Both the Euro and Great British Pound suffered significant losses and breaches of important technical support in early November.

This now sets an even more bearish outlook for both EURUSD and GBPUSD than was already evident for this month.

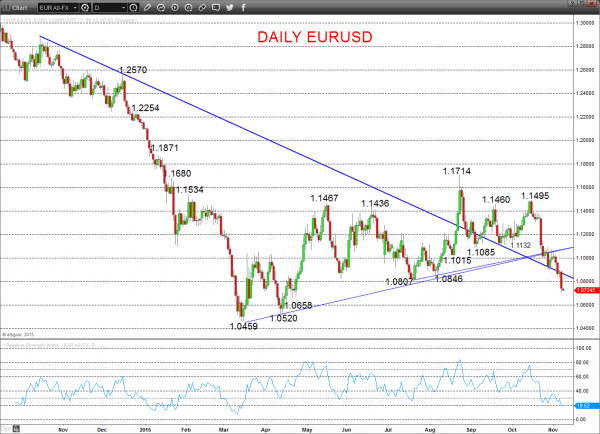

EURUSD

A plunge lower Friday through key 1.0807 after the prior push through 1.0896 and notable 1.0846 support, to leave the risk still lower Monday.

The aggressive bear break post-ECB in latter October, to plunge below 1.1085 has set a more bearish outlook for November.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a more negative tone with the bearish threat to 1.0658/07.

- Below here targets 1.0520 and 1.0459.

What Changes This? Above 1.1395 signals a neutral tone, only shifting positive above 1.1495.

Daily EURUSD Chart

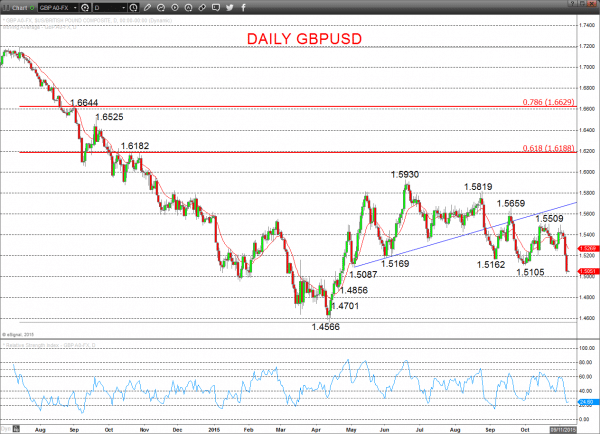

GBPUSD

An aggressive plunge lower Thursday below multiple supports, then a bear extension, through key supports at 1.5105 and 1.5087 to leave a still bear tone for Monday.

Moreover, this early November price action reinforces previous bear signals from October and sets a still more bearish theme for November.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 1.5000 and 1.4856.

- Below here targets 1.4701 and 1.4566.

What Changes This? Above 1.5509 signals a neutral tone, only shifting positive above 1.5659.

Daily GBPUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.