- The EURUSD and GBPUSD currency pairs have rebounded in early June, with the intermediate-term outlook for the EURUSD FX shifting to bullish, whilst the GBPUSD Forex rate retains an intermediate-term bear trend (but under threat from recovery efforts).

- This upside activity for both EURUSD and GBPUSD has primarily reflected a weakening of the US Dollar, which has been in reaction to heightened global trade concerns and a more dovish shift by the Federal Reserve.

- Furthermore, the ECB have delivered a somewhat less dovish tone than anticipated in early June, helping the Euro higher.

- But the Conservative Party leadership contest in the UK leaves risk for a “no deal” Brexit, which leaves Sterling vulnerable into June.

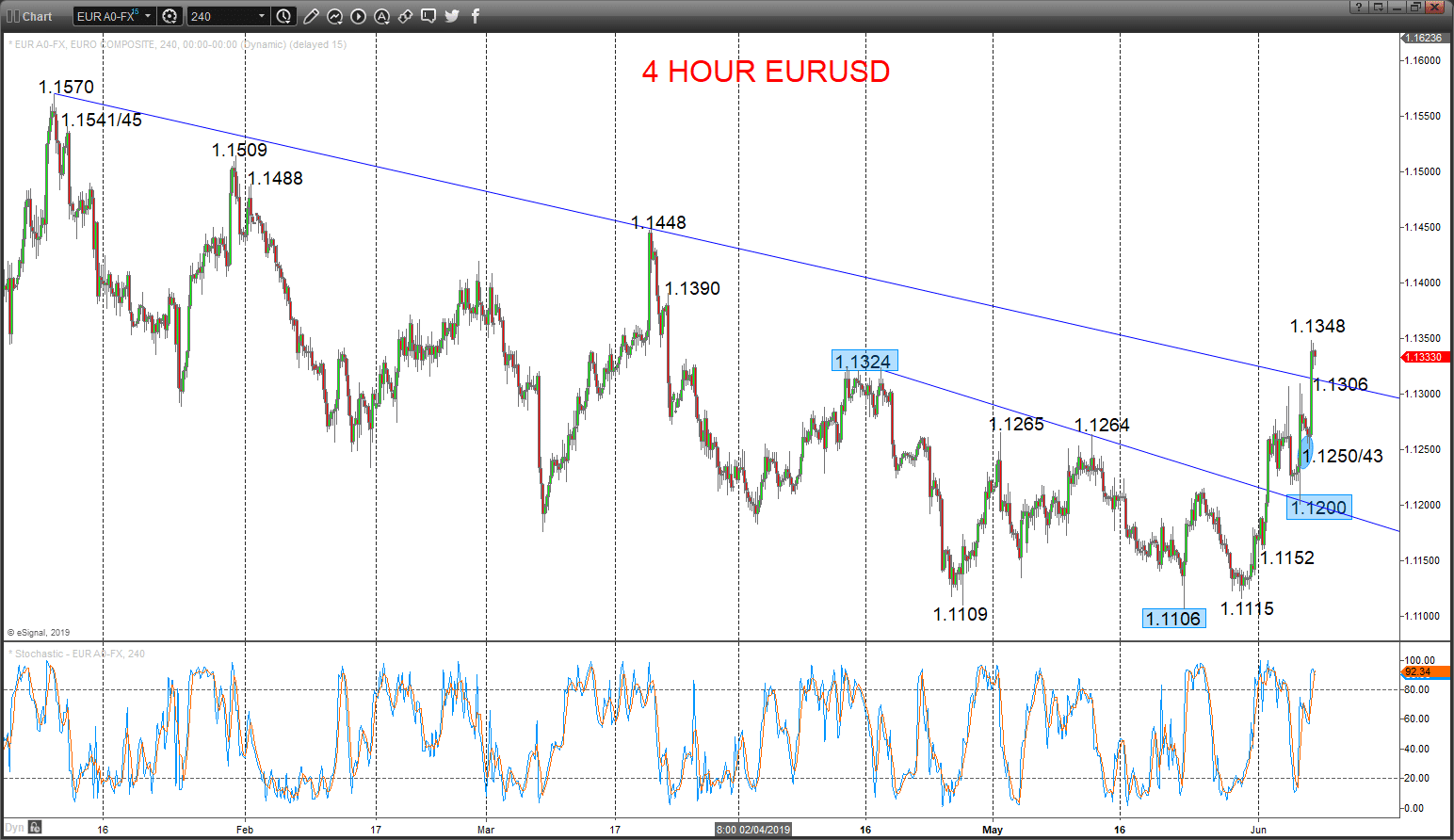

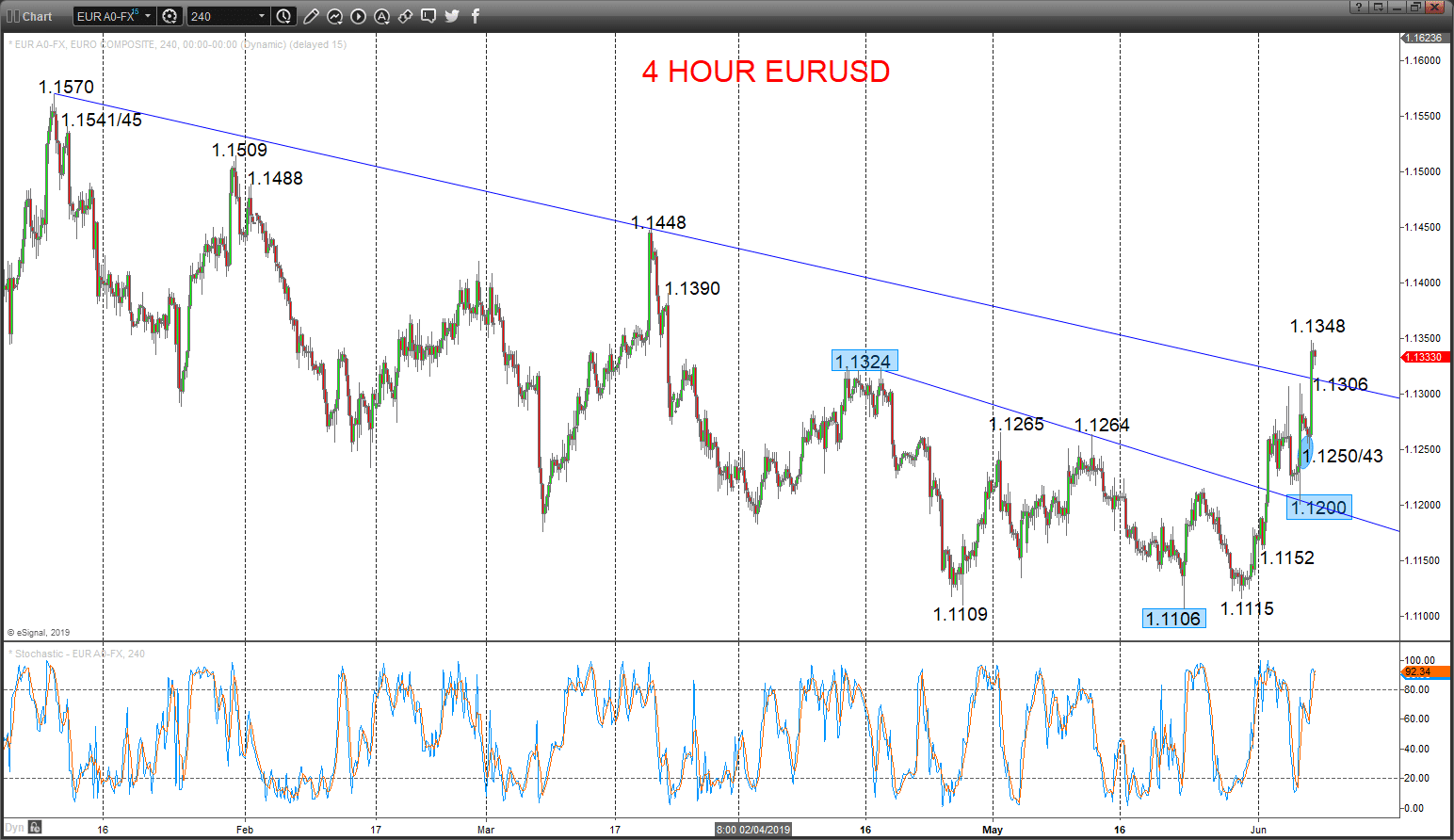

EURUSD intermediate-term bull shift

The early June push above the 1.1264/65 peaks set an intermediate-term, broader range seen as 1.1324 to 1.1106, BUT the Friday surge above 1.1324 now sets an intermediate-term bull trend.

Furthermore, this sets risks higher Monday.

For Today:

- We see an upside bias for 1.1348; break here aims for 1.1390, maybe towards 1.1448.

- But below 1.1306 opens risk down to 1.1250/43.

Intermediate-term Outlook – Upside Risks: We see an upside risk for 1.1448 and 1.1570.

- What Changes This? Below 1.1200 shifts the intermediate-term outlook back to neutral; through 1.1106 is needed for an intermediate-term bear theme.

