EURUSD and USDJPY remains caught within erratic ranges in the very near term, with short term (one week) positive US$ corrections.

However, we continue to see a weaker US currency into latter October and early November, with the bias for EURUSD higher and USDJPY lower.

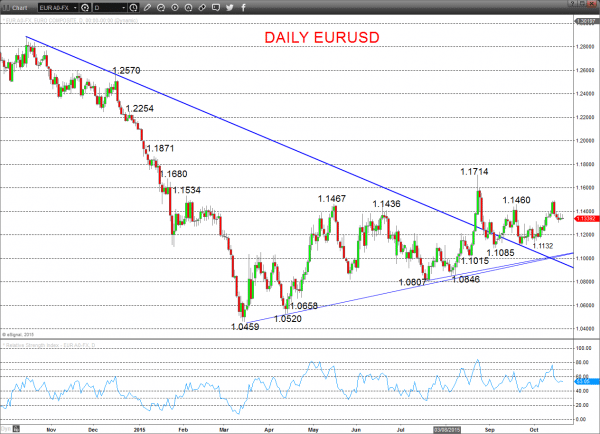

EURUSD

A rebound failure back from our 1.1380/95 resistance area after a Monday probe of support at 1.1313, leaves a negative bias.

However, the mid-October push up above 1.1460, out of the erratic range theme, leaves a bullish October outlook.

Short/ Intermediate-term Outlook – Upside Risks:

- We see a more positive tone with the bullish threat to 1.1714 .

- Above here targets 1.1871 and 1.2000.

Daily EURUSD Chart

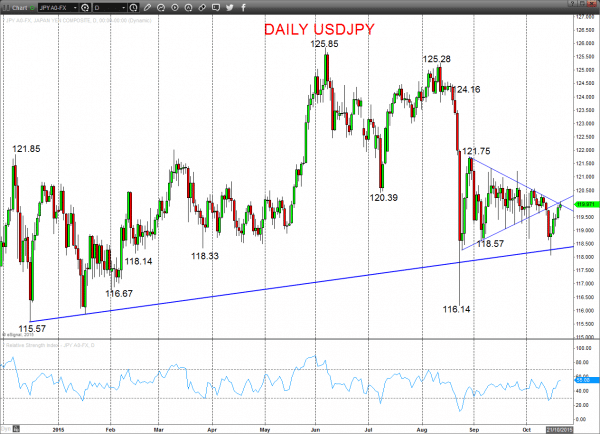

USDJPY

A bounce Tuesday through 119.66 resistance, to shift the Wednesday bias higher to probe above 119.92, but hesitant at 120.34/57 for a neutral into Thursday.

However, the aggressive August sell off through multiple 2015 supports and setback from 121.75/77 resistance, and the bear move through mid-October, leaves an underlying bear tone for October.

Short/ Intermediate-term Outlook – Downside Risks: We see a bearish threat to down to 118.03, 117.83 and maybe the 116.14 spike low.

Daily USDJPY Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.