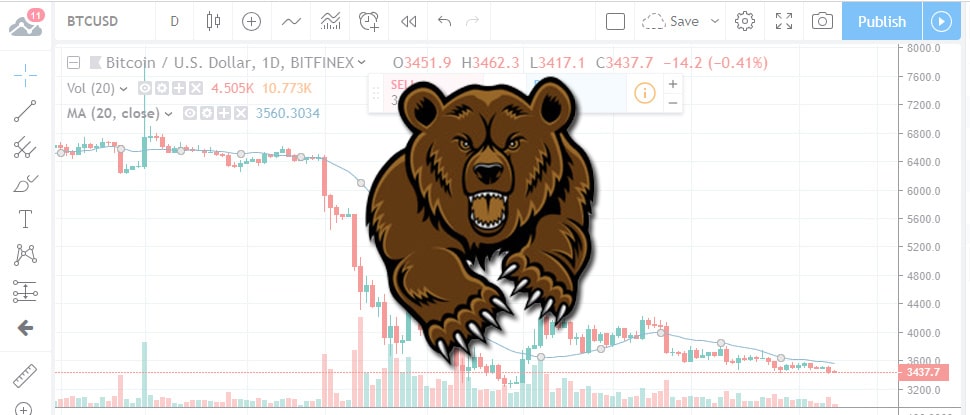

The crypto winter is still in full effect, in the face of the hopes and increasingly vocal calls of various pundits who believe that the much-awaited “bottom” has already been reached. If that fabled milestone is to be considered the December 2018 low of $3.1k, the price of BTC may soon revisit it – according to technical analysis.

Yesterday (February 6, 2019) the price of the biggest cryptocurrency hit a 7.5-week low, in a clear sign that the grip of the bears is still as strong as at any point over the last year. What’s worse still is that technical analysis points to the presence of a bearish indicator, which may indeed be the herald of yet another imminent price drop.

The indicator in question is the 50-cycle MA on the 6-hour chart – which has thus far proved to be a formidable resistance level in the path of the ever-so-shy bulls over the last 1.5 months. Yesterday, the price drew a lower high on this chart, pointing to continued bearish sentiment. Long story short: this will likely result in yet another price-drop, first to the $3.3k level, which is indeed well within reach already and then to the mentioned December low of $3.1k.

Rounding out the parade of pessimistic technical indicators is the 14-day RSI which is plowing bearish territory, and the 20-day MA, which is also pointing southward.

Tossing the bearish outlook aside for a second: what would it take to get the bulls going again, if only tentatively?

As pointed out, the 50-candle MA on the 6-hour chart forms a very strong resistance right now. Breaking through it in a convincing (high-volume) manner, would definitely give the bulls a bit of breathing room. This would require the price to move past $3,434 though and that does not seem likely.

Such a turn of events would produce a decent corrective bounce however, landing the price close to the $3,650 mark – defined by the January 26 high.

Against the backdrop of all this TA-predicted gloom and doom, what do the fundamentals say?

News-wise, the current vibe is a mixed one: while the industry is moving ahead, tackling various tech challenges, there are some rotten eggs in the basket too, which always manage to garner more attention than they deserve.

One such news-bit details the alleged practice by Hamas – a Palestinian military/political organization, which the US government has labeled as a terror group – of raising crypto funds through Coinbase. Several Bitcoin addresses have been linked by investigators such as Israeli newspaper Globes, to this fundraising activity, and indeed several more may have slipped through the net.

According to Whitestream’s Itzik Levy, several Islamic extremist organizations have been involved in crypto fundraising over the last few years. Hamas’ attempts to raise money through this new channel are therefore hardly surprising.

In other news: Canadian cryptocurrency exchange QuadrigaCX finally threw in the towel last week, filing for creditor protection while owing its clients some $130 million.

Analysts were quick to draw parallels between QuadrigaCX and the infamous demise of Mt Gox which shook the crypto industry to its core back in the days, triggering a mini crypto-winter. Reportedly, some 115,000 people are directly impacted by QuadrigaCX’s insolvency.

In still other (bad) news, scammers have apparently taken to impersonating Bakkt, looking to cash in on the hype surrounding the imminent launch of the Bitcoin futures trading platform.

The scammers claim Bakkt is aiming to raise $50 million through a second financing round. Having made their pitch in broken English – through emails sent out seemingly randomly – they then invite those interested to send their Bitcoins to a specified address. The site referenced by the emails is bakktplatform.io.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.