- A plunge lower for the Euro across major currencies on Tuesday with dovish comment from after European Central Bank President Mario Draghi stated the ECB would need to ease interest rate policy if inflation does not move back to target.

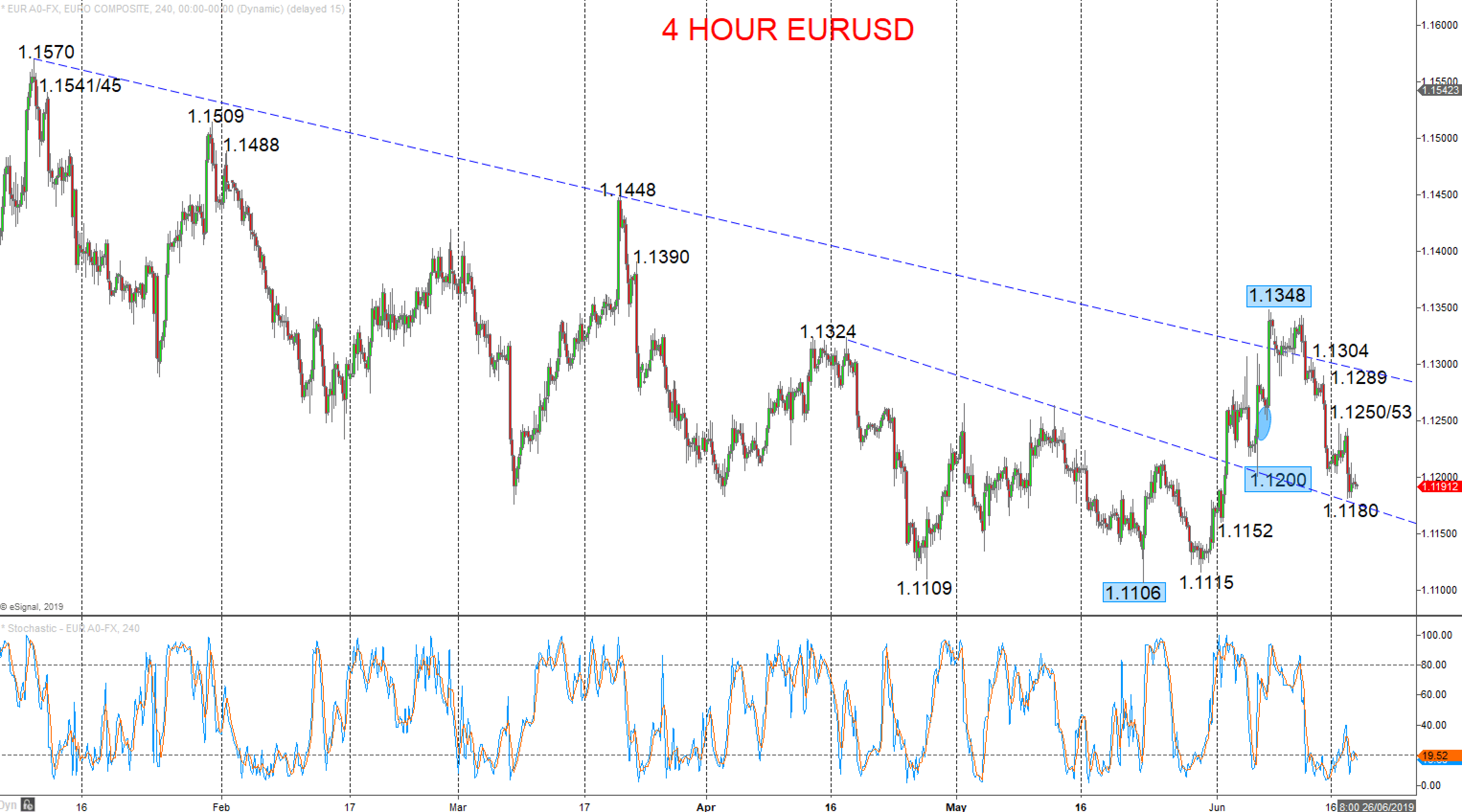

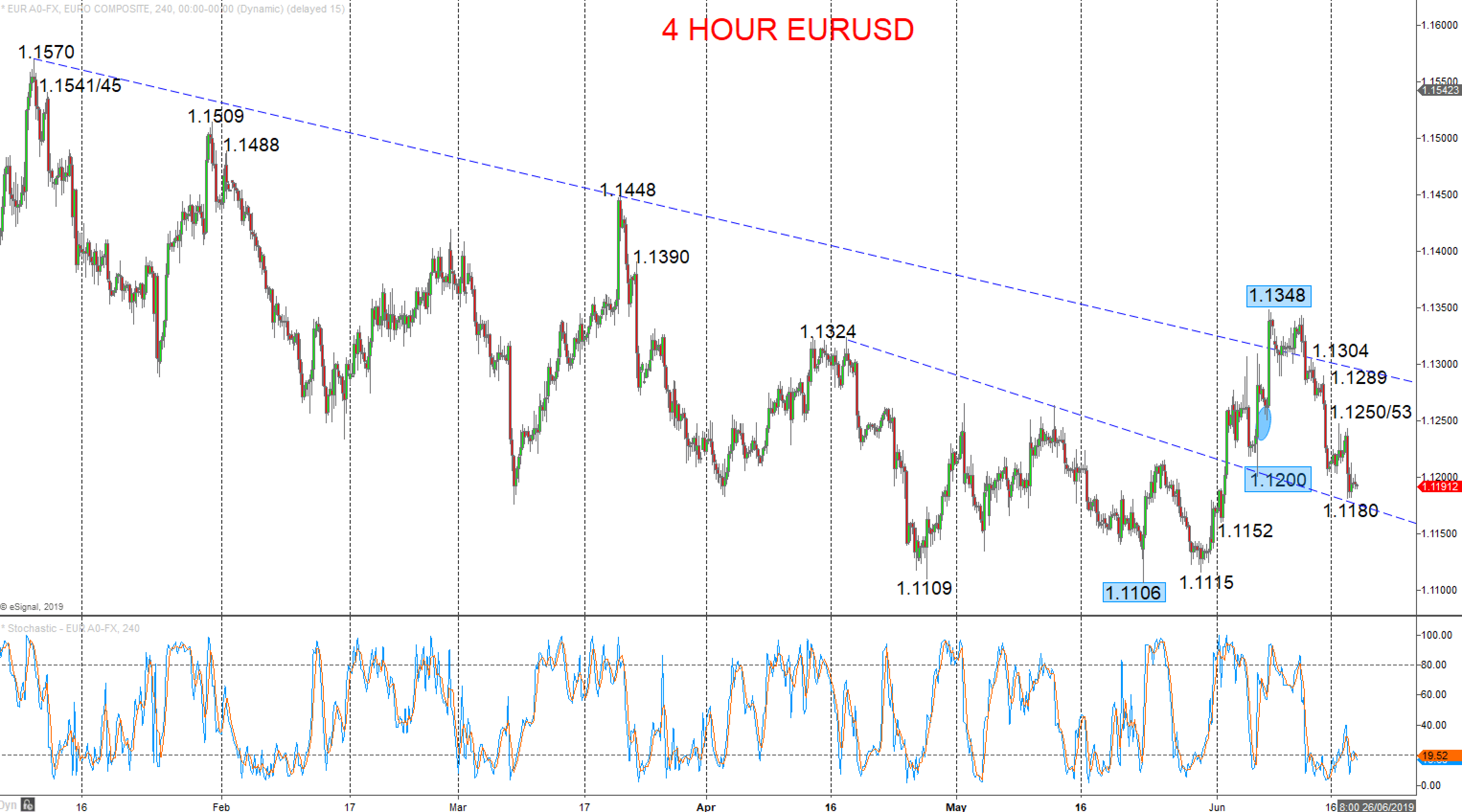

- This saw EURUSD surrender important 1.1200 support to shift the intermediate-term outlook from bullish to a neutral, range theme.

