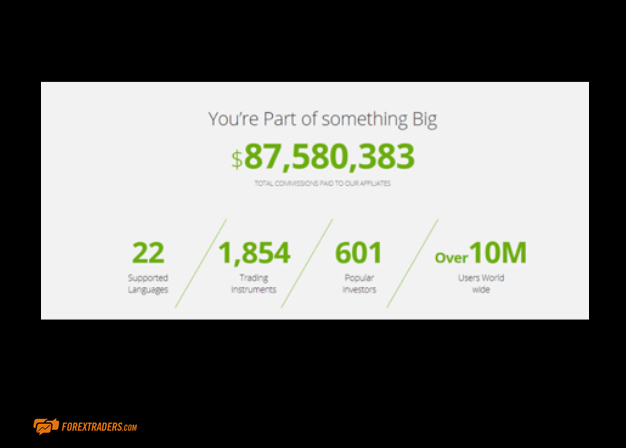

The Affiliate Account system is set up to allow ‘Partners’ to benefit by directing traffic to the site. Each time a visitor clicks through and then funds their account, the eToro Partners program makes a payment to the Partner responsible for the referral. Passive income streams are always welcome, so while this is a little out of the standard retail broker box of tools, it will certainly appeal to some.

The eToro software is able to offer Islamic accounts in accordance with Sharia law. Deposits must total a minimum of US$1,000 and accounts must be verified. Verification requires the submission of a clear colour copy of a passport and a clear colour copy of a utility bill, not older than three months, showing the account holder’s name and address.

Markets and Territories

The eToro platform currently hosts clients from more than 140 countries worldwide. One notable inclusion in that list is the USA. Breaking into the US market has always been something of a holy-grail for brokers, but the regulatory bar is set exceptionally high. The brokers willingness to invest in ticking the boxes of the US regular is a sign of their intentions and eToro is moving toward being regulated in certain US states.

*eToro USA LLC does not offer CFDs, only real Cryptocurrencies are available for US users.

INSTRUMENTS & SPREADS

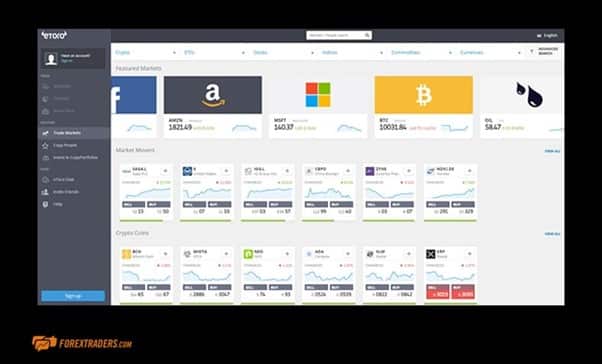

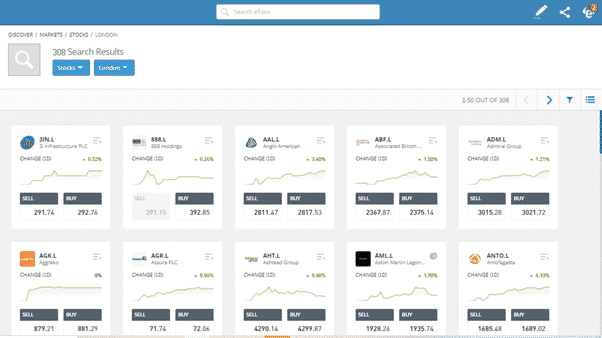

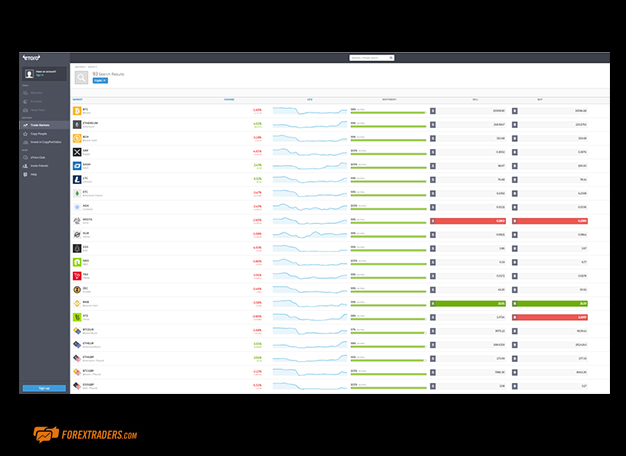

eToro offers account holders access to 1,854 financial markets. This is some way short of the more than 10,000 offered by the biggest multi-asset brokers but is still a considerable offering.