4 Hour Chart

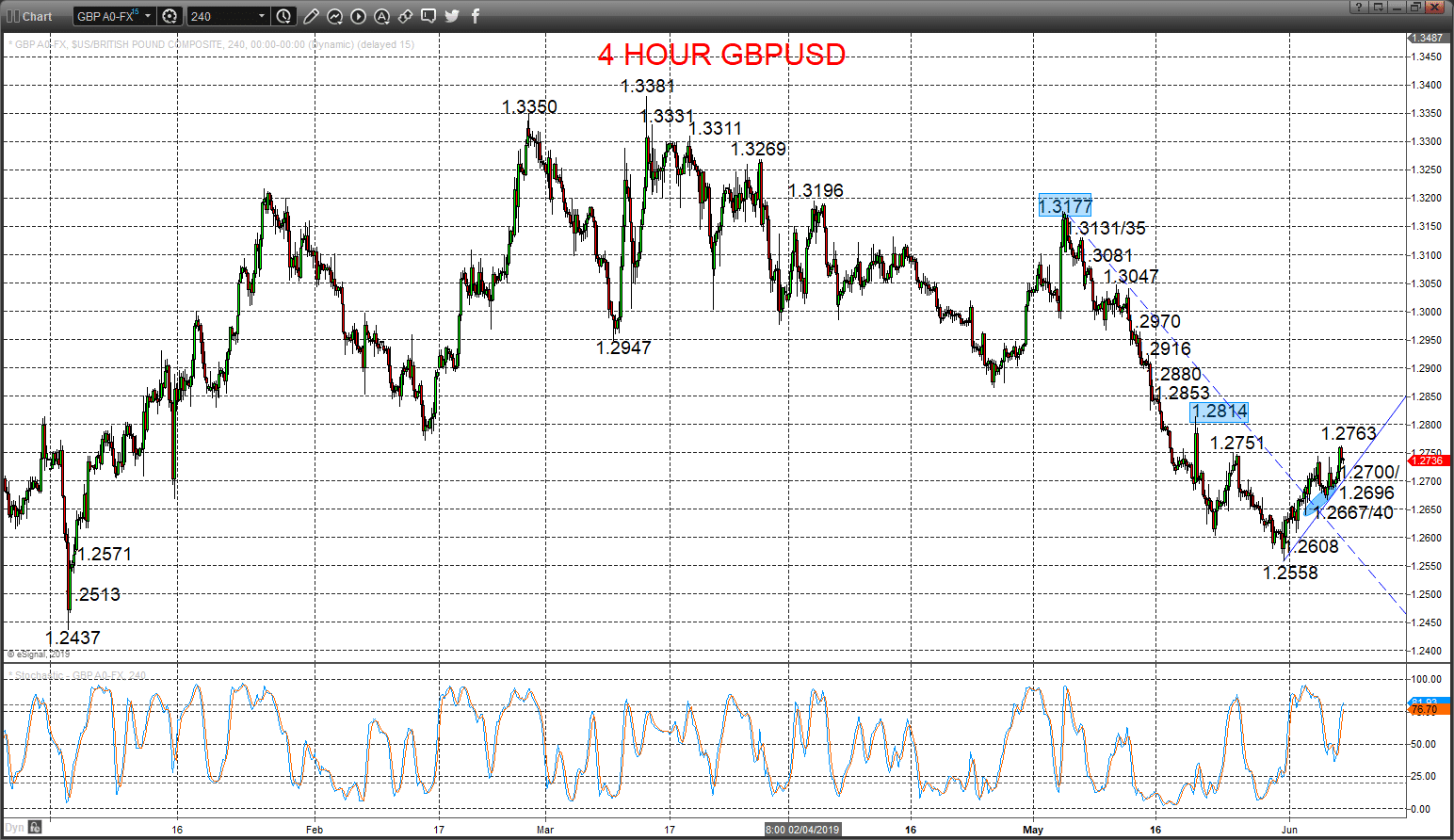

GBPUSD intermediate-term bear trend, but immediate bias is higher

A firm probe higher Friday above the 1.2744/51 resistances to build on Thursday’s dip and solid rebound from support built in the 1.2667/40 area, to reinforce the early June reversal above the down trend line from early May, to keep risks higher for Monday.

The latter April probe below 1.2947 signalled an intermediate-term Double Top pattern and set an intermediate-term bear trend.

For Today:

- We see an upside bias for 1.2763; break here aims for key 1.2814, maybe 1.2853.

- But below 1.2700/2696 opens risk down to 1.2667/40.

Intermediate-term Outlook – Downside Risks: We see a downside risk for 1.2437.

- Lower targets would be 1.2366 and 1.2109

- What Changes This? Above 1.2814 shifts the outlook back to neutral; above 1.3177 is needed for a bull theme.

Resistance and Support:

| 1.2763 | 1.2814** | 1.2853 | 1.2880 | 1.2916 |

| 1.2700/2696 | 1.2667/40 | 1.2608 | 1.2558* | 1.2513 |

4 Hour Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.