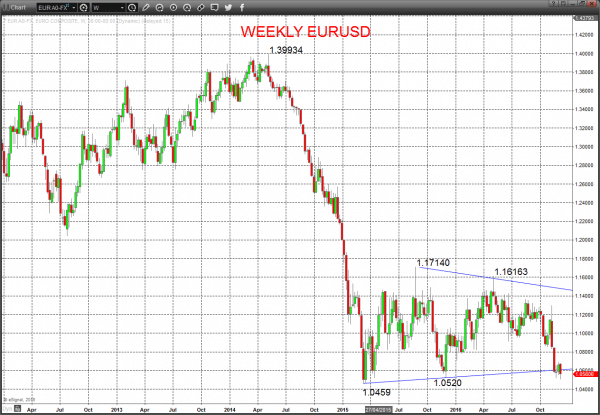

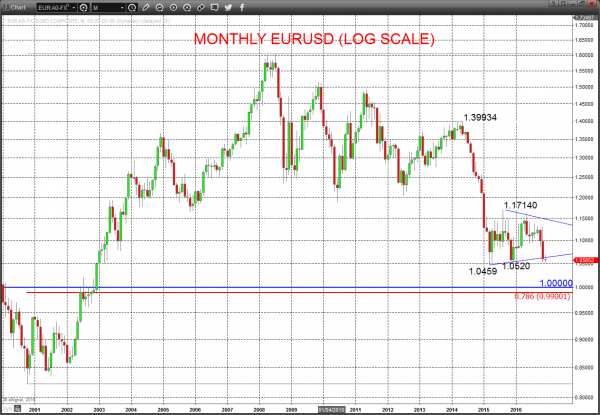

A lacklustre Euro rebound versus the US dollar since late November has simply been pause in the underlying bearish theme. Recovery activity has been capped below 1.0700, whilst the renewal bearish pressures already on Monday fifth December in the wake of the Italian constitutional vote leave the risk for further negative price action for EURUSD into December and late 2016. A second probe below the December 2015 low at 1.0520 leaves risk to the multi-decade low at 1.0469 (lowest level since 2002) and potentially for year-end for a challenge to the psychological level of parity (1.0000) and even a long-term retracement level at .9900.

EURUSD

Despite a probe to the upside late last week above minor resistance at 1.0685, a setback from 1.0690 maintained a negative bias, whilst the plunge already this morning since the Italian Referendum result to another new multi-month low points to a bearish theme for Monday.

Furthermore, another probe of 1.0520 reinforces the aggressive sell-off through 1.0987 after the US Presidential election result, enhancing the intermediate-term bearish theme.

For Monday:

- We see a downside bias for 1.0503/00; break here aims for the key multi-decade supports at 1.0459, maybe to 1.0405.

- But above 1.0628 opens risk up to 1.0690.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 1.0520 and maybe parity (1.0000).

What Changes This? Above 1.1300 signals a neutral tone, only shifting positive above 1.1366.

Weekly EURUSD Chart

Monthly EURUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.