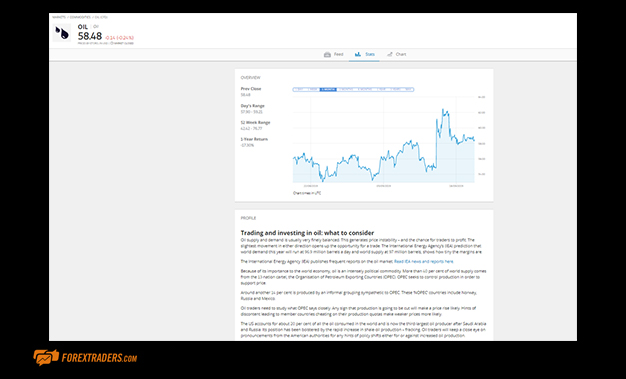

The product range is broader than that of some other brokers. ETF markets are available as well as the more familiar stocks, forex, crypto, commodities and indices. Market coverage is global in nature and the broker also offers ‘fund’ style products called Copy Portfolios, which apply the principles of copy trading to a basket of assets.

Demonstrating that there are enough markets to be getting on with, there are, for example, 308 London-listed equities from which to choose.

The attraction of eToro is the ability to combine copy, social and self-trading in one account. Providing almost 2,000 markets ensures that the focus can be on the opportunities that come from blending those three trading strategies.

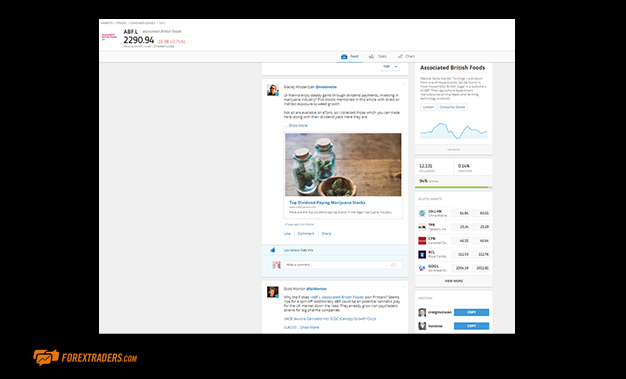

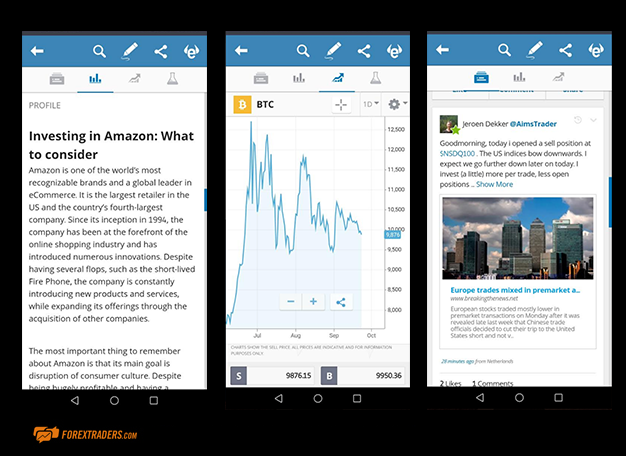

Each stock comes with its own homepage, where traders and investors can view the Feed, Stats or Chart relating to that instrument. The comments and opinions of other traders are easy to access and shared for no charge. There is 16 crypto markets to choose from, which is a very high number and puts eToro in the same bracket as brokers that bill themselves as crypto specialists.

The ability to invest in ETFs as CFDs for European users will appeal to some, and there are 249 markets, including names such as PIMCO TOTAL RETURN (Active Ex Bond) and UNG (US Natural Gas). It is also possible to trade the 13 largest global equity indices, six commodities and 49 currency pairs. eToro is in the process of rolling out a service to US clients, and currently the offering in that region is limited to cryptocurrency markets.

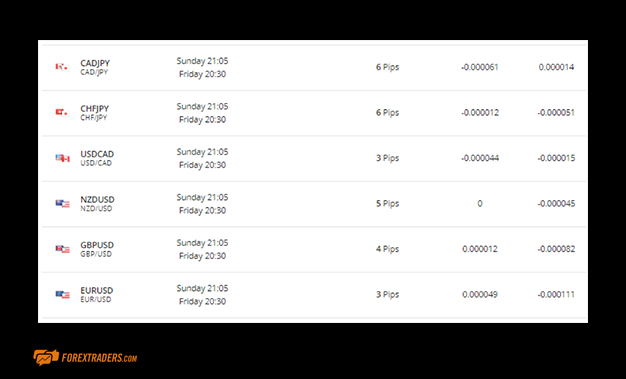

Spreads

Trading at eToro is done using variable spreads. The firm’s decision to prioritise simplicity and transparency means that all the charges and commissions are rolled up into the one set of bid-offer prices.

