A still more negative theme has started to develop through mid-November for both the Euro and GB Pound versus the US currency. EURUSD has remained bearish since the negative shift back in October through the ECB meeting and although more erratic, Cable (GBPUSD) has retained a broader bear bias since August. We still risks for further EURUSD and GBPUSD price erosion into November.

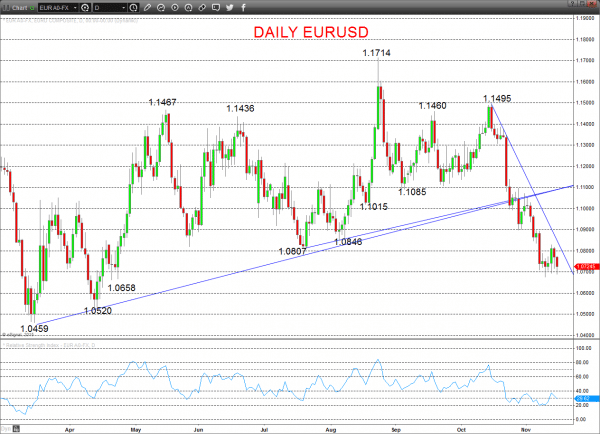

EURUSD

Despite a bounce effort to probe our resistance at 1.0815, the roll back lower Friday, leaves the risk still lower Monday.

The aggressive October bear break, to plunge below 1.1085, leaves a bearish outlook for November.

For Monday:

- We see a downside bias to 1.0671 and 1.0658; break opens up 1.0607 and 1.0570.

- But above 1.0776 opens risk up to 1.0830, which we would look to try to cap.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a more negative tone with the bearish threat to 1.0658/07.

- Below here targets 1.0520 and 1.0459.

What Changes This? Above 1.1395 signals a neutral tone, only shifting positive above 1.1495.

Daily EURUSD Chart

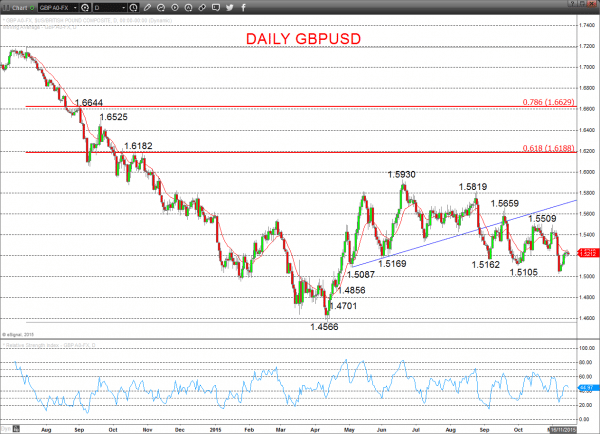

GBPUSD

A roll back lower, still capped by resistance at 1.5264 and we still see bias lower again Monday from the aggressive early November plunge through key supports at 1.5105 and 1.5087.

Moreover, this early November price action reinforces previous bear signals from October for a still more bearish theme for November.

For Monday:

- We see a downside bias for 1.5171; break here aims for 1.5131.

- But above 1.5264 opens risk up to 1.5332/58.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 1.5000 and 1.4856.

- Below here targets 1.4701 and 1.4566.

What Changes This? Above 1.5509 signals a neutral tone, only shifting positive above 1.5659.

Daily GBPUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.