Through October, NZDUSD retained a far more bullish outlook, whilst USDJPY had remained defined by an erratic consolidation phase.

However, US currency strength across many major currencies since the FOMC meeting at the end of October, has this week signalled a more negative NZDUSD tone and a more bullish USDJPY bias (both USD positive).

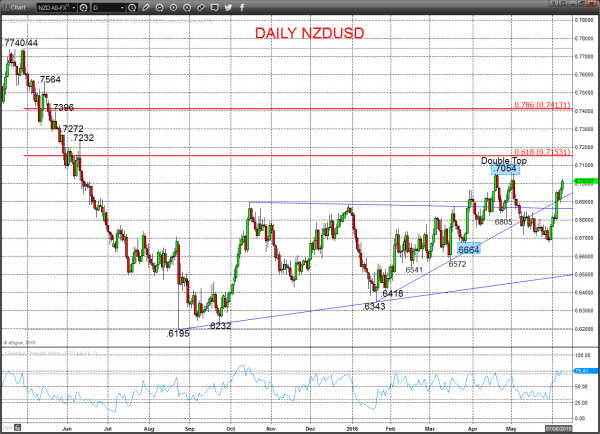

NZDUSD

A more negative tone through midweek, as the push through .6615 now sees a top completed for a shift to a broader range theme (see below) and for a bear bias near term.

Short/ Intermediate-term Range Parameters: We see the range defined by .6897 and .6232.

Range Breakout Challenge

- Upside: Above .6897 aims higher for .6924/30 and .7000/09/12.

- Downside: Below .6232 sees risk lower for .6154 and .6000.

Daily NZDUSD Chart

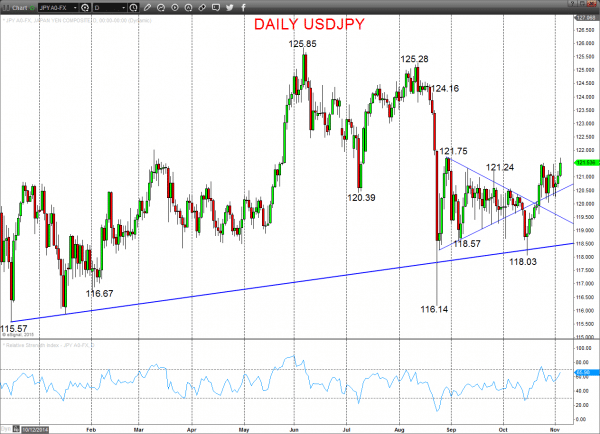

USDJPY

A firm rally Wednesday to break out of the narrow range from the past week for a more bullish theme into Thursday.

The mid-October push above the 121.24 level set a broader range theme for late October, BUT with the risk still for a bullish shift (above 121.75/77).

Short/ Intermediate-term Range Parameters: We see the range defined by 121.75/77 and 118.03.

Range Breakout Challenge

- Upside: Above 121.75/77 aims higher for 123.08 and 124.16.

- Downside: Below 118.03 sees risk lower for 116.14.

Daily USDJPY Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.