The spreads can look a little wider than other brokers that don’t offer ‘all-in’ pricing, but breaking the numbers out shows that eToro spreads compare very favourably with its peer group. Something else to remember is that the spreads remain the same regardless of whether you are copying someone or trading manually.

The broker offers a very clear and transparent breakdown of all spreads in all markets. Accessing it will provide information on all the latest rates – you can find it here: https://www.etoro.com/trading/market-hours-fees/.

FEES AND COMMISSIONS

Financing Fees

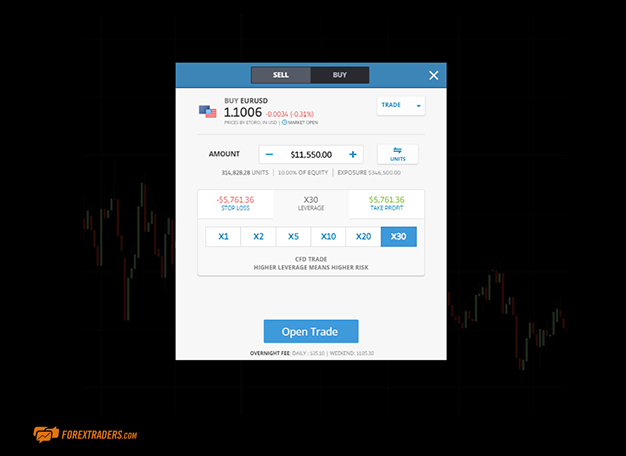

Overnight financing fees are displayed in the trading dashboard at time of trade. Having them come up on the execution interface is a really positive step towards transparency and also demonstrates that eToro thinks that its financing rates are something worth promoting. The financing fee calculations are provided in the main part of the site rather than an obscure appendix.

The equations are as follows:

- For BUY (long) positions: (Units * Price) * (1% /365) + (Units * Tom-Next Rate)

- For SELL (short) positions: (Units * Price) * (1% /365) – (Units * Tom-Next Rate)

Long (BUY), non-leveraged crypto, stock and ETF positions are not executed as CFDs but as ‘receipt vs payment’ transactions and do not incur any fees.

Trading Commissions

The commissions on trade execution are included in the bid-offer spreads – there are no separate trading costs.

Cash Processing Fees

eToro charges a $5 fee for cash withdrawals and the minimum withdrawal amount is $30. There are also conversion fees ranging between 50 and 100 pips on wire transfer deposits and withdrawals. The broker offers a full and clear breakdown of fees here: https://www.etoro.com/trading/market-hours-fees/.

In line with the current market trend, eToro applies an inactivity fee of $10 per month for accounts that haven’t been used for 12 months or more. Even just logging in is sufficient interaction to avoid the fee.

Fees are an unavoidable part of trading but one positive feature found at eToro is that they don’t charge extra commissions for Copy Trading.

Forex Trading PLATFORM REVIEW

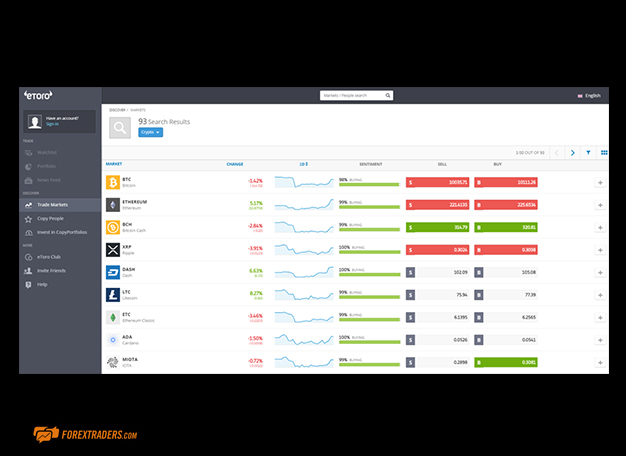

The eToro platform has a crisp and clean aesthetic and is very easy to navigate. Its simple layout means that traders can move with ease between the site’s three key areas: self-trading, copy trading and social trading.

