If you’re new to the forex markets and are interested in learning about the basics before diving into trade in the 24/5 markets, you would undoubtedly have come across the term pips, pipettes or pip forex. But what is a pip in forex? A PIP is an abbreviation for ‘price interest point’ or ‘percentage in point.’ In simpler terms, it is the smallest price change between two currencies.

Before we go any further, let’s quickly understand the basics of foreign exchange and forex markets.

Foreign exchange is simply the process of exchanging one currency for another at the prevailing exchange rate. On the other hand, forex trading is carried out in a global marketplace where individuals, firms and financial institutions buy one currency and concurrently sell another for many reasons. For instance, some could be speculating on the price moves to profit from them; others could be hedging their forex exposure, while financial institutions such as banks could be buying or selling currencies on behalf of their clients.

Background

Millions of participants across the world buy and sell currencies, making forex markets the world’s largest traded financial instrument. The Bank for International Settlements (BIS) surveys foreign exchange and OTC derivatives every three years to determine the size and structure of these markets. According to its last survey in 2019, the average daily traded volume was a massive $6.6 trillion.

In summary, forex trading involves buying or selling one currency against the other to profit from the price variation. In other words, you are simply speculating on a pair of currencies, or if you’ve done your analysis, you believe one currency should appreciate against the other. Therefore, you buy the one you think would go up and sell the other, anticipating it to fall.

For instance, if the euro-dollar pair, abbreviated by EUR/USD, quotes 1.0101², and you expect the euro to gain versus the dollar, you would buy the euro and sell the dollar.

Currencies primarily quote in five-decimal places, but there are exceptions like the Japanese yen, where the exchange rate extends to only three decimals. The pip is the minimum price change in the fourth decimal place for other currencies and the second decimal place for the yen. This last number is called a pipette or a fractional pip.

Examples

The following is an illustration of the British pound/US dollar pair, which is typically represented as GBP/USD:

![]()

In the above illustration, if the fourth decimal of the GBP/USD pair falls from 1.1528 to 1.1527, it means prices dropped by one pip. On the other hand, prices have increased by one pip if the GBP/USD pair rises from 1.1528 to 1.1529.

Let’s say you bought the pound at 1.1528 with the expectation that it would appreciate against the US dollar, and it did increase to 1.1530. Your notional profit, in this case, is two pips. It is notional because you have not exited your trade. However, if the exchange rate or price fell to 1.1525, you would have incurred a loss of three pips.

The value of a pip in forex depends on the lot size or contract size of a currency pair, which typically represents the minimum quantity you are allowed to trade. In forex trading, a lot is divided into four sizes: Nano, Micro, Mini and Standard. When you trade, you are only allowed to do so in multiples of a lot.

For instance, if you’d like to buy 10,000 USD/JPY, you can buy a hundred lots of Nano, 10 lots of Micro or one Mini lot.

The following table illustrates the lot sizes for each:

| Name | Lot size |

| Nano | 100 |

| Micro | 1,000 |

| Mini | 10,000 |

| Standard | 100,000 |

So, what does a pip imply, and why is it important?

A forex pip helps to:

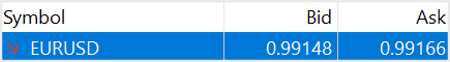

- Identify the spread or difference between the buying and selling price, represented by the bid/ask on the forex broker’s trading terminal

The primary objective of a forex trader is profits. To be profitable, not only should the analysis be spot on but you should also ensure that the FX broker you sign up with offers a low Bid/Ask spread. Spread is the difference between the price you buy or sell a currency pair. When you trade in the financial markets, you typically buy at the Ask price and sell at the Bid price. If the spread is small, so is your break-even price. In other words, you pay a smaller difference to buy and sell a currency. To conclude, you can maximize profits only when the spread is small.

In the above illustration, the Bid/Ask spread on the EUR/USD pair is 1.8 pips (0.99166 – 0.99148). If you buy the euro expecting it to appreciate versus the dollar, your buying price would be 0.99166, and you will break even at 1.8 pips. Put simply, the Bid side of the currency pair should be equal to the Ask side for you to achieve a break-even point. So, the larger the spread, the higher your break-even price will be.

- Calculate profits/losses on a trade

The key feature of a pip is to calculate profits/losses on a trade. But, before we get there, let’s quickly understand forex quotes.

Since currencies are traded in pairs, the first is the BASE, and the second is the QUOTE.

Forex pairs are quoted in three ways:

- Direct quote – The domestic currency is the base currency, and the US dollar is the quoted currency. Example: EUR/USD, AUD/USD. Here, the EUR and AUD are the base currencies, and the USD is the quoted currency.

- Indirect quote – Here, the US dollar is the base currency, and the domestic currency is the quoted currency. Example: USD/JPY, USD/CAD. Here, the USD is the base currency, and the JPY and CAD are quoted currencies.

- Mixed quote – This refers to any currency pair that does not include the US dollar as the base or quoted currency. Example: EUR/GBP, AUD/JPY.

Now that you know the different currency quotes, let’s learn how to calculate the pip value for each quote type.

- Direct quote – The formula to calculate the pip value is:

PIP = 0.0001 * lot size

Example: If the EUR/USD pair is at 1.0176, and the lot size is 10,000, the pip value would be 0.0001 * 10,000 = $1

- Indirect quote – Here, the formula to calculate the pip value is:

PIP = (0.0001 * lot size) / current price

Example 1: If the USD/CHF pair is at 0.9895, and the lot size is 100,000, the pip value would be (0.0001 * 100,000) / 0.9895 = $10.10

Example 2: If the USD/JPY pair is at 110.15, and the lot size is 1,000, the pip value would be (0.01 * 1,000) / 110.15 = $0.0908

- Mixed quote – Here, the pip value formula is:

PIP = (0.0001 * contract size * base quote) / current price

Example 1: If the EUR/GBP pair is at 0.8773, and the EUR/USD quotes 0.9826, if the lot size is 100,000, the pip value would be:

- * 100,000 * 0.9826)/ 0.8773 = $11.20

Conclusion

It is imperative to understand all the terminologies and pip definitions in forex trading. A pip definition forex is a simple term that defines the smallest price fluctuation in a forex pair. However, it plays a crucial role in determining your breakeven point and profit/losses even before you place a trade. It’s always critical to recognize how much a pip generates to know the risk you’re taking before you start trading.

Always remember that the value of a PIP depends on the currency pair, the exchange rate and the lot size. The bigger the lot size, the higher the PIP value, and vice-versa.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.