- A weakening of the US Dollar has been a theme across Forex markets in early 2019.

- This has mainly been driven by a more dovish tone from Federal Reserve members since latter 2018, and in particular from the FOMC Chair, Jerome Powell into early January, reinforced Wednesday by the most recent FOMC Minutes.

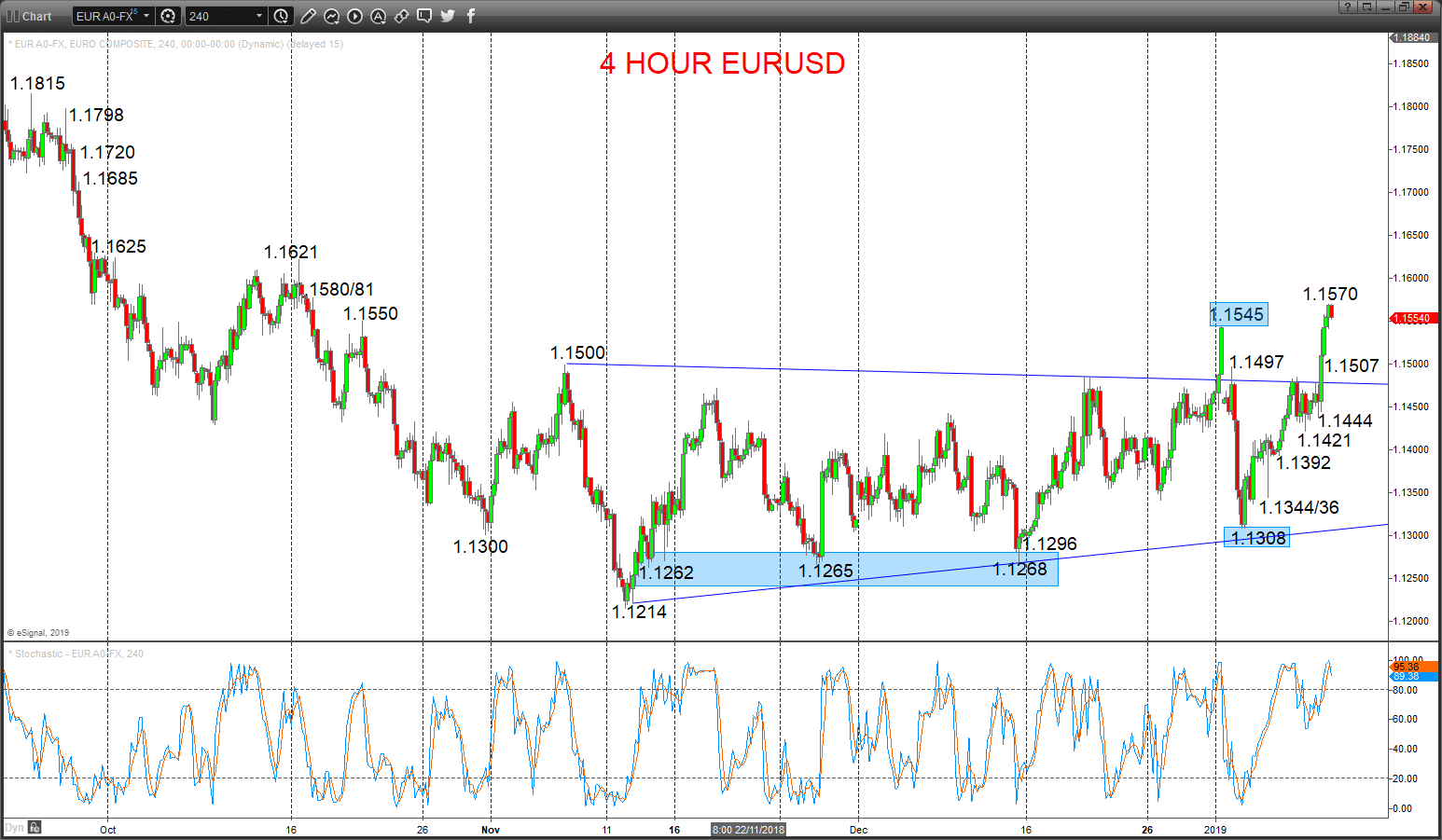

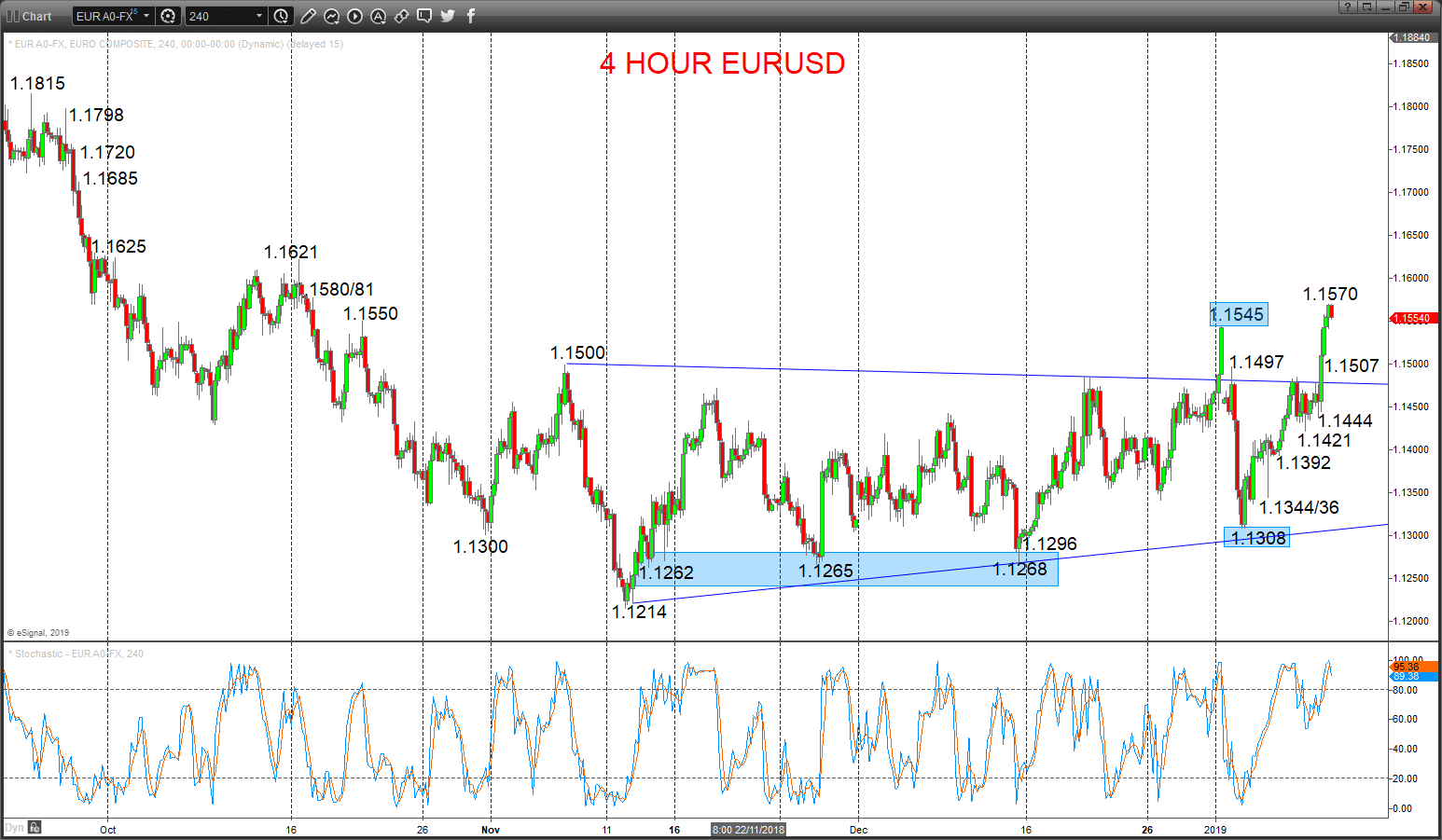

- The weakened US Dollar has seen the EURUSD currency pair recently surge through 1.1545 resistance, switching the intermediate-term outlook from neutral to bullish.