One very appealing feature that helps eToro stand out from the pack is the News Feed area, where comments and opinions of other traders mingle with official announcements.

MOBILE Forex TRADING

eToro provides mobile trading apps that are downloadable to both iPhone and Android devices, and the functionality of the mobile platform is the same as that of the desktop version. The service is very user-friendly and the clean aesthetics of the site work well on a smaller screen.

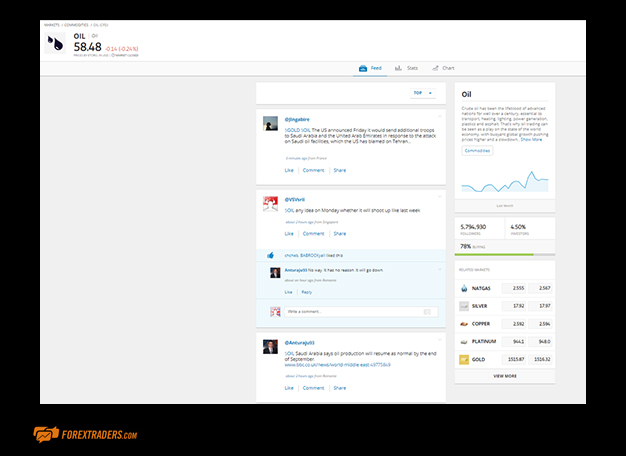

SOCIAL TRADING

The Social Trading area of the eToro platform is as good as they get. Groups of traders are able to create a trading desk-style environment where ideas relating to trading strategies are discussed as the strategy actually trades the markets. It all feels very real-time, and you can even ask the Lead Traders questions. Visiting the groups is a great way to get started and for developing your trading ideas.

Clients, even newbies, can be even more proactive and start off their own discussions by sharing ideas and questions with the trading community. The ‘Write a Post’ feature allows for any chart to be put up for others to comment on.

COPY TRADING

One of the main attractions of eToro is its copy trading service. Those wanting to get a better understanding of it or even run a virtual copy portfolio can do so using the free to use and easy to access eToro demo account. Some other brokers don’t offer copy trading to demo accounts, so eToro already scores positive marks for doing so. A demo account also allows users to get a feel for the site as a whole.

*Past performances are not an indication of future results.

When it comes to automated trading, the copy trade feature is the main plus here. This allows less-experienced users to find and copy other successful eToro traders and involves the ‘following’ account automatically opening and closing positions as and when the ‘Popular Investor’ account does.

Successful traders who gain followers are rewarded through the Popular Investor Program, where there are thousands of Popular Investors from which to choose.

