- Both the Australian and New Zealand Dollars had displayed an even more bullish tone through mid-July against the US Dollar, both reflecting US Dollar weakness and emerging strength for the Antipodean currencies.

- For AUDUSD the surge up through a long-term retracement barrier at .7878 leaves a more bullish theme into late July and August.

- For NZDUSD the threat is to challenge the 2016 cycle high .7485.

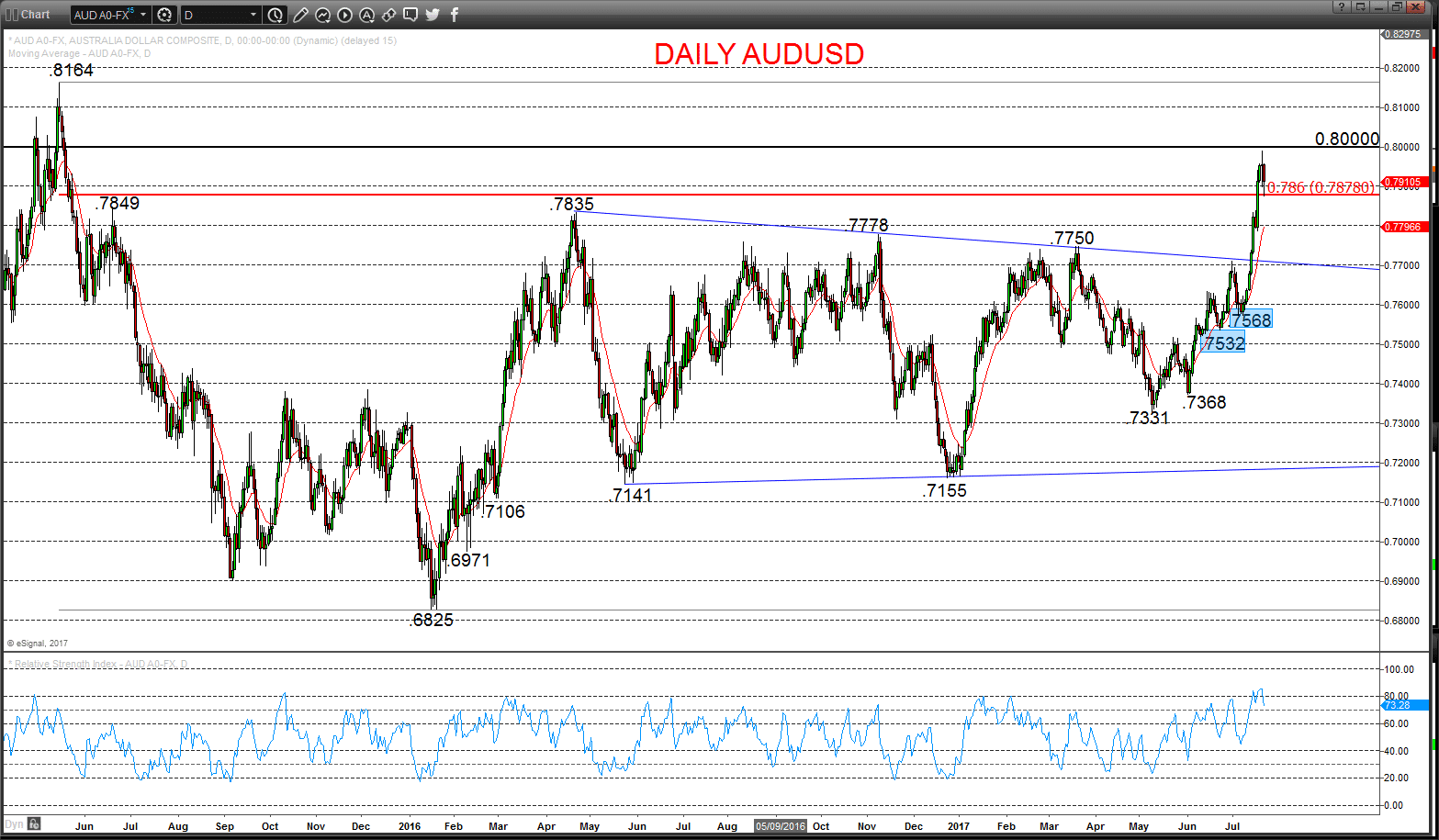

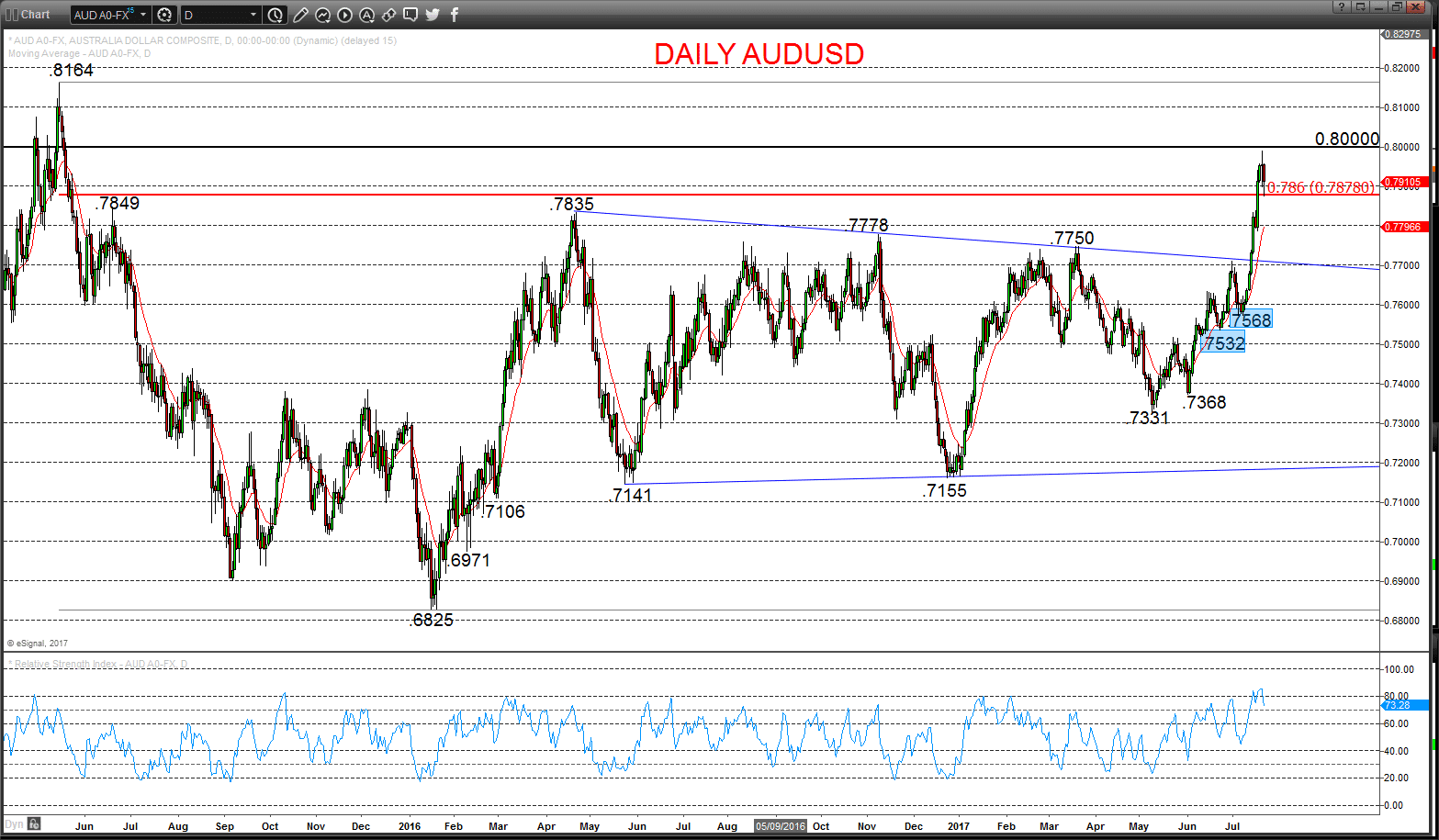

AUDUSD – Bullish trend reinforced

Despite a setback late last week to probe at minor support at .7880, the rebound from .7874 highlight a still bullish tone from the July push to another new recovery high up close to the psychological/option target at .8000 (to .7990), sustaining the bullish trend into Monday.

Furthermore, the robust July recovery activity has re-energised the intermediate term bullish outlook.

For Today:

l We see an upside bias to .7950; above here would target .7990 and the psychological/option target at .8000, then a chart target at .8052.

l But below .7874 opens risk down to .7850, maybe towards .7784.

Intermediate-term Outlook – Upside Risks:

l We see a positive tone with the bullish threat through the psychological/ option level at .8000.

l Above here targets the 2015 high at .8164.

What Changes This? Below .7532 signals a neutral tone, only shifting negative below .7368.

