Both the Euro and the GB Pound suffered significant losses into late October against the US Dollar, reinforcing intermediate-term bearish themes and also leaving negative pressures in the very near term into early November.

For EURUSD, the breakdown through support at 1.0950 and 1.0910 has signalled a more bearish outlook on an intermediate-term basis through mid-Q4. This could see further significant losses, maybe towards a key target at 1.0520.

For Cable (GBPUSD), further losses through the low since the mid-October “flash crash” at 1.2088 in late October have maintained downside vulnerability.

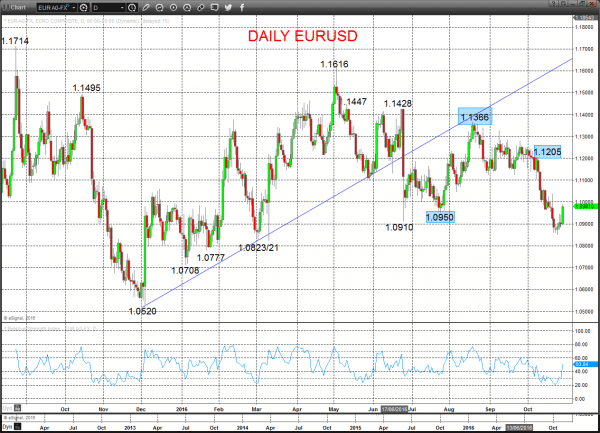

EURUSD

A far stronger rebound on Friday than anticipated, pushing up through resistance at 1.0945/47, easing immediate downside risk, and setting the bias for a further corrective advance on Monday.

However, the latter October push through 1.0910 and key support at 1.0950, signalled an intermediate-term bearish shift.

For Monday:

- We see an upside bias for 1.1000; break here aims for 1.1039 and 1.1058/61, maybe 1.1100/02.

- But below 1.0910 opens risk down to 1.0880 and 1.0848.

The late July push above 1.1189 saw a shift to an intermediate-term, neutral range theme.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 1.0823/21.

- Below here targets 1.0777/08 and maybe 1.0520.

What Changes This? Above 1.1205 signals a neutral tone, only shifting positive above 1.1366.

Daily EURUSD Chart

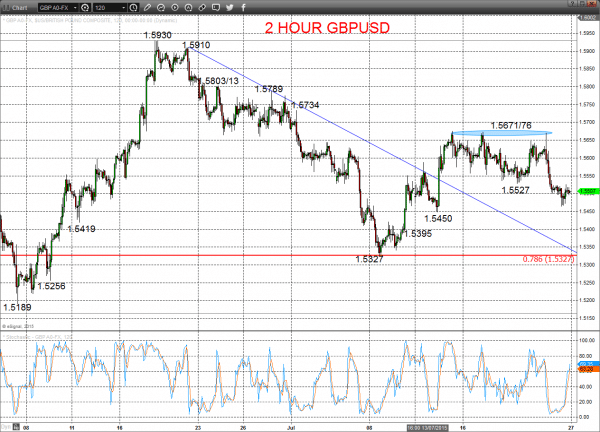

GBPUSD

A push below support we had flagged at 1.2145 on Friday, to reinforce the Thursday spike higher and then sell-off through support at 1.2196 and 1.2153/45 area, and despite the intraday rebound leaving risk back lower on Monday

Moreover, the 7th October “flash crash” wiped out multi-decade supports, 1.2565 and psychological 1.2000 and reinforced a far more negative intermediate-term outlook.

For Monday:

- We see a downside bias for 1.2135 and 1.2111; break here aims for 1.2081.

- But above 1.2200 and 1.2220 aims for 1.2272 and 1.2298, maybe opening risk up to 1.2333.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 1.1943.

- Below here targets 1.1880, 1.1000 and even the 1985 low at 1.0520.

What Changes This? Above 1.3279 signals a neutral tone, only shifting positive above 1.3445.

2 Hour GBPUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.