- Both EURUSD and GBPUSD retain a bullish outlook on an intermediate-term timeframe into July.

- In particular, EURUSD continues to threaten significant higher price action in the near term.

- However, GBPUSD is threatening a corrective setback early this week, before bigger picture bullish pressures likely return into July.

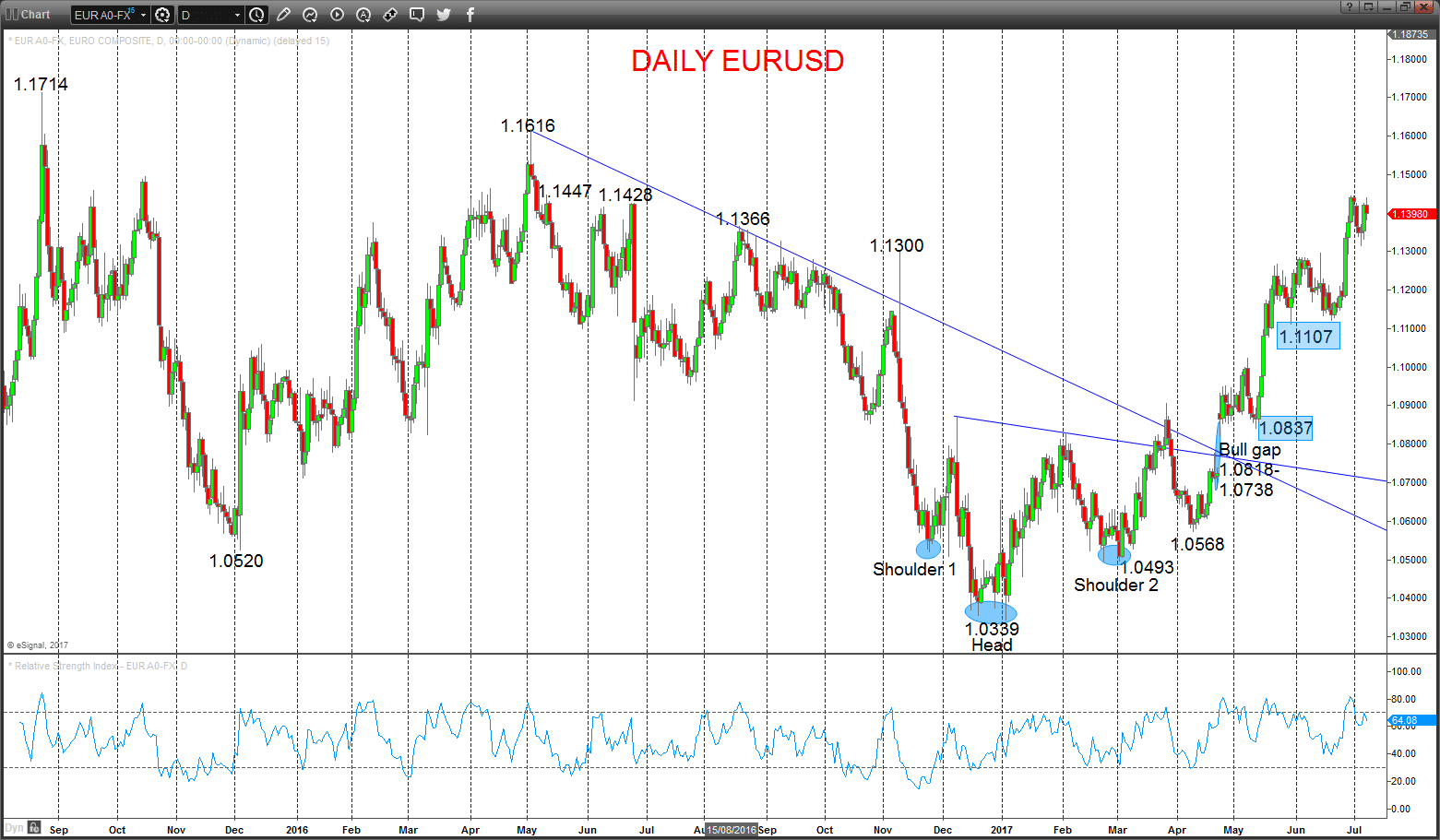

EURUSD – Upside threat

Despite a setback Friday, modest support at 1.1340 was untouched, leaving upside pressures from the Thursday rebound effort (driven by higher European bond yields after the French auction), keeping the risk higher for Monday.

Furthermore, we still see a bullish intermediate-term outlook into July.

