Despite recovery efforts by both the GB Pound and Euro versus the US Dollar throughout July, the inability to push above any significant resistances leaves the intermediate theme still very bearish for GBPUSD and EURUSD into the second half of July and for the Summer.

The GBPUSD and EURUSD aggressive sell offs after the Thursday 23rd June Referendum in the UK, leaves a bigger picture bearish threat, reinforced by renewed negative price action on Friday (15th July).

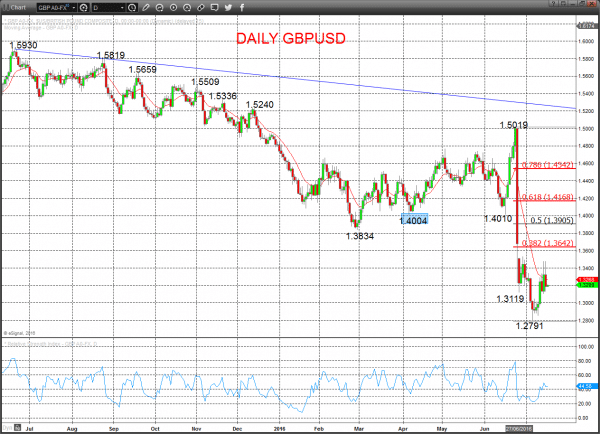

GBPUSD

An extremely negative turnaround on Friday, with early strength and the rally from last week fading and a plunge back lower from 1.3478/81 peaks, through 1.3277 for a mini-Double Top and through the 1.3200 impulse level to shift the tone back to negative into Monday.

Furthermore, the aggressive break lower in early July through the recently set multi-year low at 1.3119, long-term chart support at 1.3045, psychological/ option level at 1.3000 and to probe long-term retrace support at 1.2797 reinforced the Brexit plunge lower on Friday 24th June, to leave the July risks still lower.

For Today:

- We see a downside bias for 1.3103; break here aims for 1.3047, maybe closer to 1.2970.

- But above 1.3255 opens risk up to 1.3304, maybe closer to 1.3384.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 1.2791.

- Below here targets 1.2565, 1.2000 and 1.1880 (risk to 1.1000 and 1.0520?!?!)

What Changes This? Above 1.4635 signals a neutral tone, only shifting positive above 1.5019.

Monthly GBPUSD Chart

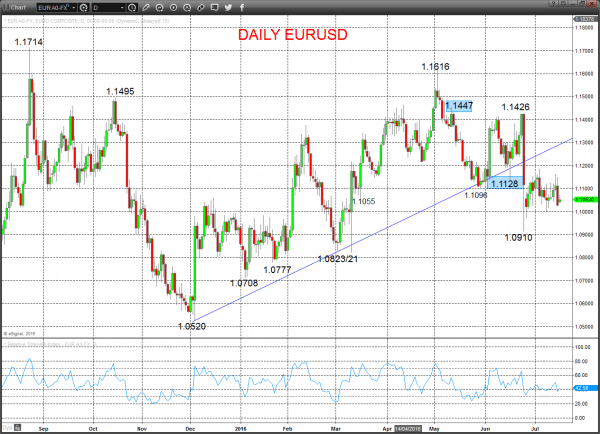

EURUSD

The prod higher Thursday through our 1.1125/30 resistance area was rejected Friday with a setback from ahead of 111.85/89 barriers (from 1.1165), to shift the bias back to the downside Monday.

Furthermore, the aggressive plunge lower on Friday 24th June (after the UK Referendum result) leaves the intermediate-term bias lower.

For Today:

- We see a downside bias for 1.1040; break here aims for 1.1000, maybe 1.0970.

- But above 1.1165 opens risk up to 1.1185/89, then maybe 1.1231.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 1.0823/21.

- Below here targets 1.0777/08 and maybe 1.0520.

Daily EURUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.