Cable (GBPUSD) pushed to new cycle lows into the end of 2015, whilst USDCAD remains at the upper end of a strong, multi-year bull trend.

This leaves both the GB Pound and Canadian Dollar vulnerable to further losses versus the US currency into early 2016.

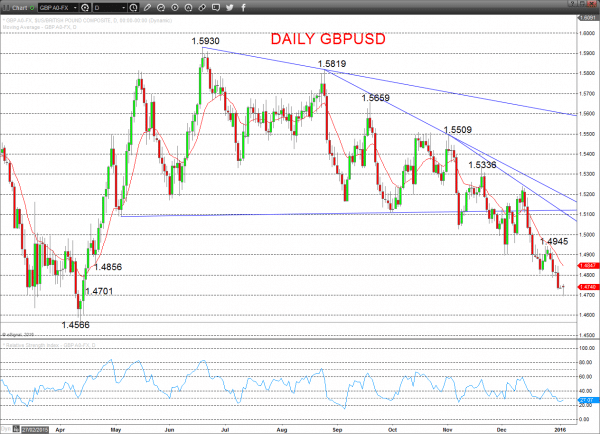

GBPUSD

A push to a new cycle low into year-end leaves a negative bias for Monday.

Moreover, whilst below 1.5336, the previous bear signals from Q4 through 1.5024, 1.4894 and 1.4856, leave a bigger picture negative theme for January.

Into Midweek:

- We see a downside bias for 1.4691; break here aims for 1.4655 and 1.4604, maybe key 1.4566.

- But above 1.4893 opens risk up to 1.4914.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 1.4701 and 1.4566.

- Break aims for 1.4346, 1.4229 and 1.4000.

What Changes This? Above 1.5336 signals a neutral tone, only shifting positive above 1.5509.

Daily GBPUSD Chart

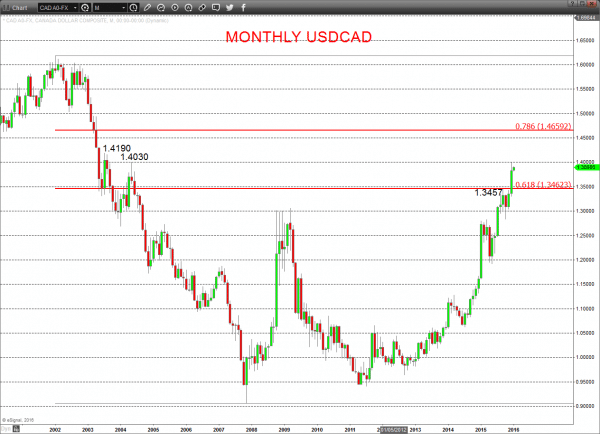

USDCAD

The December surge through the key 1.3457/62 resistance area set a bullish tone into January (and beyond).

Despite the setback and consolidation to end 2015, whilst minimally above 1.3811, we see an upside bias for Monday.

Into Midweek:

- We see an upside bias for 1.3940; break here aims for 1.4002/4030.

- But below 1.3811 opens risk down to 1.3740/38, which we would look to try to hold.

Short/ Intermediate-term Outlook – Upside Risks:

- We see a positive tone with the bullish threat to 1.4000/4030.

- Break targets 1.4190, 1.4500 and 1.4660.

What Changes This? Below 1.3221 signals a neutral tone, only shifting negative below 1.3036.

Monthly USDCAD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.