- The GB Pound surged after the Thursday 14 September Bank of England meeting, with perception of a more hawkish tone pushing GBPUSD to its highest level post-Brexit.

- With GBPUSD already in a bull trend, this more recent activity points for a move potentially towards 1.40 into September/October.

- Furthermore, the strength in the GB Pound has weighed on the FTSE 100 future, with a significant sell-off shifting the intermediate term outlook to bearish.

See more technical analysis videos

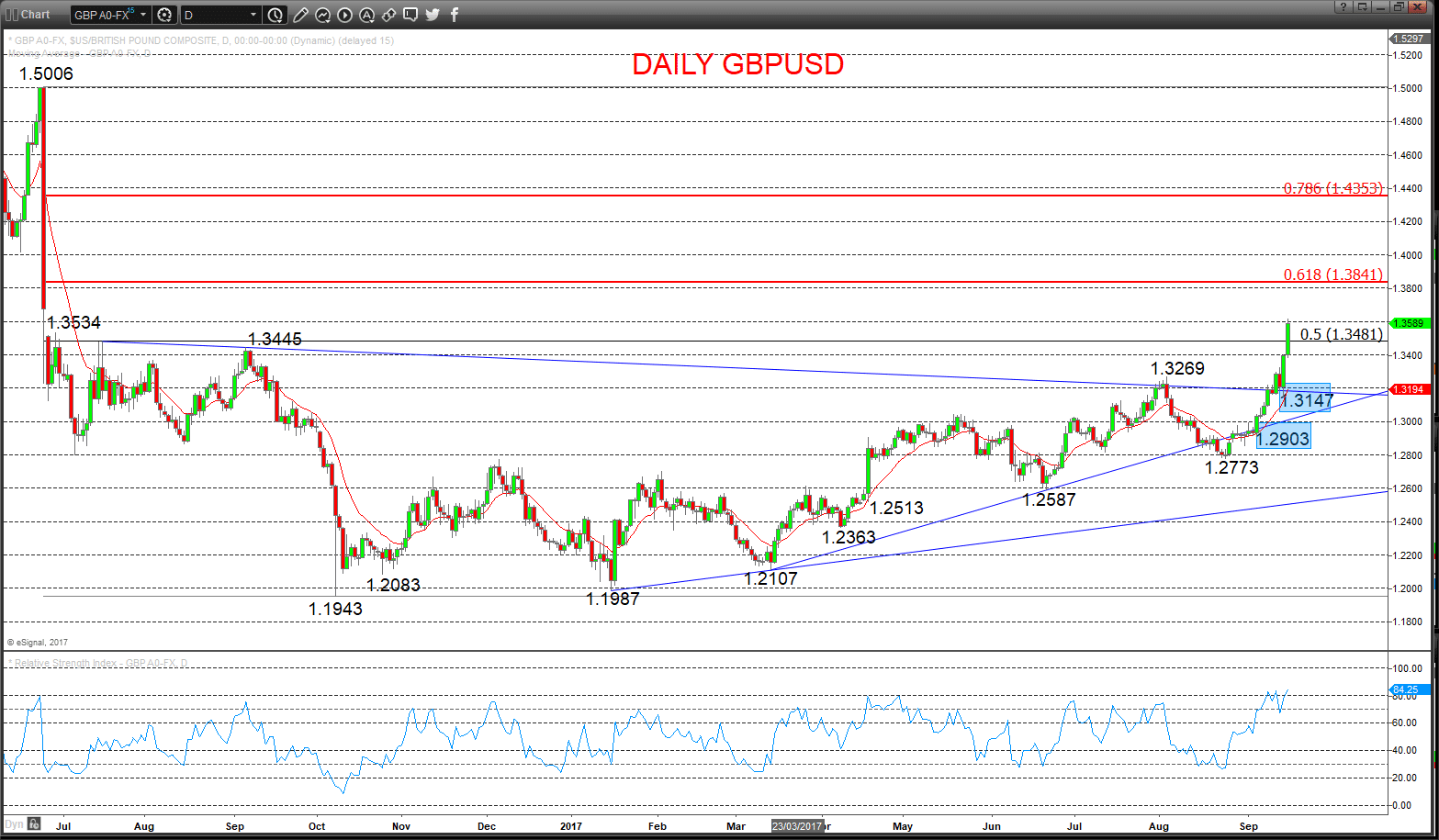

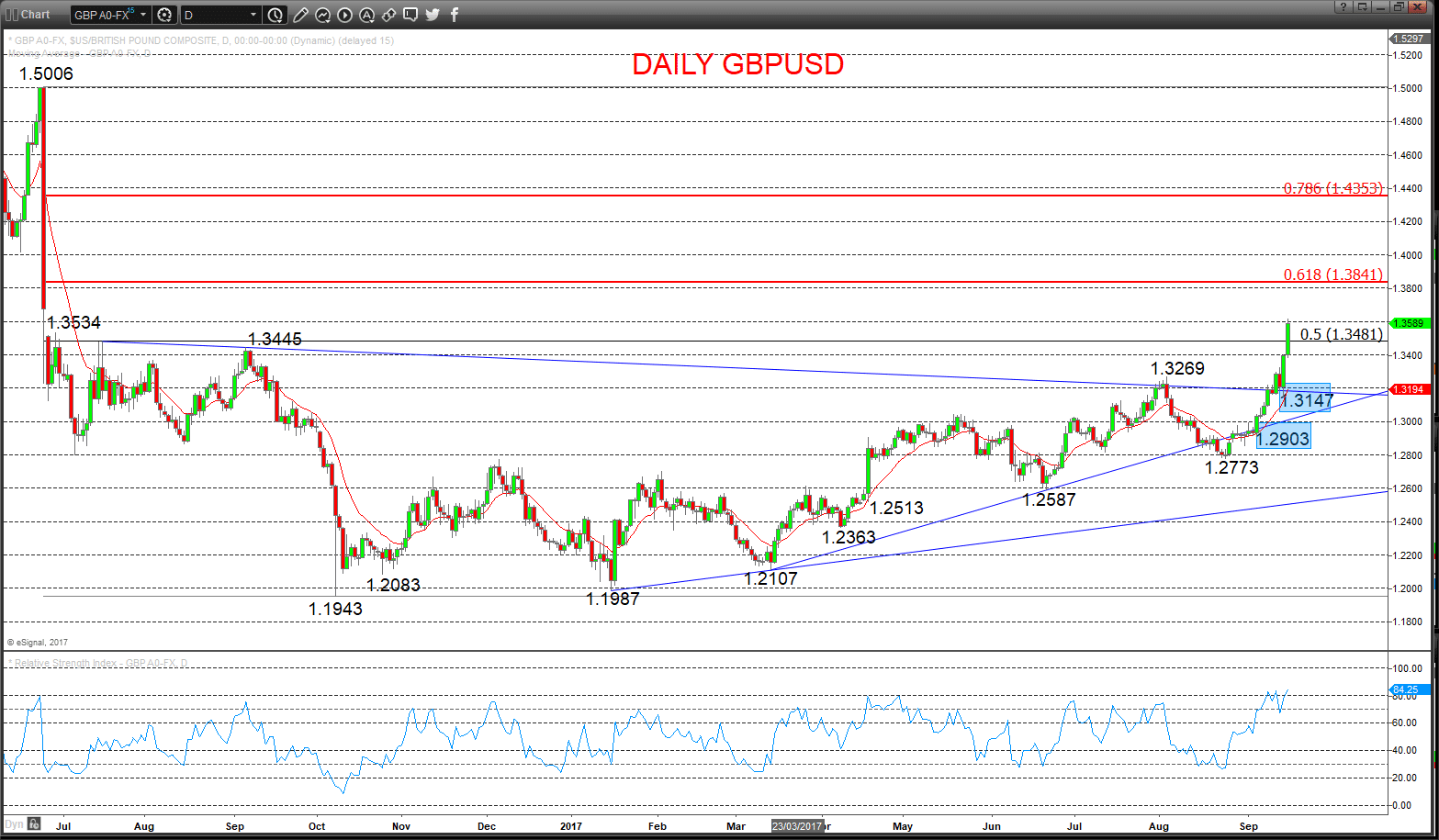

GBPUSD – Bullish trend further energised

Another extremely aggressive push higher on Friday through key targets at 1.3445, 1.3481, 1.3500 and 1.3534, placing the market as highs level post-Brexit, leaving risk of further gains into Monday.

The September surge through 1.3269 signalled an intermediate-term bullish tone.

For Today:

l We see an upside bias through 1.3617; break here aims for 1.3675 and 1.3727, then the retracement target at 1.3841.

l But below 1.3521 opens risk down to 1.3434, maybe 1.3380.

Intermediate-term Outlook – Upside Risks:

l We see a positive tone with the bullish threat to targets 1.3841 and1 .4000.

What Changes This? Below 1.3147 signals a neutral tone, only shifting negative below 1.2903.