Daily Chart

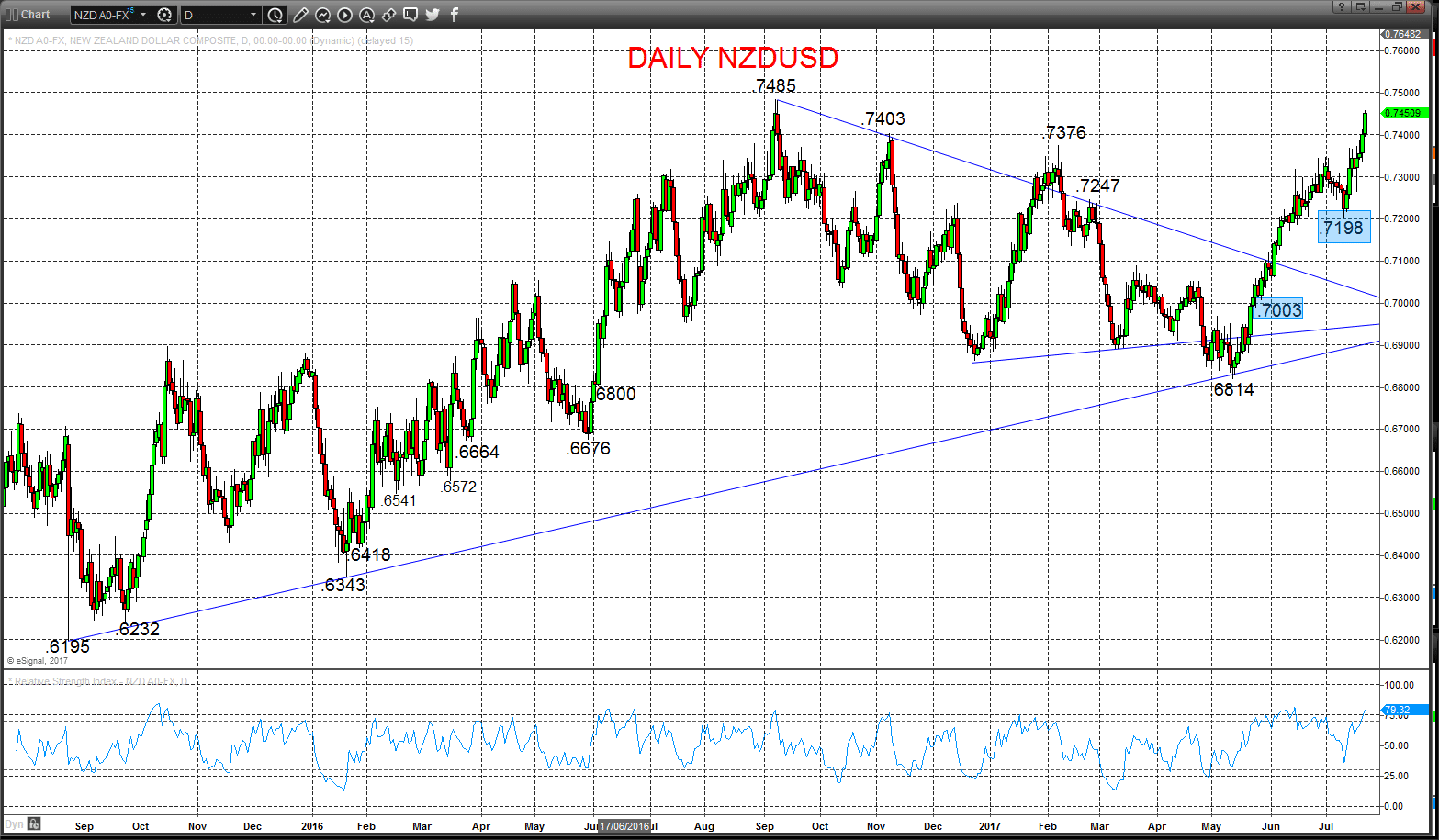

NZDUSD – Bullish threats

A more bullish tone to end the week with the push above the November 2016 high at .7403 and .7455 resistance after a solid consolidation through mid-July, keeping the upside bias into Monday.

Furthermore, the mid-June push through .7247 set a bullish outlook into early July.

For Today:

l We see an upside bias through .7459; through here targets the September 2016 cycle high at .7485 and psychological/option target at .7500.

l But below .7390 opens risk down to .7330, maybe .7318 supports.

Intermediate-term Outlook – Upside Risks:

l We see a positive tone with the bullish threat through .7485.

l Above here targets .7744 and .8000/45 area.

What Changes This? Below .7198 signals a neutral tone, only shifting negative below .7003.

Daily Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.