Despite the Canadian & New Zealand Dollars gaining ground versus the US Dollar after the FOMC decision and statement on Thursday 17th September, these rallies have been rejected. This leaves USDCAD risks higher, back to the multiyear high whilst NZDUSD remains vulnerable to a re-energizing of bearish pressures evident during the plunge in late August alongside the equity market sell offs

USDCAD

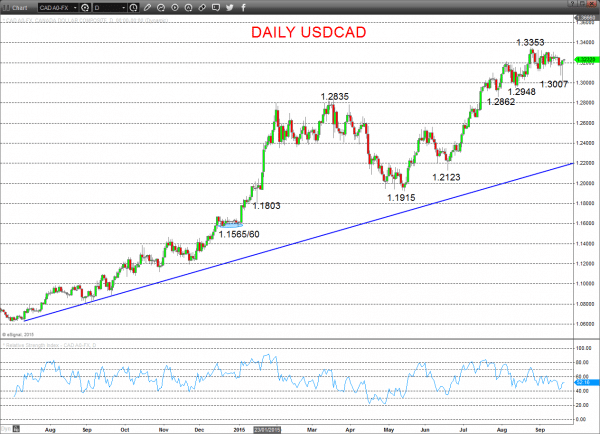

- Another even more significant dip lower Friday through 1.3069 support, but then an intra day rebound as also seen on Thursday to reject a downside move and leave a bullish tone for Monday.

- Furthermore, the strong July advance above the 2009 peak at 1.3064 to a 10 year high and the August extension leaves risks for a push higher into latter September, to aim for further long term targets.

Short/ Intermediate-term Outlook – Upside Risks:

- We see a more positive tone with the bullish threat to 1.3353 and 1.3454.

- Above here targets longer term levels at 1.3819 and 1.4000.

What Changes This? Below 1.2948 signals a neutral tone, only shifting negative below 1.2859.

Daily USDCAD Chart

NZDUSD

- A push through .6425/29 last week, but then a Friday setback from ahead of better barriers at .6474 and .6505/13 to reject a recovery effort and maintain bigger picture and Monday risk to the downside.

- Furthermore, the previous aggressive plunge to a new cycle and multi-year low in latter August, through a long term support at .6404 leaves bias for a push lower into the 2nd half of September.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to longer term targets at .6196/54.

- Overshoot threat is lower to .6000, maybe .5741.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.