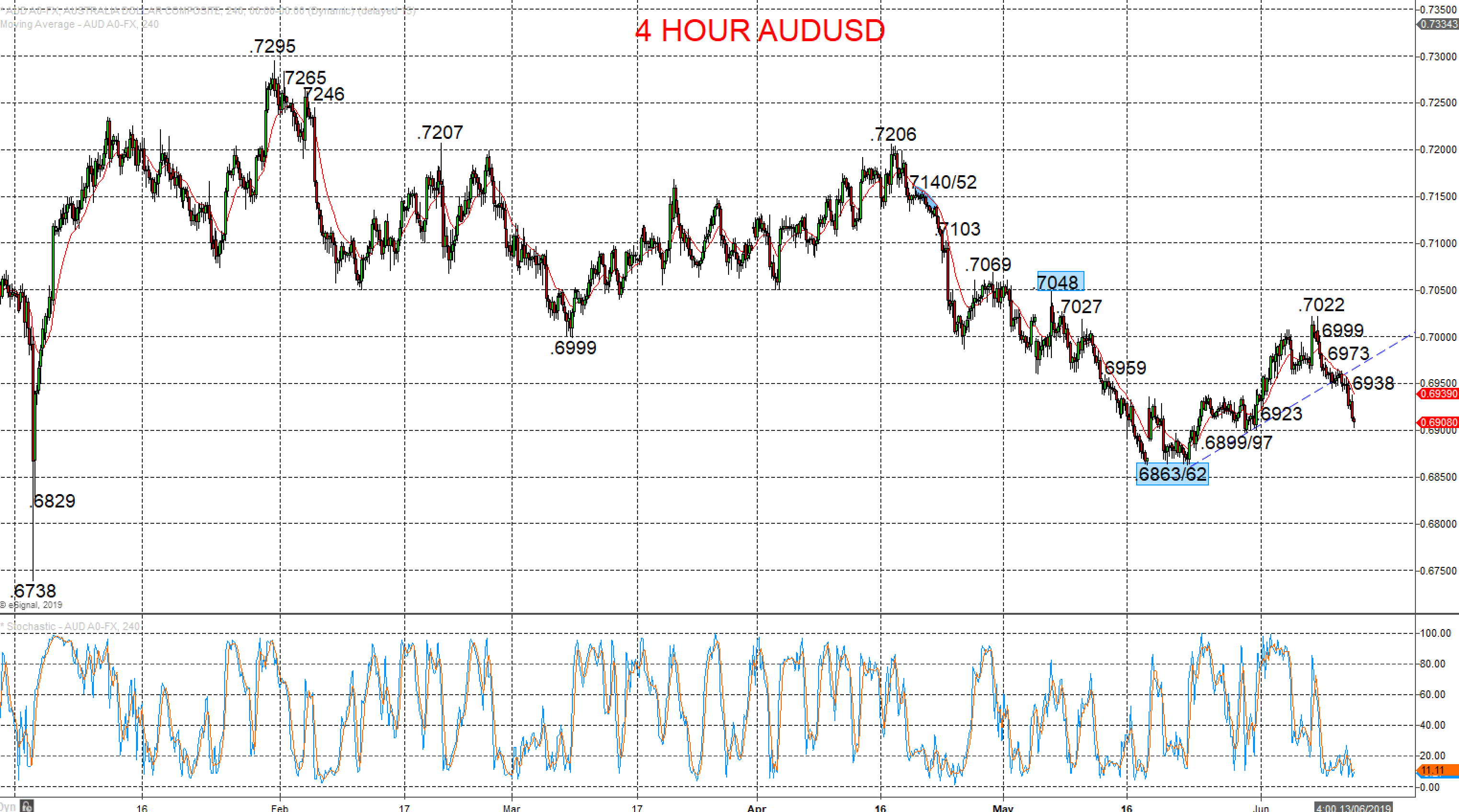

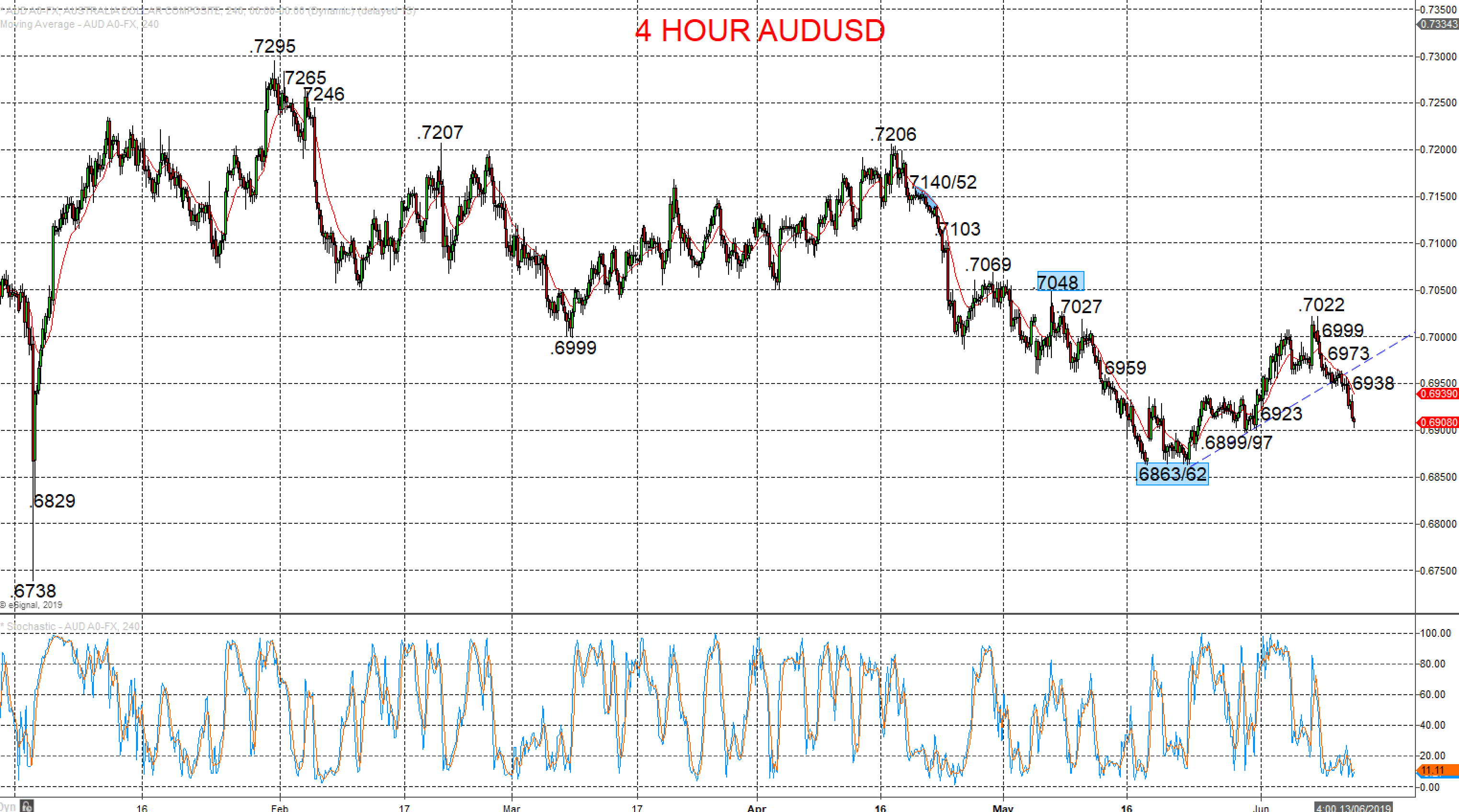

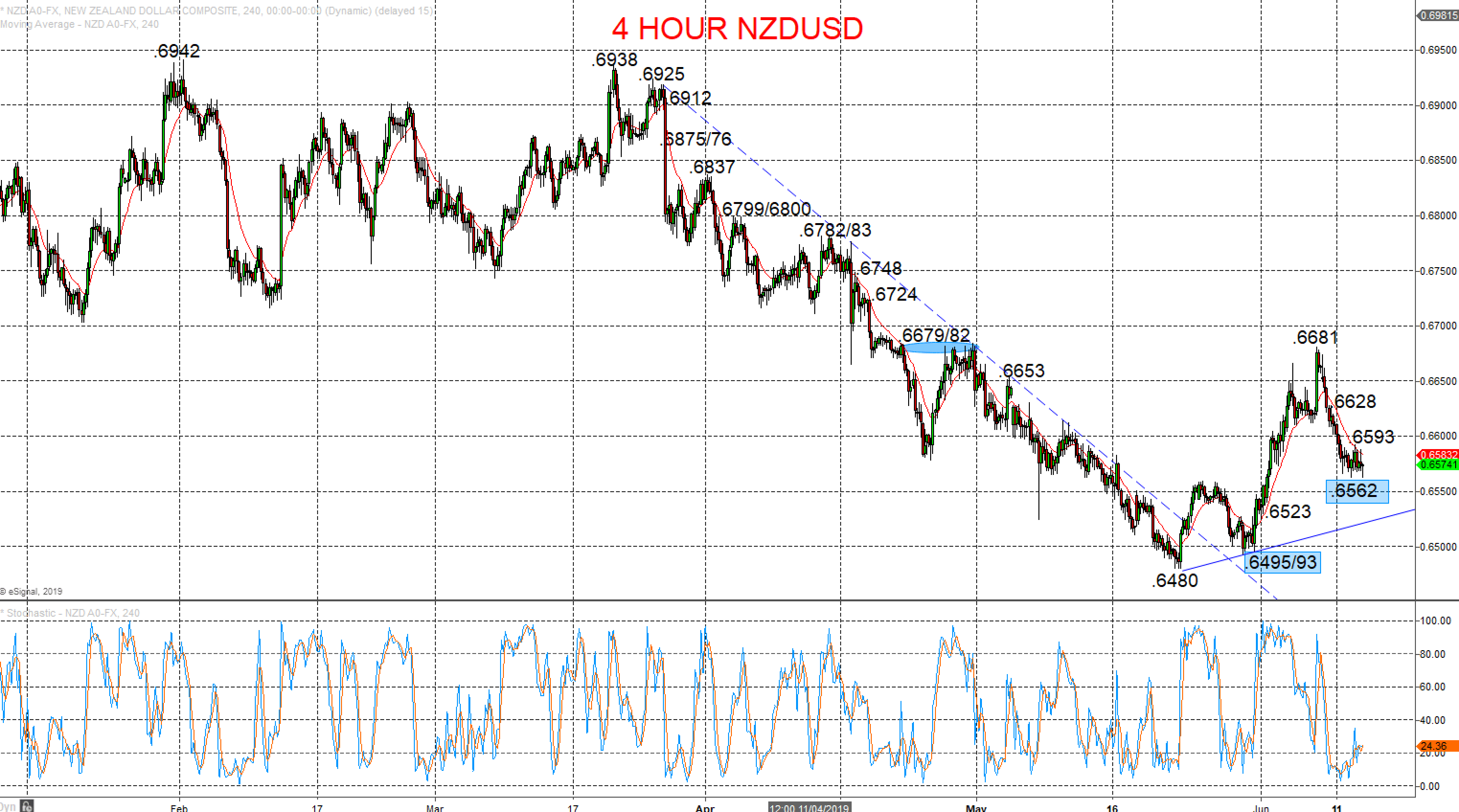

- AUDUSD and NZDUSD currency pairs are exhibiting a mixed tone in both the short- and intermediate-term outlooks

- The AUDUSD Forex has established an intermediate-term range, but negative price action into mid-June and over the past 24 hours sets the immediate bias lower within this broader range environment.

- The NZDUSD FX rate established a bullish intermediate-term outlook with a strong rally in early June and recent price erosion is just holding support (.6562), to hang onto a very near term rebound bias.

AUDUSD support surrenders