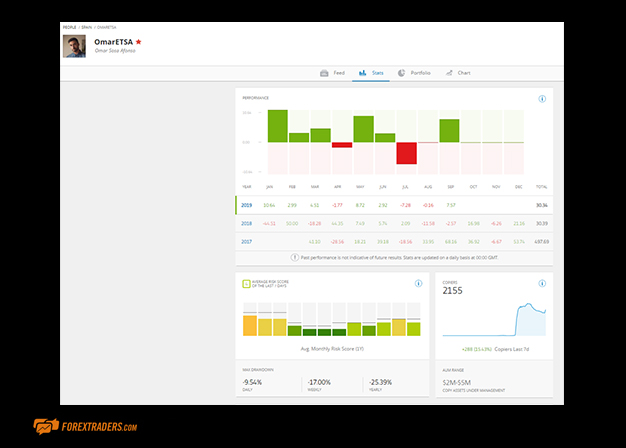

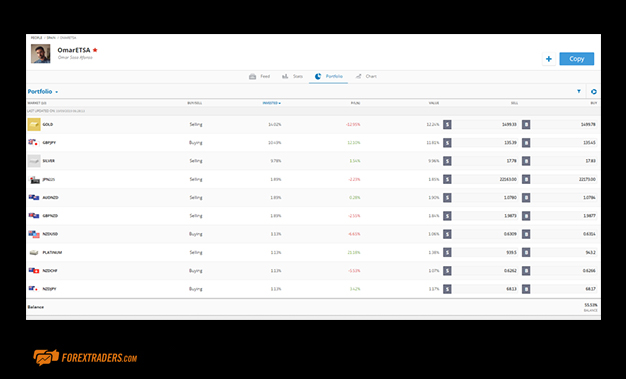

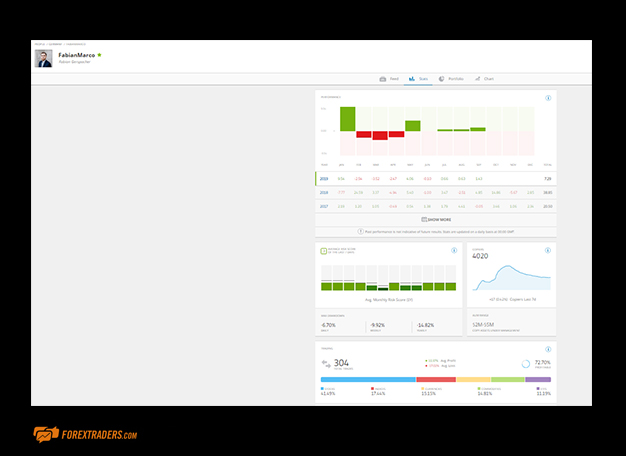

All Popular Investors are required to share not only their ideas but also information about their strategy so that investors can make a more informed choice. eToro also applies an algorithmic filter to present its clients with what it sees to be the best of the Popular Investor Trader accounts. The eToro rankings are based on performance statistics such as total gain or winning ratio.

The Copy Portfolios feature is provided so that clients can copy a bundle of traders rather than a single one, the intention being to diversify risk.

All investors are recommended to carry out their own due diligence before deciding to copy another trader. The parameters used by eToro would form a good starting point of that process. eToro even provides a breakdown of some of the metrics it uses when ranking traders.

*Past performances are not an indication of future results.

CRYPTO TRADING WITH ETORO

There are an impressive 16 crypto markets to choose from, which is a high number for a multi-asset broker. This even puts eToro in the same bracket as brokers that bill themselves as crypto specialists.

UK retail clients who want to trade crypto have recently been flocking to the site. In January 2021, the FCA introduced new regulations which banned retail clients from trading crypto using CFDs. eToro have processed a work around which allows their clients to still access the market. You can’t use leverage, but you can buy outright, and eToro stand out in the market for being able to offer this.

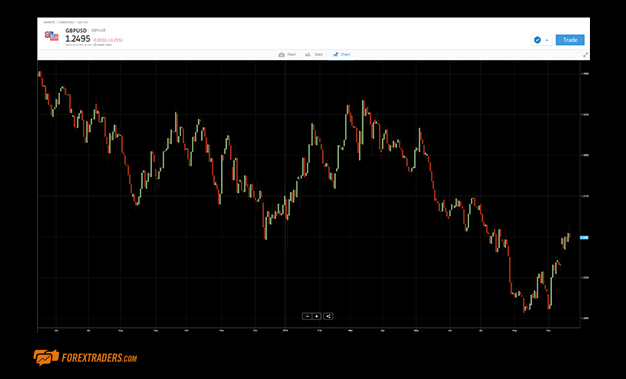

Forex Charts and Tools

In terms of charting and technical indicators, the platform comes with market standard functionality. It is simple to use and extends to metrics such as moving averages, Bollinger Bands and stochastics.

More experienced traders may find that some particular indicators or advanced charting tools are not available on the eToro platform.

Learn Forex Trading with eToro

Basic tools such as an Economic Calendar and Daily Market Review are available and form a basic framework with which to approach the trading day. There are more in-depth reports available in a section entitled ‘The Complete Guide to Fintech’.

eToro is very much a pioneer of social trading, and as a result, clients of the site can interactively engage with other traders and get down to discussing the pros and cons of real strategies being applied to the live markets. This is a great way for traders to learn more about the markets, but the more formulaic education and learning areas of the eToro site can only be described as adequate.

Forex Trader Protections by Territory

Clients of eToro can take comfort from the platform demonstrating an awareness of the importance of regulatory compliance and choosing to operate under licences from top-ranking regulators. Depending on their domicile, clients will fall under the regulatory protection of one of the following:

- eToro (Europe) Ltd, a Financial Services Company, is authorised and regulated by the Cyprus Securities Exchange Commission (CySEC) under the licence number 109/10.

- eToro (UK) Ltd, a Financial Services Company, is authorised and regulated by the Financial Conduct Authority (FCA) under the licence FRN 583263.

- eToro AUS Capital Pty Ltd is authorised by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services Licence 491139.

Operational risk is also considered. All transactions are communicated using 128 Secure Sockets Layer (SSL) technology, ensuring that your personal information is safe. Client funds are kept in tier-one European banks and segregated from the broker’s own accounts.

The eToro General Risk Disclosure can be found here: https://www.etoro.com/customer-service/general-risk-disclosure/.

