Thursday 4th June at 11.30 a.m. local time sees the release of the Australian Retail Sales and Trade Balance data. The reaction to this data will be important given the RBA statement and solid recovery effort this week, which has questioned bearish pressures evident since mid-May.

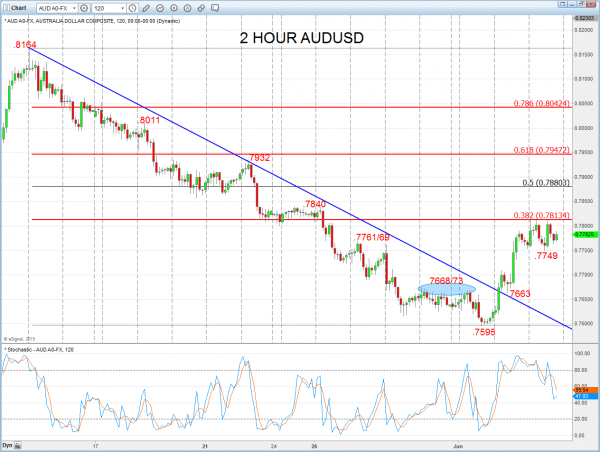

AUDUSD further upside correction risks

An aggressive recovery effort Tuesday, post RBA and as expected a resilient follow through Wednesday to hit resistance at .7813.

This has again eased the immediate downside pressures and sees upside into Thursday.

However, whilst capped below .7932, we see bearish risks intact for June.

For Today:

- We see an upside bias through .7813 for .7840, maybe .7880, which we would look to try to cap.

- But below .7749 opens risk down to .7663.

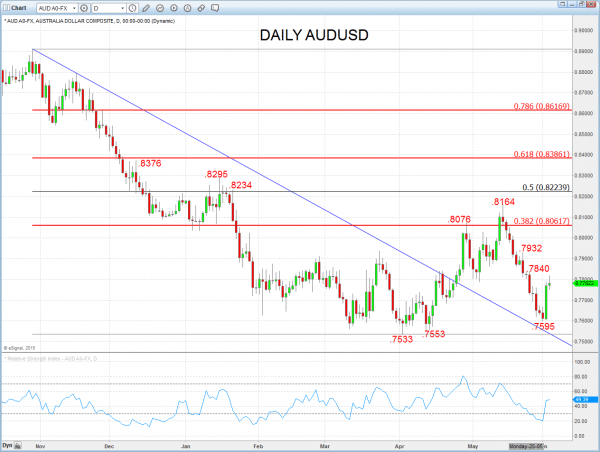

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to .7595 and .7533.

- Below here targets .7500, .7269 and .7094.

What Changes This? Above .7840 eases bear risks; through .7932 signals a neutral tone, only shifting positive above .8164.

Momentum: The 8-day RSI, short-term momentum is OS, but we still see scope to go lower this week…

2 Hour AUDUSD Chart

Daily AUDUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.