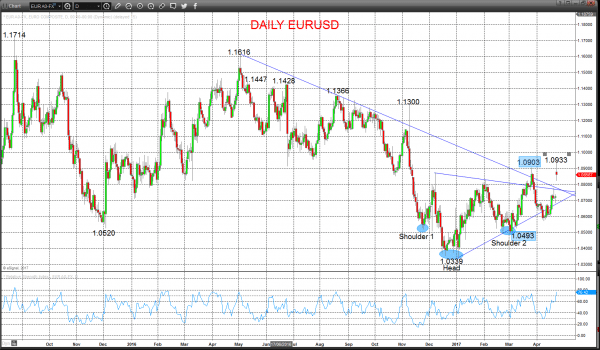

A surge higher by EURUSD on Monday in reaction to the French Presidential election result has created an intermediate-term shift and sets the bias higher into late April and through into May.

Furthermore, this activity sees the Euro join the GB Pound in a more positive outlook versus the US Dollar, with the GBPUSD previous push above 1.2775 indicating a bullish intermediate term view.

EURUSD – Upside risks reinforced

An aggressive bull gap on Monday in the wake of the French Presidential election results (gap 1.0818-1.0738), surging above the March peak at 1.0906, shifting the intermediate term outlook from neutral to bullish and leaving an upside bias for Monday.

For Today:

l We see an upside bias for 1.0933; break here aims for 1.1000.

l But below 1.0818 opens risk down to 1.0778, maybe to 1.0738.

Intermediate-term Outlook – Upside Risks:

l We see a positive tone with the bullish threat to 1.1000.

l Above here targets 1.1300

What Changes This? Below 1.0568 signals a neutral tone, only shifting negative below 1.0493.

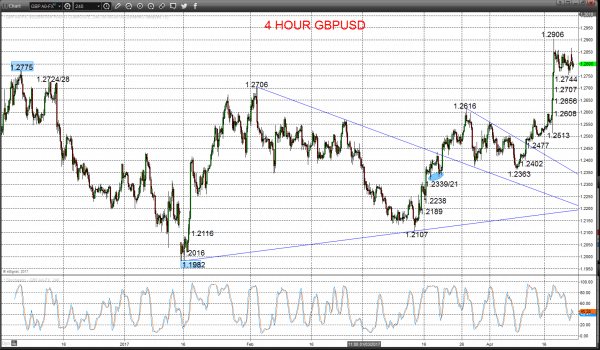

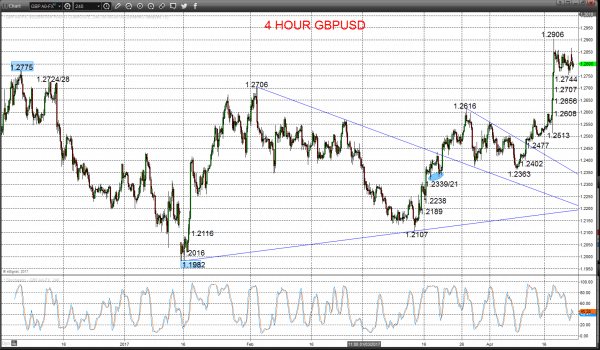

GBPUSD – Intermediate-term bullish view

High level consolidation Wednesday-Friday last week above minor support at 1.2744, maintaining bullish pressures from the aggressive Tuesday surge above key resistance at 1.2775, aiming higher for Friday.

Furthermore, the push above 1.2775 produced a multi-month Triple/ Quadruple Bottom pattern, which signalled an intermediate-term bullish shift.

For Today:

l We see an upside bias for 1.2906 and then 1.2946; break here aims towards 1.3000 and maybe 1.3058.

l But below 1.2744 opens risk down towards 1.2707 and 1.2656.

Intermediate-term Outlook – Upside Risks:

l We see a positive tone with the bullish threat to 1.3000.

l Above here targets 1.3121 and 1.3455/3534 area.

What Changes This? Below 1.2363 signals a neutral tone, only shifting negative below 1.2107.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.