Daily GBPUSD Chart

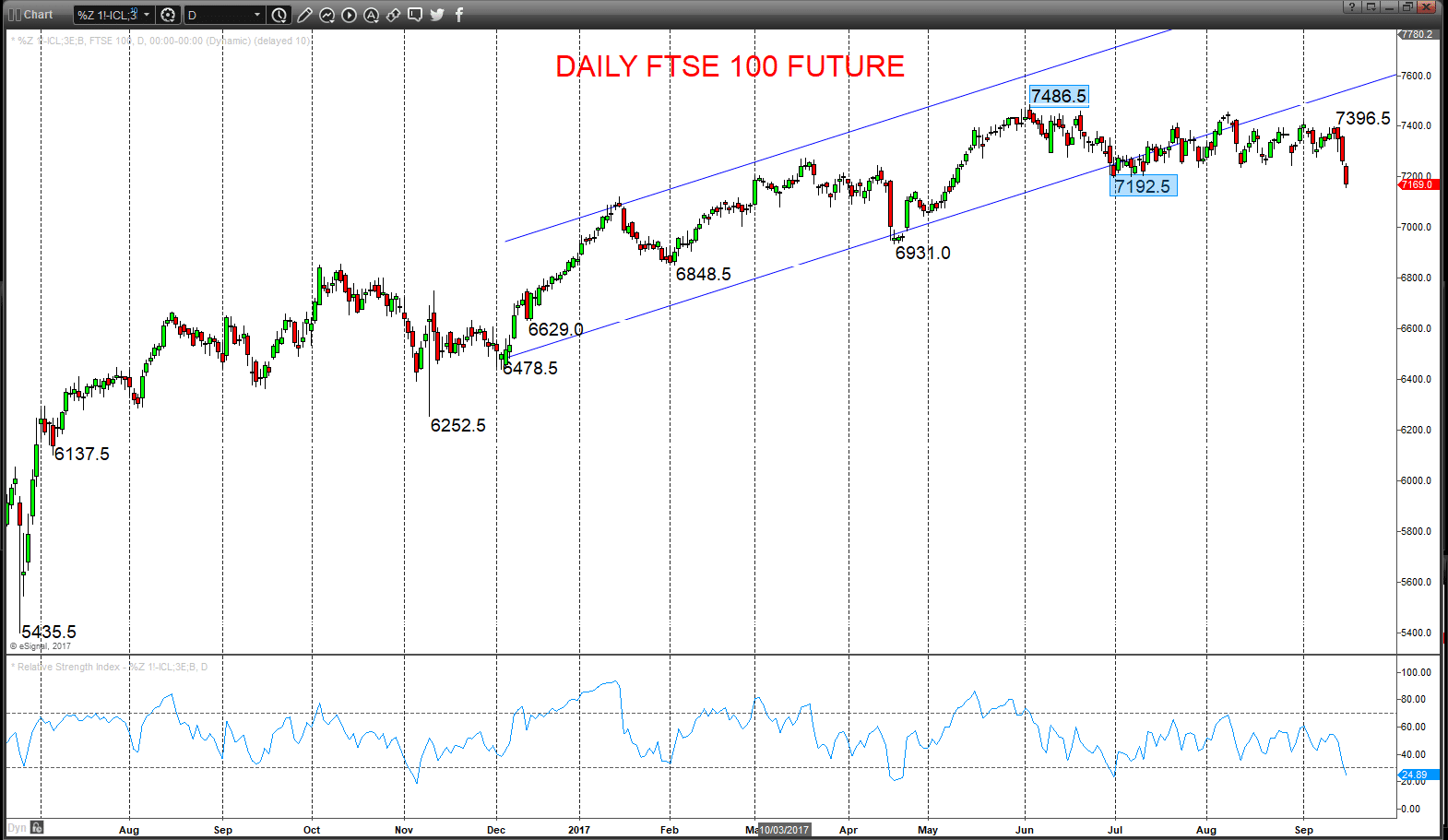

FTSE 100 – Bearish trend reinforced

An aggressive plunge lower Friday as seen from the middle of last week, through the July swing low on the continuation chart at 7192.5, setting a bear theme for September.

Furthermore, the Thursday-Friday aggressive sell-off in the wake of the Bank of England meeting in reaction to the strength in the GB Pound, keeps risk lower for Monday.

For Today:

l We see a downside bias through 7153; break here aims for 7131.5, 7100 and maybe as deep as 7073.5.

l But above 7215.5 opens risk up to 7251.5.

Intermediate-term Outlook – Downside Risks:

l We see a negative tone with the bearish threat to 6931.

l Below here targets 6848.5 and maybe 6638.5.

What Changes This? Above 7396.5 signals a neutral tone, only shifting positive above 7486.5.

Daily FTSE 100 future Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.