A Wednesday-Thursday selloff through the uptrend line from May and .6923 support for a negative short-term signal, to ease immediate upside forces from last week’s late surge and the earlier June push up through the key .6959 level, to set lower into Thursday.

The push above .6959 resistance to start June set an intermediate-term range, seen as .6862 to .7048.

For Today:

- We see a downside bias for .6899/97; break here aims for key .6863/63.

- But above .6938 opens risk up to .6973.

Intermediate-term Range Breakout Parameters: Range seen as .6862 to .7048.

- Upside Risks: Above .7048 sets an intermediate-term bull trend to aim for .7206/07 and .7295.

- Downside Risks: Below .6862 sees an intermediate-term bear trend to target .6829 and .6738.

4 Hour Chart

NZDUSD support prodded, but just holding onto a rebound bias,

A Wednesday/ Thursday probe lower but to twice just rebound from .6562, to thereby hang onto upside forces from last Friday’s surge AND the earlier June, intermediate-term bullish shift (above .6653), to just keep risks higher Thursday

The early June surge produced an intermediate-term bullish shift above .6653, intact whilst above .6562.

For Today:

- We see an upside bias for .6593 then .6628; break here maybe aims towards .6681/82.

- But below key support at .6562 opens risk down to .6523, maybe critical .6495/93.

Intermediate-term Outlook – Upside Risks: We see an upside risk for 6782/83 and .6938/42.

What Changes This? Below .6562 shifts the intermediate-term outlook to neutral; through .6495/93 is needed for an intermediate-term bear theme.

4 Hour Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.