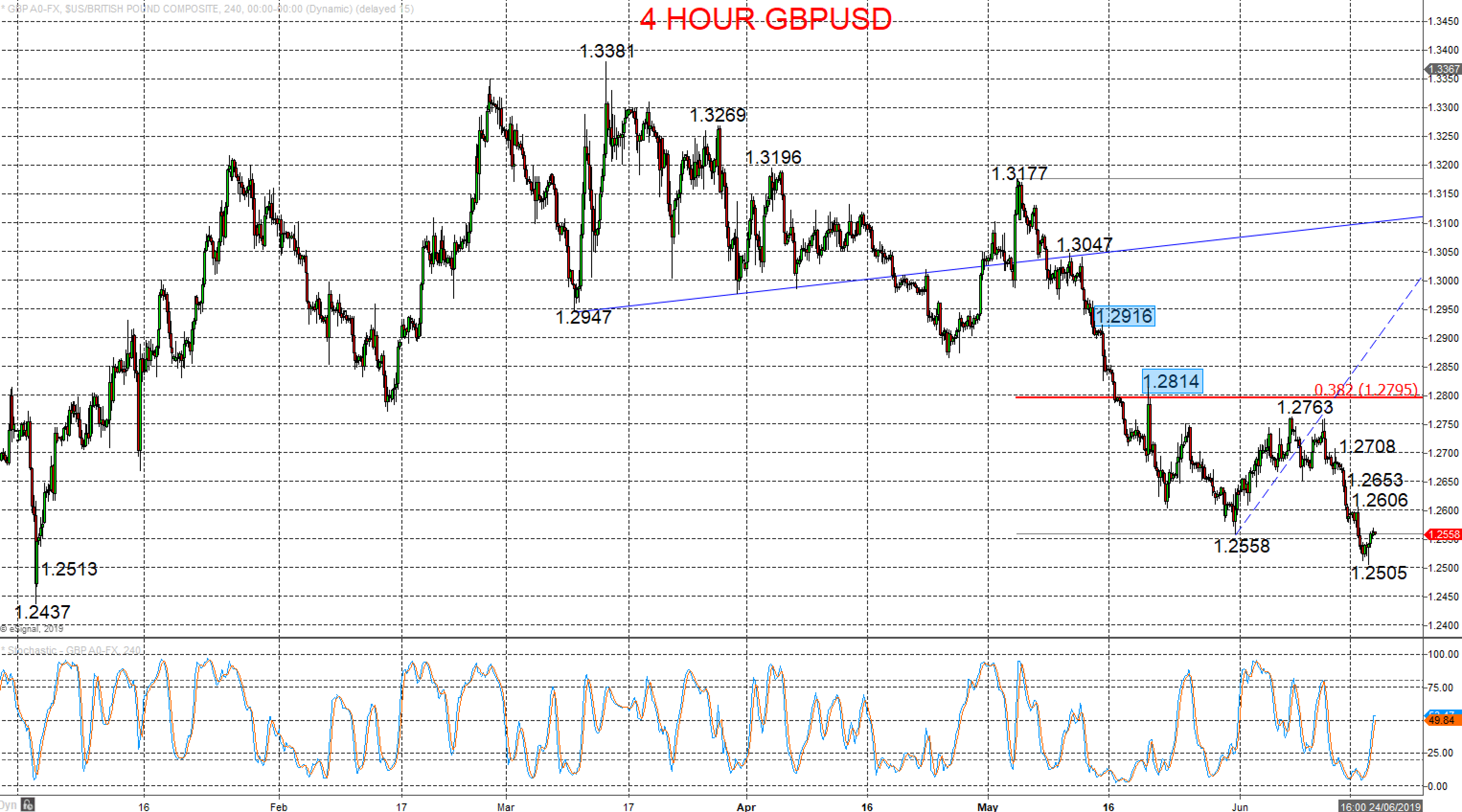

- Sterling remains weak with Boris Johnson’s lead in the Conservative party leadership race intact and ongoing concerns regarding a no deal Brexit.

- This leave GBPUSD bearish on both short- and intermediate-term outlooks.

EURUSD intermediate-term shift to a neutral range below 1.1200

The June surge above 1.1324 set an intermediate-term bull trend, BUT the break below 1.1200 on Tuesday has now set an intermediate-term range seen as 1.1106 to 1.1348.

This negative price action reinforced the setback from 1.1348 through supports since mid-June and also leaves a negative tone for Wednesday.

For Today:

- We see a downside bias for 1.1180; break here aims for 1.1152, maybe closer to 1.1115.

- But above 1.1221, aims quickly for 1.1250/53 and maybe opens risk up towards the 1.1289/1.1304 area.

Intermediate-term Range Breakout Parameters: Range seen as 1.1106 to 1.1348.

- Upside Risks: Above 1348 sets an intermediate-term bull trend to aim for 1.1448, 1.1509 and 1.1570.

- Downside Risks: Below 1106 sees an intermediate-term bear trend to target 1.1100, 10839 and 1.0579.

4 Hour Chart

GBPUSD bear trend intact

A prod lower Tuesday to another new bear move low after the Friday-Monday plunge through 1.2558 and 1.2513, reinforcing the failure last week from below the 38.2% Fibonacci retracement at 1.2795, sustaining short- and intermediate-term bear forces, to keep risks lower Wednesday.

The latter April probe below 1.2947 signalled an intermediate-term Double Top pattern and set an intermediate-term bear trend.

For Today:

- We see a downside bias for 1.2505; break here aims for 1.2474, maybe 1.2437.

- But above 1.2606 opens risk up to 1.2653.

Intermediate-term Outlook – Downside Risks: We see a downside risk for 1.2437.

- Lower targets would be 1.2366 and 1.2109

- What Changes This? Above 1.2814 shifts the outlook back to neutral; above 1.2916 is needed for a bull theme.

4 Hour Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.