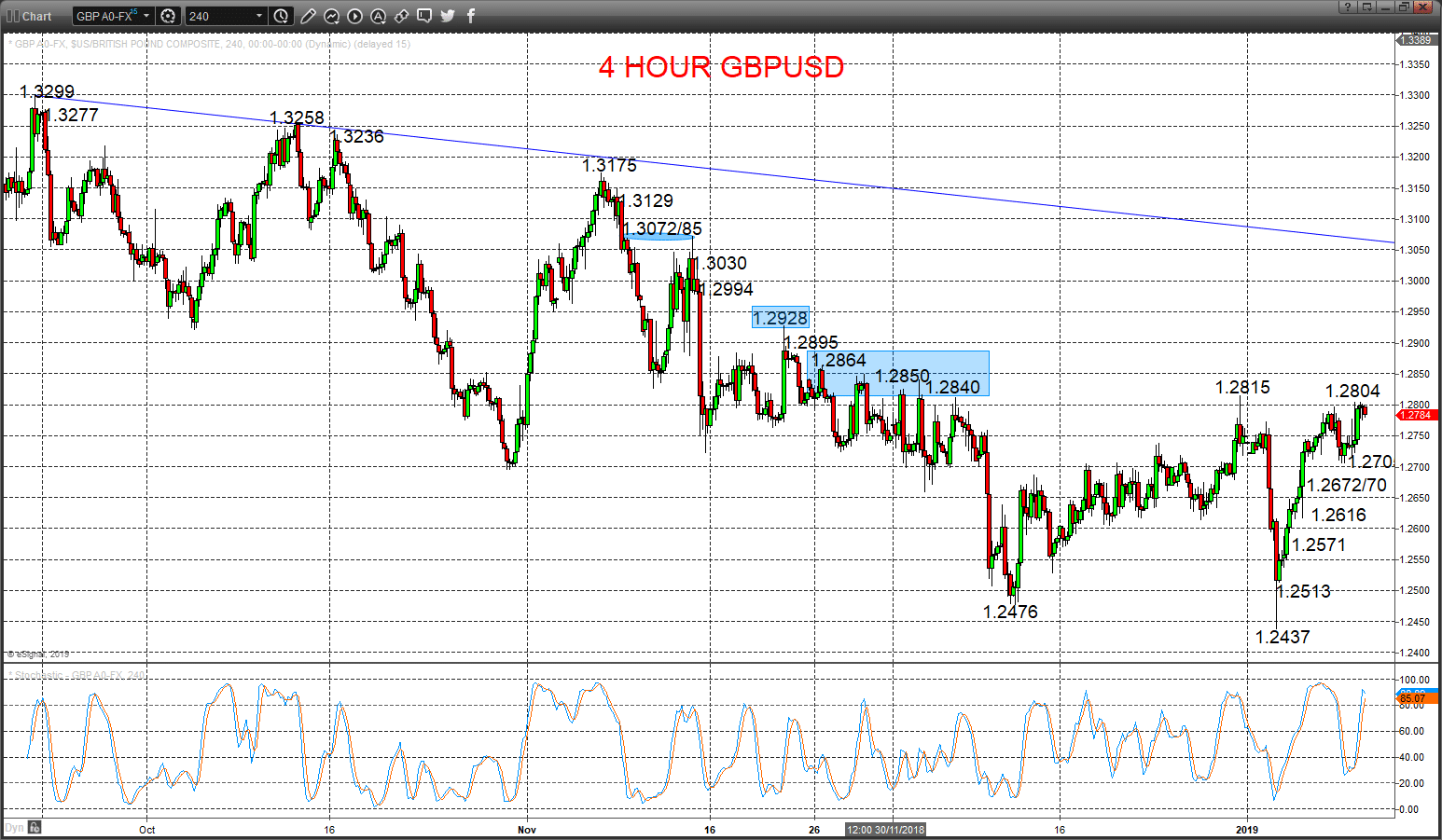

- The GBPUSD rebound for early 2019 has positioned this FX rate to make a more positive technical statement in at least the short-term, as we go into a key Brexit phase in the UK Parliament.

EURUSD Intermediate-term bullish shift

We have stressed in recent reports to our Market Chartist clients in early 2019 that “erratic early 2019 price action leaves an intermediate-term range theme defined as 1.1545 to 1.1268/62, BUT NOW with risks skewed towards an intermediate-term bull shift above 1.1545” and the Wednesday surge to probe above 1.1545 sets an intermediate-term bull theme.

Furthermore, this price action above 1.1545 has built on Monday’s firm advance above 1.1434 resistance, to keep the immediate risks higher for Thursday.

For Today:

- We see an upside bias for 1.1570/80/81; break here aims for key 1.1621/25 and maybe then 1.1685.

- But below 1.1507 opens risk down to 1.1444 and 1.1421.

Intermediate-term Outlook – Upside Risks: We see an upside risk for 1.1621.

- Higher targets would be 1.1815 and 1.2000.

- What Changes This? Below 1.1308 shifts the outlook back to neutral; through 1.1268/62 is needed for a bear theme.

Resistance and Support:

| 1.1570/80/81 | 1.1621/25** | 1.1685 | 1.1720 | 1.1798* |

| 1.1507 | 1.1444/21** | 1.1392* | 1.1344/36** | 1.1308/1.1296** |

4 Hour EURUSD Chart

GBPUSD Risks stay higher

A firm rebound Wednesday from above the 1.2672/70 area, off of 1.2705, top probe above 1.2797 resistance, sustaining upside pressures from the Friday-Monday push above various resistances, to keep the bias higher Thursday.

The early December push through key 1.2694 support set an intermediate-term bear trend BUT risk is now for an intermediate-term shift to neutral above the key 1.2840/64 area and maybe to bullish above 1.2928.

For Today:

- We see an upside bias for 1.2804/15; break here aims for the key 1.2840/64 area, then 1.2895 and maybe even towards critical 1.2928.

- But below 1.2705 aims for 1.2672/70 and opens risk down to 1.2616, which we would look to try to hold.

Intermediate-term Outlook – Downside Risks: We see a downside risk for 1.2366, 1.2109, 1.2000/1.1987 and 1.1950.

- What Changes This? Above the 2840/64 resistance area shifts the outlook back to neutral; above 1.2928 is needed for a bull theme.

Resistance and Support:

| 1.2804/15** | 1.2840/64*** | 1.2895 | 1.2928*** | 1.2994 |

| 1.2705 | 1.2672/70 | 1.2616** | 1.2571 | 1.2513* |

4 Hour GBPUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.