- A negative US Dollar tone has re-emerged in January 2018 across G10 FX markets.

- The US$ has been weakening since the FOMC rate hike in December 2017.

- For EURUSD, we see an intermediate-term bullish environment, with threat up to 1.2272 and 1.2600.

- GBPUSD aims higher for January for 1.3841 and 1.4000.

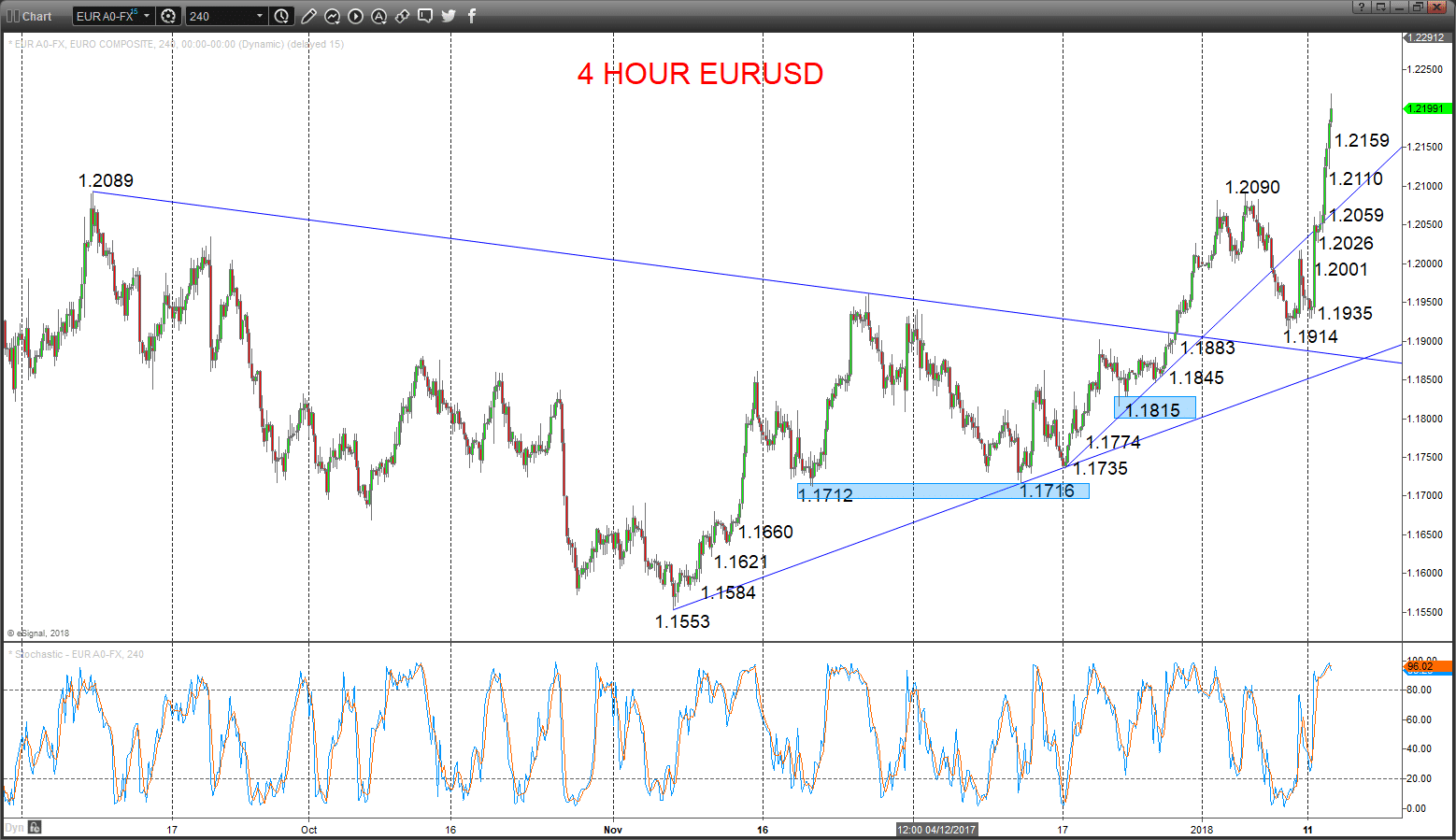

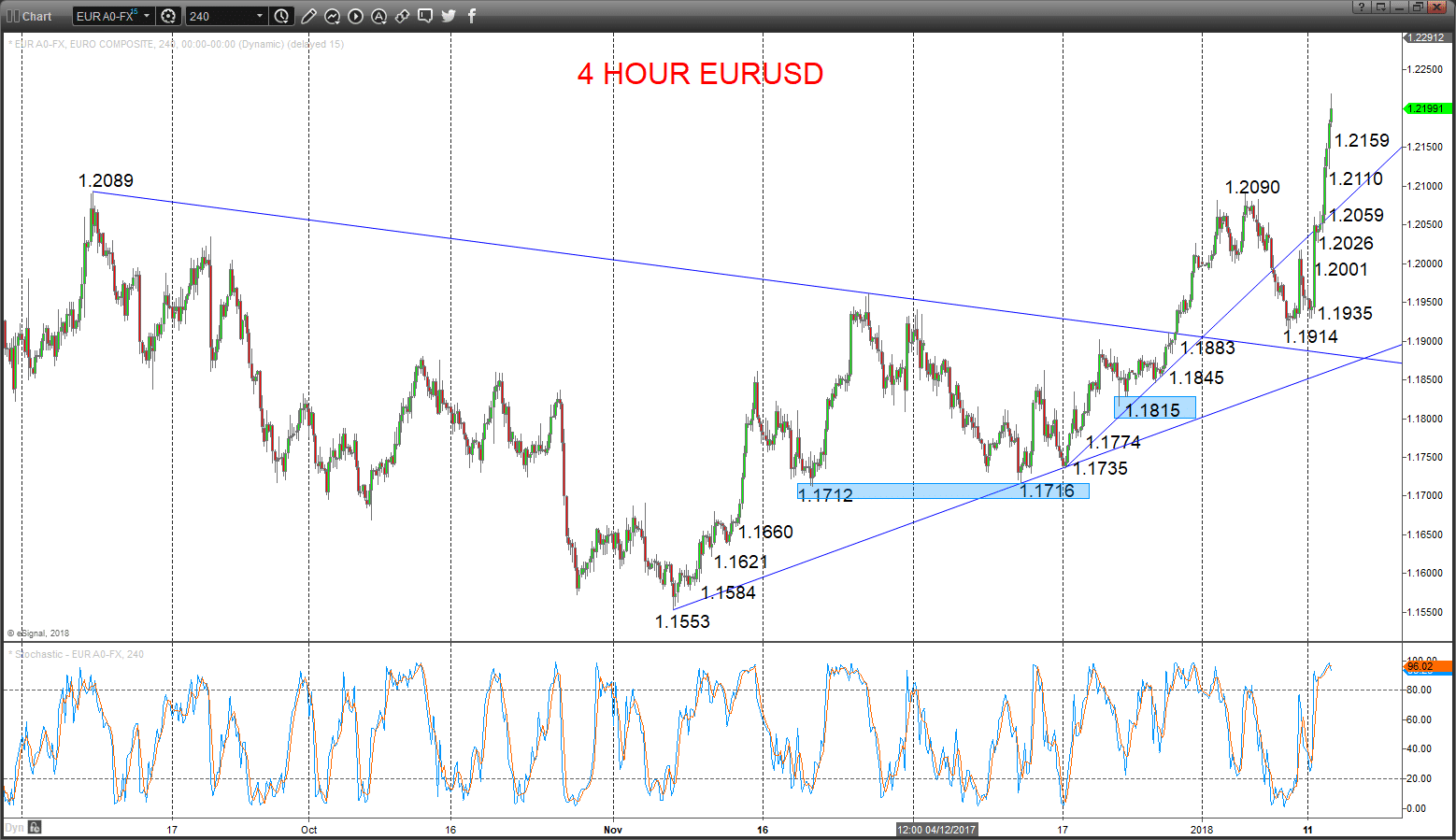

EURUSD Bull theme fully re-energized

A Friday surge to build on the extremely aggressive rally Thursday (all in the wake of a more dovish ECB tone), surging through multiple longer-term resistances from 2015, keeping risks back higher for Monday.

The end of 2017 push through 1.1961 saw an intermediate-term bullish shift to set an upside bias for January.

For Today:

- We see an upside bias for 2219; break here aims for 1.2254, maybe 1.2306.

- But below 1.2159 opens risk down to 1.2110, maybe 1.2059.

Intermediate-term Outlook – Upside Risks:

- Whilst above 1.1815, we see a positive tone with the bullish threat up to 1.2272 and 1.2600.

What Changes This? Below 1.1815 signals a neutral tone, only shifting negative below 1.1712.

