The price of bitcoin has shown quite an erratic evolution lately, proving technical analysts wrong time and time again over the last couple of days. Though the fundamentals point to a definite drop below $10,000 too, the price has been clinging to the $11,000 mark seemingly against all odds.

Despite the fact that – as pointed out above – technical analysis fails us more often than it helps us with cryptos such as bitcoin, we just need to take a look at what the various indicators tell us – after all, even a broken clock is right twice a day…

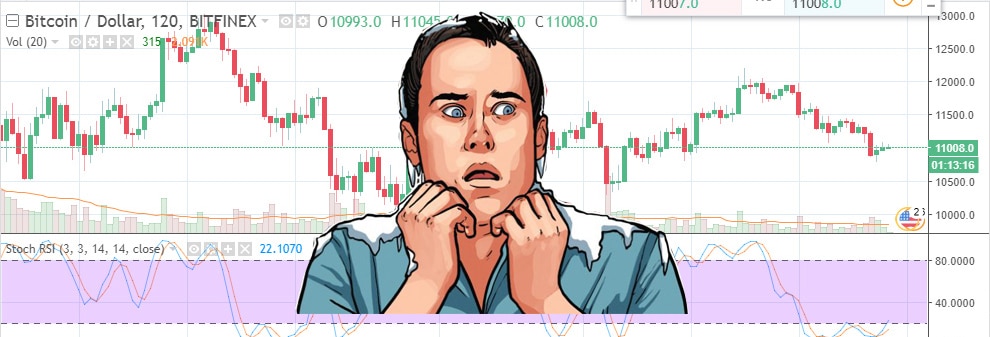

Yesterday (January 29), a bullish breakout was apparently attempted, only to run out of steam at around $11,690. Since then, things have mostly been in the red for BTC, and the price is now breaking through the rising trendline support.

The MAs (the 50, the 100 and the 200) are also sloping downward, pointing to yet more gloom and doom. $9k is now in the books even for the most optimistic analysts, and some predict the dip to go as low as $6k.

The stochastic oscillator on the other hand (as visible on the chart below, from just a few minutes ago) begs to differ, crawling along in oversold territory, even as its lines have crossed multiple times already.

There’s little doubt about the fact that at this point, BTC is indeed oversold and the oscillators point to an impending bullish reversal at $11,000. With the first solid resistance level set to $11,690, a break above that point might apparently yield a rally all the way to the $13k mark.

While this bit of insight contradicts the above analysis, it paints a compelling picture of the current market sentiment: up or down…it’s anyone’s guess.

What do the news say?

Fundamentals have thus far proven much more reliable in predicting upcoming BTC price swings, and this time around, the news are not on the rosy side to say the least. Over the last few days, a steady drumbeat of scary, just plain bad or downright apocalyptical news have been hitting the grapevine. That is not to say there weren’t any positive developments on the crypto front, but for some reason, these did not gain much press-traction…

Coincheck’s hack last week – though not particularly significant in terms of the big picture – was hyped as a meltdown “bigger than MtGox”. Sure enough, it had a negative impact on BTC, though this effect was a limited one at best.

Tether’s emerging problems on the other hand, prompted a much more significant drop of almost 7%. The insolvency issues of the startup, coupled with the breaking down of its relationship with regulators, resulted in yet more gloom and doom, although from an objective angle, the impact of a Tether meltdown on BTC shouldn’t even amount to a Coincheck-like problem.

While according to some, the price of BTC is now held artificially low, we should also bear in mind that January has always been a historically weak month for the crypto industry and for BTC in particular. It might have something to do with Chinese investors converting some of the their crypto holdings to fiat, for seasonal reasons. Futures traders are also in the picture this time around, and as we pointed out in the past, their impact on the bearish side of the crypto equation should never be underestimated.

What about the other cryptos?

Ethereum, though dealing with some back-and-forth of its own, has been quietly rallying close to its historical high. Despite the tug of the bear, it is still quite comfortably sitting above the $1.1k mark.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.