The strong sell-off in crude means that the FTSE 100 (Strong Sell) which is heavily weighted towards oil stocks is heading towards posting a third negative week in a row.

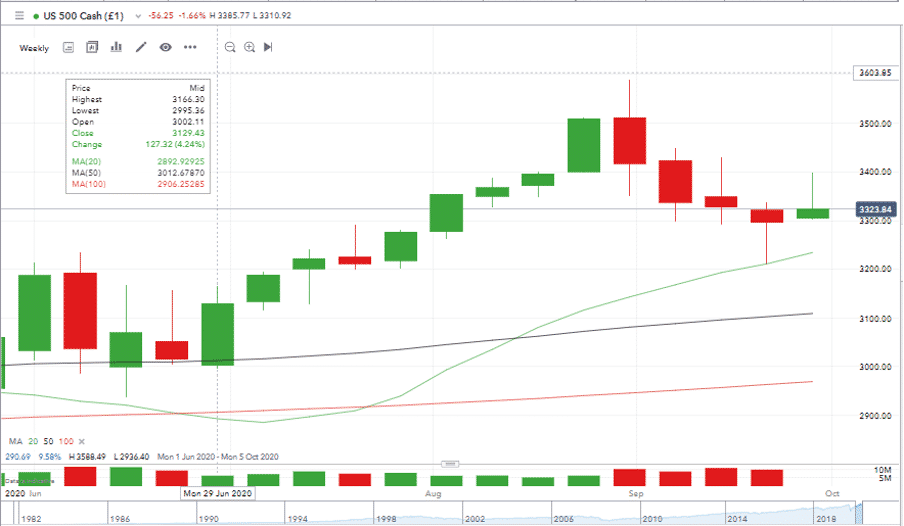

It will be interesting to see if the S&P 500 (Strong Buy) holds positive ground for the week. It risks posting 5 successive red candles. The bar it would have to clear to post a positive weekly return is 3296. Currently trading at 3,321 there could be at least a test of that level as Presidential Covid infections and Non-Farm Payrolls come in to play on Friday.

Instrument | Hourly | Daily | |

GBP/USD | 1.2877 | SELL | BUY |

EUR/USD | 1.1723 | SELL | NEUTRAL |

FTSE 100 | 5,801 | STRONG SELL | STRONG SELL |

S&P 500 | 3,321 | STRONG BUY | STRONG BUY |

Gold | 1,905 | BUY | NEUTRAL |

Silver | 23.75 | NEUTRAL | SELL |

Crude Oil WTI | 37.42 | STRONG SELL | STRONG SELL |

Bitcoin | 10,437 | STRONG SELL | STRONG SELL |

Our analysis is based on a comprehensive summary of market data. We use a range of metrics with weighting given to simple and exponential moving averages and key technical indicators.

Risk Statement: Trading Foreign Exchange on margin carries a high level of risk and may not be suitable for all investors. The possibility exists that you could lose more than your initial deposit. The high degree of leverage can work against you as well as for you.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.