A firmer US Dollar tone has emerged since late September and particularly now into early October. US currency gains versus both the Australian and New Zealand Dollars have signified a more negative tone for these currencies going into mid-October.

AUDUSD losses this week have rejected the threat of a more bullish shift above resistance at .7760, favouring a rollback lower into the September rebound range into mid-month. For NZDUSD, the surrender of .7200 has reinforced a Head and Shoulders topping structure from August, leaving risk of a more bearish shift below .7084 into October.

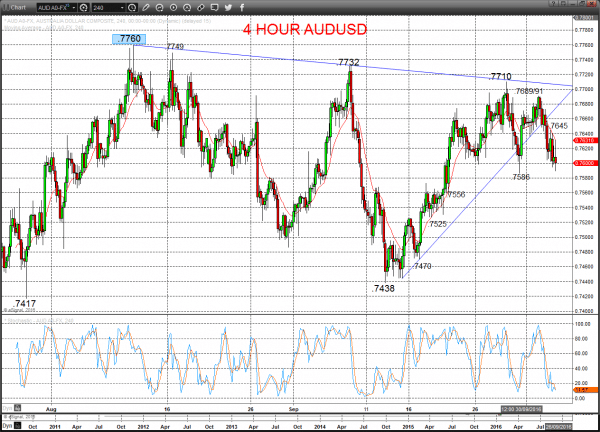

AUDUSD

A nudge lower Wednesday to reinforce negative pressures from the Tuesday failure back from just above resistance at .7689 (back from .7691), and plunge below initial support at .7605/00, to keep the very near term bias to the downside Thursday.

For Thursday/Friday:

• We see a downside bias for .7586; break here aims for .7556.

• But above .7645 opens risk up to .7689/91.

The early September plunge below the .7489/86/84 support area produced a shift in the intermediate-term view from bullish to neutral.

Short/ Intermediate-term Range Parameters: We see the range defined by .7403 and .7760.

Range Breakout Challenge

• Upside: Above .7760 aims higher for .7835/50/78, .8000 and .8164/66.

• Downside: Below .7403 sees risk lower for .7284 and .7141.

4 Hour AUDUSD Chart

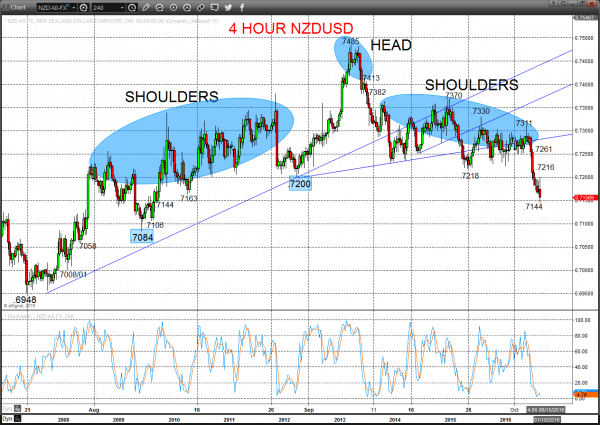

NZDUSD

A push still lower Wednesday through .7163 to prod .7144 support (as we had indicated), to enhance the Tuesday breakdown below .7200 (reinforcing the Head and Shoulders pattern that has developed from August), to keep the bias lower for Thursday.

The push below .7200 shifted the intermediate-term trend from bullish to neutral; growing threat is lower to challenge .7084, through which would see a shift in the intermediate-term outlook to bearish.

For Thursday/Friday:

• We see a downside bias for .7144; break here aims for .7106, maybe down to key .7084.

• But above .7216 opens risk up to .7261.

Short/ Intermediate-term Range Parameters: We see the range defined by .7084 and .7485.

Range Breakout Challenge

• Upside: Above .7485 aims higher for .7516/64 and .7744.

• Downside: Below .7084 sees risk lower for .6948 and .6676.

4 Hour NZDUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.