When determining the definition of Prime Rate, several considerable aspects must be addressed before it’s clear to corporate, retail borrowers and any investment-centric audience. The two words in the term – ‘Prime’ and ‘Rate’ – are pivotal to this conversation. Together, they intimate the concept relates to something crucial, especially ‘Prime’, which many interpret as “main, chief, key, central, foremost, or first”, according to Theasaurus.com.

‘Rate’ is more straightforward – a percentage (calculated ‘per year’) of the capital lenders forward to the borrower. Indeed, it’s the lender’s compensation for releasing the funds for someone else to use. So, by combining the two (i.e., The Prime Rate, sometimes called the Prime Lending Rate), the term signifies the minimum level of compensation the bank is prepared to accept for advancing money to third parties. There’s an exception, which we’ll address lower down.

The Background and Context of Prime Rate

The modern vision of the Prime Rate is that it’s the yardstick banking institutions rely on to guide interest rates for different class loans. For example, if a lender tells you they are charging Prime + 2%, it gives one a sense of how expensive the advance is. Why? Simply because anyone deserving a loan at the Prime Rate is the bank’s most valued and creditworthy customer. Put another way; the banks offer their best rates (i.e., the Prime Rate) to the customers representing the least risk.

Prime Rates (referred to alternatively as PRs) are country (and therefore currency) specific. Thus, Australian banks determine their country’s PR for loans in the Australian Dollar (AUD), as does the UK for loans in Sterling (GBP).

In this article, we’ll focus on the US (USD), with references to other situations later on – USD being an anchor denomination for all major currency pairs traded on international currency exchanges.

The history behind the Prime Interest Rates in the US

The next logical question is how stable are PRs once set? The answer is that they can move in and out of economic phases ranging from tight deviation to highly volatile. For example:

- Since COVID-19 and the supply chain fractures, global inflation has been rampant. There’s no country on any continent unaffected by it.

- The last time America experienced double-digit inflation was during President Carter’s presidency, and it probably cost him a second term. For years after 2000, inflation was under control, resulting in years of economic prosperity from 2012 until the pandemic and beyond.

- At the time of writing, recession is on the tip of everyone’s tongue as the Fed ramps up interest rates to quell rising dollar prices (touching an 8% inflation rate).

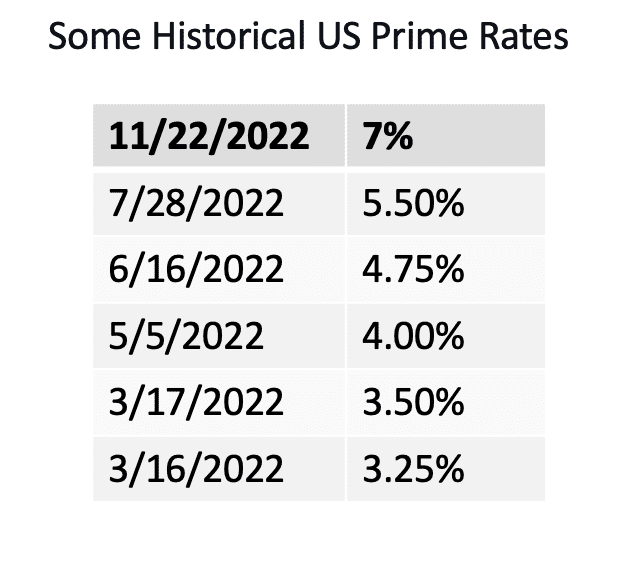

- This sets the tone for a volatile environment where the PR reacts to every DR jump. See the table below for a view of PR movements from 2020 to date.

Source: Investopedia

Examples

After reviewing the Federal Reserve’s overnight Discount Rate (DR), the leading commercial banks collaborate to decide on the Prime Rate. The DR is the foundation stone of PR lending – the benchmark rate, as it is known. For example, after a series of rate hikes in 2022:

- The Fed’s DR in November 2022 ranged between 3.00% and 3.25%.

- However, the PR reflects an added 3.75% to the Fed’s upper limit, thus equalling 7%.

In summary, the Fed’s Discount Rate defines the interest rate percentage that registered depository institutions with cash surpluses lend overnight to others in the same category experiencing deficits. In other words:

- The Fed’s discount rate is the ground floor cost of borrowing that controls the money supply.

- From there, the elevator goes to the first floor – the Prime Rate level (as described above), striking the lowest rate a bank ordinarily expects to earn on funds lent to their most valued customers outside the banking fraternity.