For Today:

l We see an upside bias for 1.1410; break here aims for the cycle peak at 1.1447, potentially closer to 1.1500.

l But below 1.1340 opens risk down to the 1.1311/1.1291 area.

Intermediate-term Outlook – Upside Risks:

l Whilst above 1.1107, we see a positive tone with the bullish threat to 1.1366.

l Above here targets 1.1428/47, 1.1616 and 1.1714.

What Changes This? Below 1.1107 signals a neutral tone, only shifting negative below 1.0837.

Daily Chart

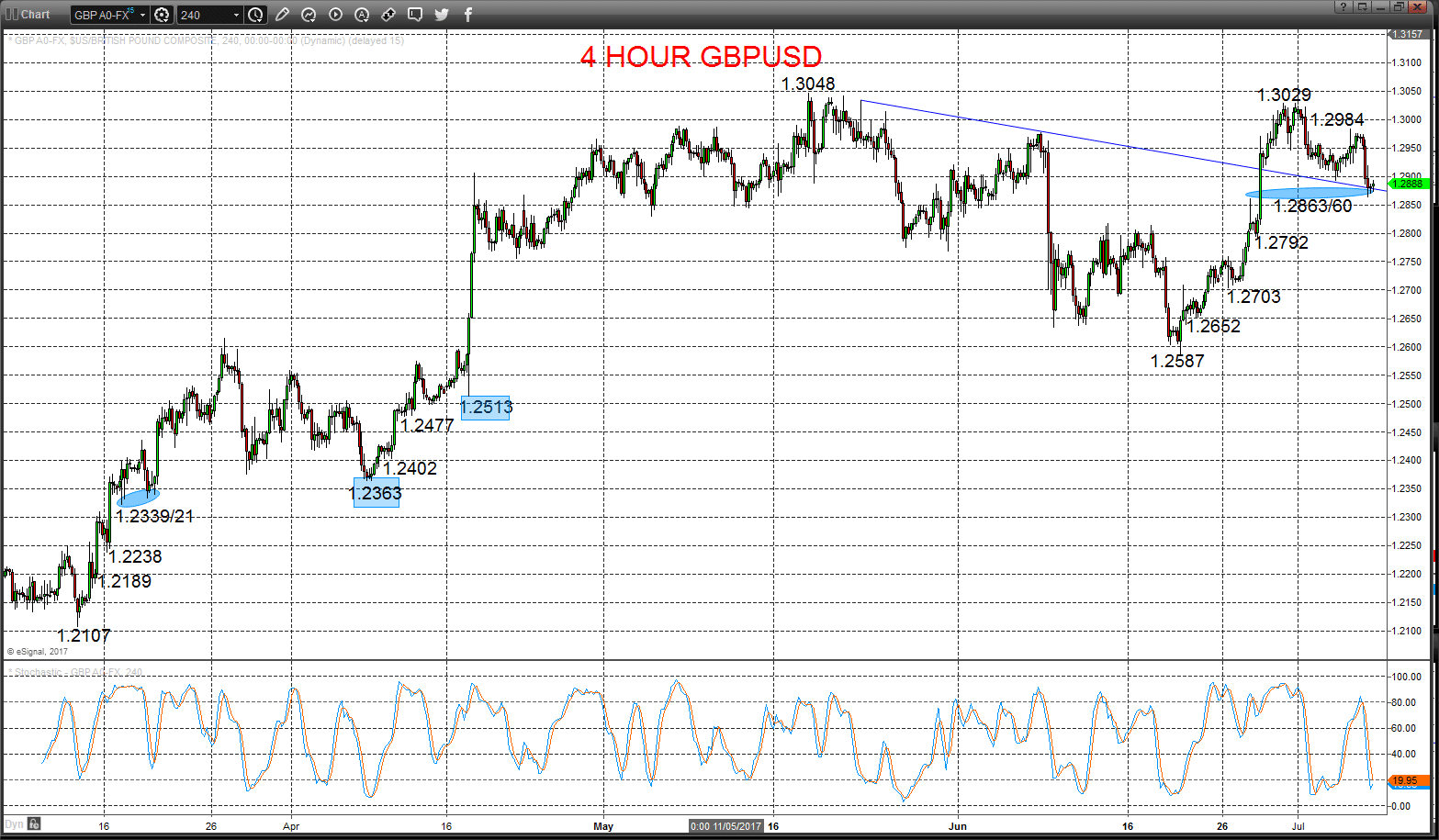

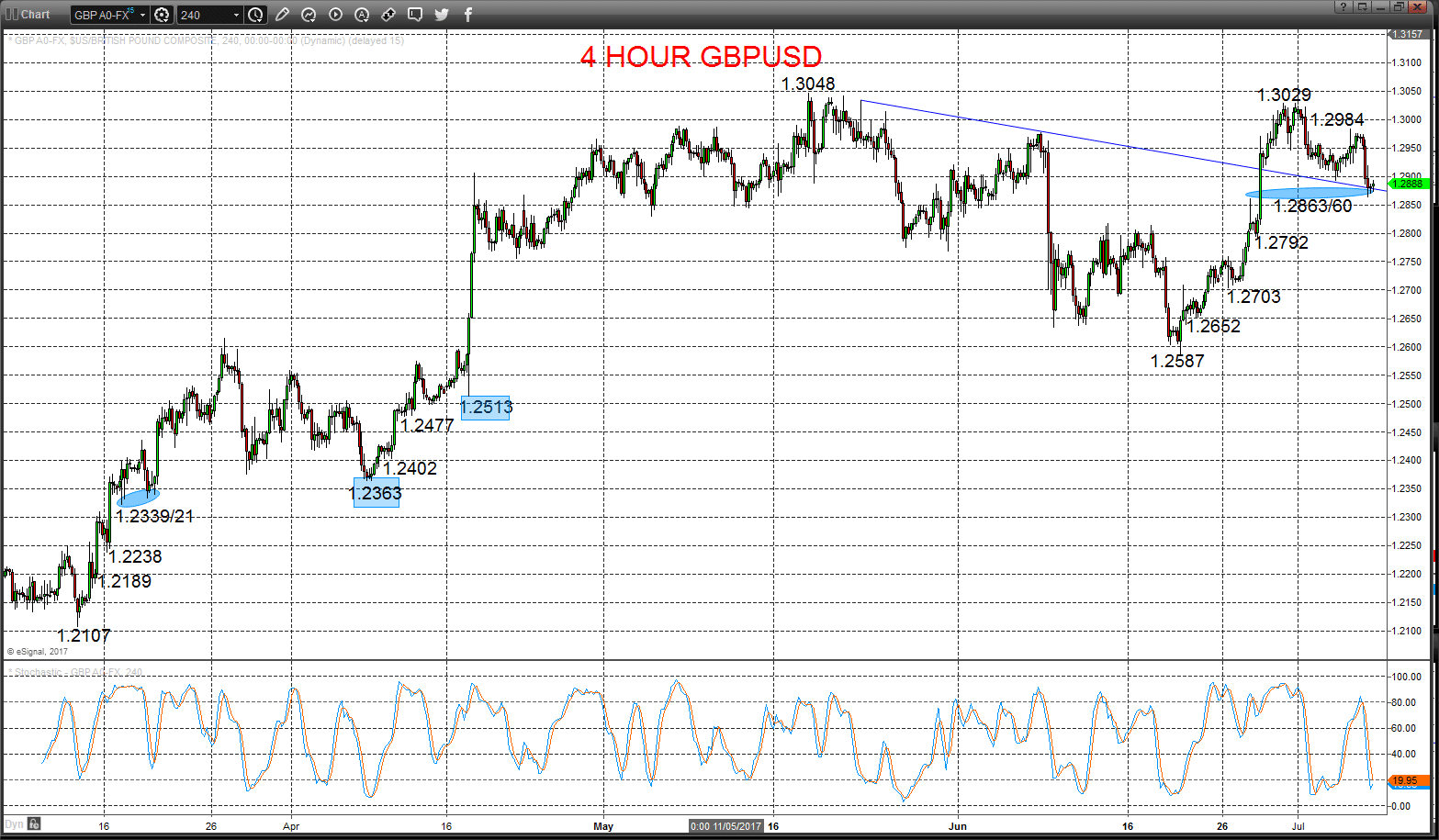

GBPUSD – Downside threat

A significant sell-off Friday, rejecting the Thursday rebound and resuming the early July corrective activity, switching the immediate risk to the downside for Monday.

However, the intermediate-term outlook still remains significantly bullish for July.

For Today:

l We see a downside bias for 1.2863/60; break here aims for 1.2792.

l But above 1.2935 opens risk up to 1.2984.

Intermediate-term Outlook – Upside Risks:

l We see a positive tone with the bullish threat to 1.3121.

l Above here targets the 1.3455/3534 area.

What Changes This? Below 1.2513 signals a neutral tone, only shifting negative below 1.2363.

4 Hour Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.