The November plunge lower for both the Australian and New Zealand Dollars versus the US currency have reinforced negative themes, within broader range settings.

Furthermore, the with key AUDUSD and NZDUSD supports breached, we see risk for a still more bearish tone through mid-month.

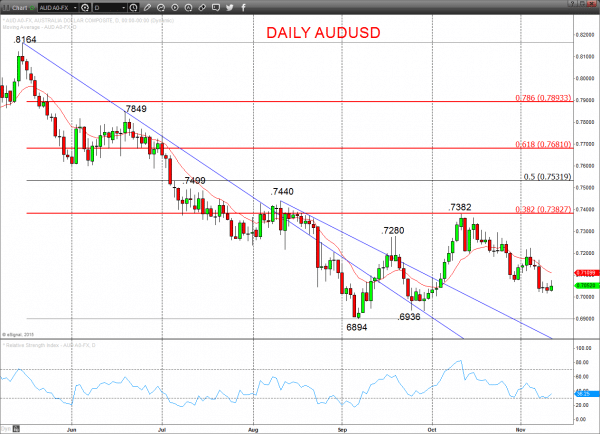

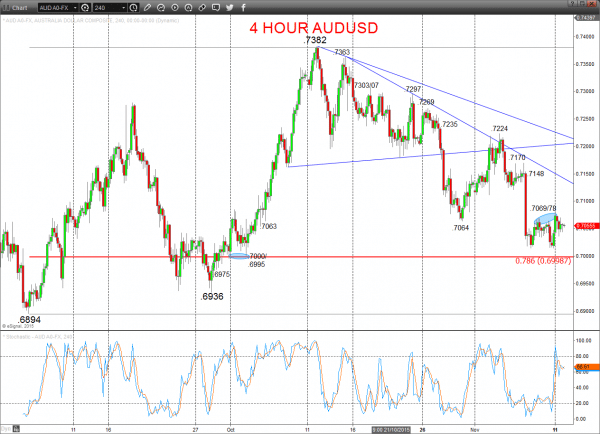

AUDUSD

A rebound Wednesday to just prod at .7069/74, but another setback (after the lacklustre rebounds this week), to maintain the bearish tone into Thursday from the Friday push below .7064/63 support.

This maintains the broader range theme into mid-November, but with bias to the lower end of the range to threaten a bear shift below .6936.

For Thursday:

- We see a downside bias for .7000/6995; break here aims for key .6936.

- But above .7078 opens risk up to .7148, maybe .7170.

Short/ Intermediate-term Range Parameters: We see the broader range defined by .6936 and .7382.

Downside Range Breakout Challenge: Below .6936 sees risk lower for 6894, .6857 and .6645.

Daily AUDUSD Chart

4 hour AUDUSD Chart

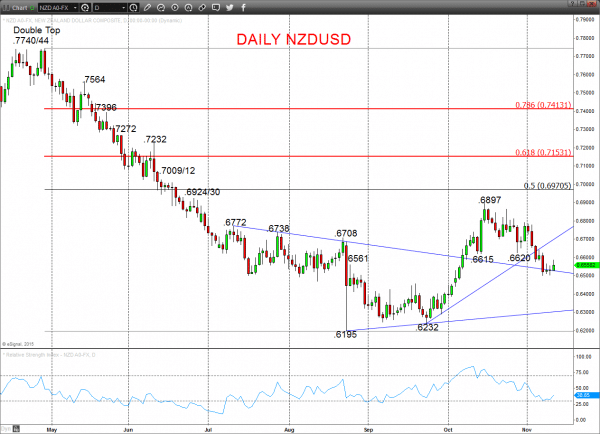

NZDUSD

A better bounce (above .6575), but then a failure Wednesday from ahead of better barriers at .6625/42 and the Friday plunge through support leaves a bearish bias for Thursday.

Friday losses reinforced the early November push through .6615 that completed a top, for a shift to a broader range theme.

For Thursday:

- We see a downside bias for .6500/6490; break here aims for key .6473, maybe .6434.

- But above .6587 opens risk up to .6625/42.

Short/ Intermediate-term Range Parameters: We see the range defined by .6897 and .6232.

Downside Range Breakout Challenge: Below .6232 sees risk lower for .6154 and .6000.

Daily NZDUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.