Compare eToro with other approved brokers

|  |  |  | |

| Education | courses, webinars, market analysis | courses, market analysis | webinars, market analysis | courses, webinars, market analysis |

| Customer Support | email, phone | email, phone, live chat | email, phone, live chat | email, phone, live chat |

| Minimum Deposit | 50$ | $100 | $100 | $200 |

| Total Markets | 2000+ | 1260 | 725 | 1000+ |

| Total Currency Pairs | 49 | 55 | 64 | 62 |

| Total Cryptos | 37 | 17 | 3 | 12 |

| Total CFDs | 2000+ | 626 | 725 | 900+ |

| Trading Platforms | eToro Platform | MetaTrader4, Sirix, AvaOptions, AvaTrader, Mirror Trader | MT4, MT5 | MetaTrader 4, MetaTrader 5, cTrader |

How to Open a Forex Trading Account

Setting up a demo account takes moments and leads new users through to the core of the site, and it’s possible to explore the copy and social trading features as well as the self-trading area.

Leverage rates in the self-trading area are set to the preference of the account holder and on a trade-by-trade basis. At the time of execution, traders can adjust the amount of leverage on the trade by just clicking a button. Leverage is dependent on the domicile of the account holder, but UK-domiciled accounts can take levels of 1:1, 1:2, 1:5, 1:10, 1:20 and 1:30. Trading with leverage is subject to high risk. You can suffer a total loss. Please inform yourself about the risks.

The minimum account balance is dependent on account holder domicile and whether it is corporate or individual, but the amounts mentioned are generally in line with the industry standard:

USD50 (Australia), USD10 (USA), USD200 (the UK and Europe). Corporate accounts USD10,000.

Judging by the amount of KYC documentation requested by eToro during the onboarding process, it’s clear that the firm takes its compliance role seriously.

Deposits are allowed using the following methods: (Visa, Mastercard, Diners Club, Maestro), Neteller, Skrill, WebMoney, Giropay and Yandex Money, bank transfer (with minimum $500).

The Bottom Line

eToro continues to lead the way in terms of providing traders and investors with the best aspects of social and copy trading. The service is well thought out, and the eToro experience stands out because it provides some very appealing innovative features that other brokers just don’t offer.

eToro also compares well in terms of the ‘standard’ part of the brokerage service. The platform is especially user-friendly and allows all social, copy and self-trading to be carried out in one place. Trading costs are competitive, and the regulators that oversee the operation are as strong as you’ll find. There is only a basic offering of educational and research literature, but eToro clients will more likely engage in the ‘on-the-job’ learning found in the social trading areas of the site, where it is possible to interact with other traders.

The customer services function is something that could be improved. The site is very straightforward and has a transparent layout, but should clients find that they do have a question to ask, they may find it harder than imagined to get an answer.

Clients of eToro benefit from the site’s cutting-edge technology, but the firm offers the security of having been around the markets since 2007. Over that time, it has acted as a pioneer of the social and copy trading space, and it now hosts in excess of 13 million client accounts.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

FAQs

How can I open an account with eToro?

It takes no more than five minutes to open an account with eToro. In order to open an account, you must visit the site and fill out all of your details in the provided account registration form.

Is eToro a regulated broker?

Yes, eToro is regulated in several jurisdictions:

- eToro (Europe) Ltd., a financial services company authorised and regulated by the Cyprus Securities Commission (CySEC) under license number 109/10.

- eToro (UK) Ltd, a financial services company authorised and regulated by the Financial Conduct Authority (FCA) under license FRN 583263.

- The Australian Securities and Investment Commission (ASIC) authorises eToro AUS Capital Pty Ltd. provides financial services pursuant to Australian Financial Services License 491139

What fees does eToro charge?

eToro charges a $5 cash withdrawal fee and a minimum withdrawal fee of $30. There is also a conversion fee ranging from 50 to 100 points for deposit transfers and withdrawals.

How do I withdraw money from eToro?

Customers can withdraw funds from their account at any time. Funds may be withdrawn in an amount not exceeding the balance of funds in your account, minus the amount of margin security used.

The withdrawal of funds is carried out using the method that you used earlier to replenish the account, and to the bank account from which the replenishment was made. Payments are made in the following order of priority:

- Bank Transfer

Risk Warning

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of eToro retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.

Between 74-89% of CFD traders lose

Between 74-89% of CFD traders lose  Your capital is at risk

Your capital is at risk  Your capital is at risk

Your capital is at risk