Resistance and Support:

| 1.2219 | 1.2254 | 1.2272** | 1.2306 | 1.2355 |

| 1.2159 | 1.2110* | 1.2059 | 1.2026** | 1.2001 |

4 Hour EURUSD Chart

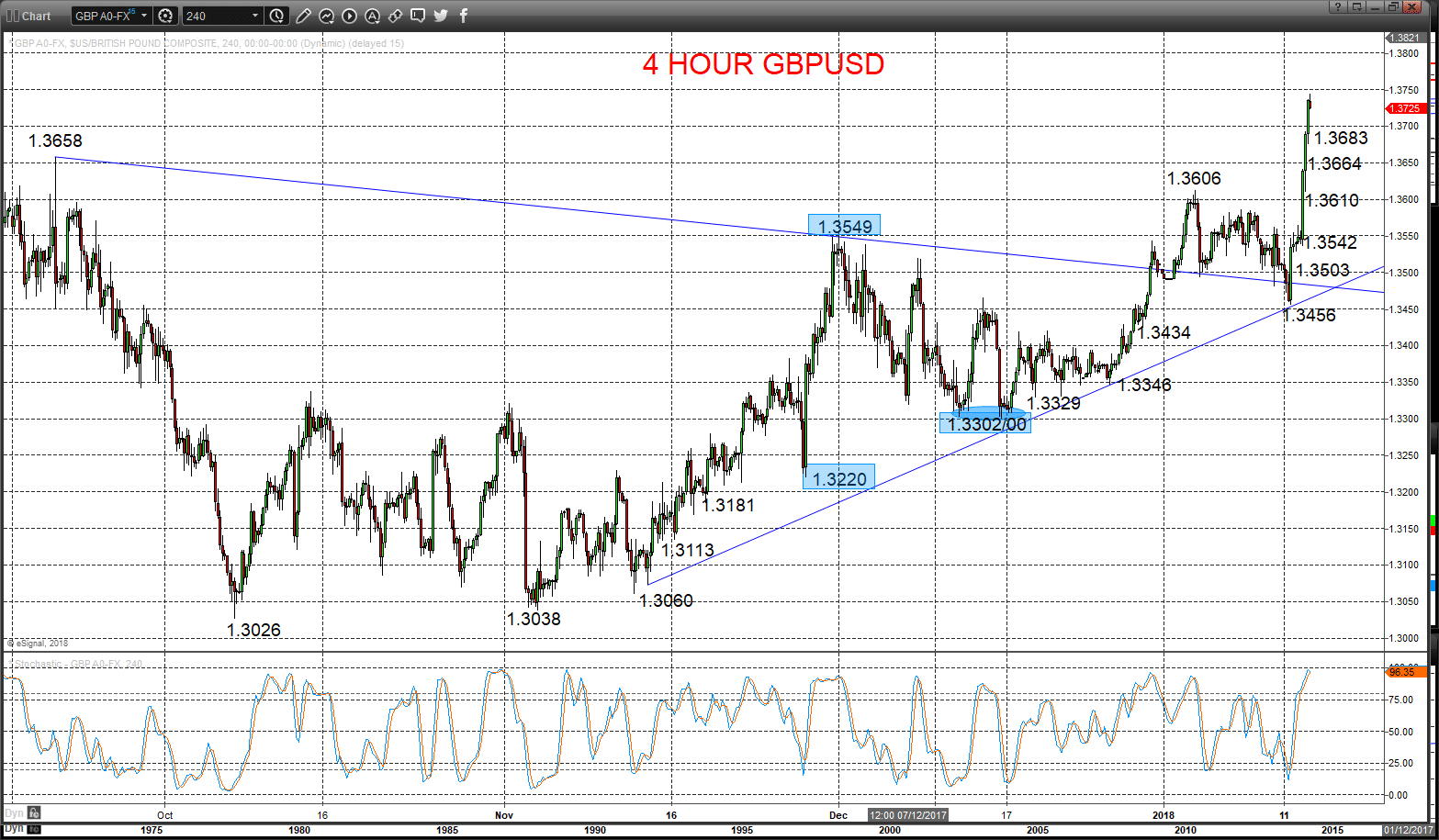

GBPUSD Bullish theme intact

A Friday surge through the 1.3658 peak and a notable resistance target at 1.3705 to post-Brexit highs (as we had flagged), building on the strong Thursday rebound from just above 1.3434 support (off 1.3456) keeping risks back to the upside Monday.

The prior break above 1.3549 shifted the intermediate-term outlook from neutral to bullish and sees upside risks for January.

For Today:

- We see an upside bias for 3744 and 13755; above here aims for 1.3791, maybe 1.3841.

- But below 1.3683 opens risk down to 1.3664, possibly 1.3610.

Intermediate-term Outlook – Upside Risks:

- We see a positive tone with the bullish threat back up to 1.3841 and 1.4000.

What Changes This? Below 1.3300 signals a neutral tone, only shifting negative below 1.3220.

Resistance and Support:

| 1.3744/55 | 1.3791 | 1.3841*** | 1.3875 | 1.3936 |

| 1.3683 | 1.3664* | 1.3610* | 1.3542** | 1.3503 |

4 Hour GBPUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.