Unfortunately, many higher floors are waiting for the borrowing public using credit cards, applying for mortgages, accessing mezzanine funding, bridge financing, and other verticals. Each time the ‘elevator’ rises, you can be sure it’s Prime plus a percentage number that can legally go to double digits. Therefore, while solid low-risk borrowers (e.g., Public S&P 500 companies) enjoy 7% per annum rates, Mastercard, Amex, and Visa charge some cardholders Prime + 13%.

In the US, PR premiums can go as high as +22% for the riskiest category (i.e., the ones allowing their credit card debt to multiply by spending more than their minimum monthly instalments.) Moreover, when borrowers fail to pay interest on time, they’ll discover they’re paying the ruling rate on the latter still owing, now lumped onto the original capital. So, they’re now caught in a compound interest trap until they rectify the shortfall, allowing a simple interest calculation to kick in again.

Consider the following to wrap up the Prime Rate definition and examples highlighted about:

- Although the Fed sets the benchmark rate, it has no direct say in setting the PR.

- Even if the Fed keeps raising the DR, the banks aren’t obligated to follow suit.

- Although the five most prominent banks collaborate to set the PR, all the other financial institutions are free to set their own.

- Theoretically, there could be numerous PRs floating around, depending on the bank.

- Nonetheless, the most deployed PR is the one the Wall Street Journal publishes daily (which most lenders adhere to).

- So far, we have covered relatively risky borrower situations where lenders add a percentage to the PR in their arrangements. On the other hand, banks are free to discount the latter if they feel the security or risk rating behind the loan is exceptional.

How does the Prime Rate impact other loan classes?

Loan categories in commerce and real estate transactions drive deals forward or slow them down. Consequently, CFOs, property developers, and investors in every asset class require supplementary funding outside their equity commitments. As a result, lenders from all walks of life emerge, offering financial services to a highly segmented market, including the following:

- Retail bankers – Otherwise known as consumer banking to families and individuals

- Commercial banks – Focusing on for-profit and non-profit corporations (NPCs), Real estate Investment Trusts (REITs), and government entities with skills to carve out special-need loan arrangements.

- Community development banks (CD banks) – Privately owned, lending funds within a social responsibility theme, frequently receiving federal government support to bolster the living standards of underserved communities.

- Investment banks – Somewhat of an outlier, not lending money to anyone. Instead, they generate earnings by investing their own equity or a client’s money in mergers, acquisitions, and IPOs.

- Online banks (neobanks or virtual banks) – These may look like banks, but they front a partnership with traditional institutions that manage the transactions in the background.

- Credit Unions (CUs) – Belong to their members as NPCs doing what retail banks do but for member benefits only. Thus, CU customers expect lower loan interest charges and higher deposit rates versus dealing outside the CU.

- Savings and Loan Associations – Specialise in homeowner lending on mortgage platforms.

- Hard Money Lenders – Providers of faster financing at PR + at least 7% (plus origination fees). They always back the loan with asset security and pay little attention to credit scores.

All the lender categories noted above rely on the prime rate to set the level for different loan types and credit ratings. Essentially, they depend on it to see whether the Prime Rate definition fits perfectly with the customer profile or warrants an adjustment up or down.

This brings us to mortgage loans as a mainstream funding channel. In many cases, borrowers take advantage of the fixed interest accommodations that mortgage lenders offer on real estate when they suspect that Prime Interest Rates will likely increase. So, in 2020 when the PR was 3.25% (less than half of November 2022), lenders pinned it on many mortgages (globally considered the safest asset security loan available). As a result, savvy borrowers jumped at the option of locking in the interest rate at the prime level for the entire loan term (generally between fifteen and thirty years).

Conversely, those mortgagees who stayed with a variable rate witnessed their rates escalating quickly to 7%. But, of course, it’s all a matter of timing. Fixing the rate when the Fed’s DR increases are near the top of the cycle may work against you when it goes in the opposite direction. However, the bottom line is that, not surprisingly, fixed-rate mortgages are the most popular amongst US borrowers.

Conclusion

The takeaway is that the US banks and other American registered lenders are arguably the most aggressive interpreters of the Prime Rate definition versus the other three currency funder participants, with Australia a close second. The net result is that first-world countries facing the same economic pressures react similarly. All are afraid of escalating price levels eroding consumer buying power.

However, this is not rocket-science methodology. The central regulators in these countries have only one tool to moderate things – the DR rate. Moreover, they desperately rely on the banks and other lending institutions to react by adjusting the loan prices accordingly. Frequently, DR regulators can overdo it, throwing the nation into a recession. Getting the balance right is tricky, more of an art than a science.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.