- The US Dollar remains bullish, continuing to strengthen against major G10 and Emerging Markets currencies into early may, a trend evident since mid-April, with a continuing perception of rising inflationary pressures, higher US Treasury yields and a more hawkish Federal Reserve.

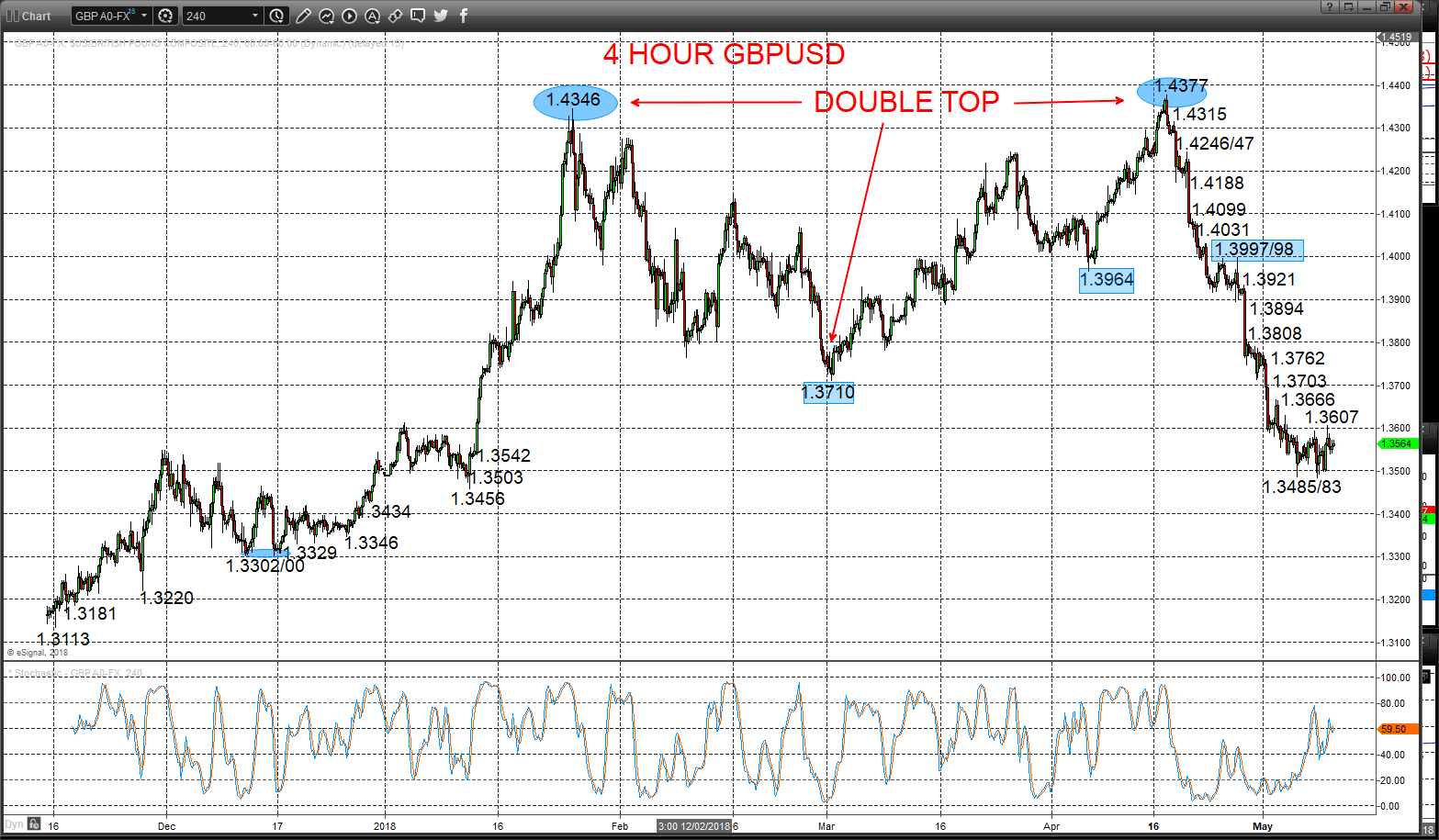

- GBPUSD has sold off not just due to the aforementioned US$ strength, BUT also from decreased prospects of a Bank of England rate hike today, with an intermediate-term Double Top signalled in early May with the plunge through 1.3710.

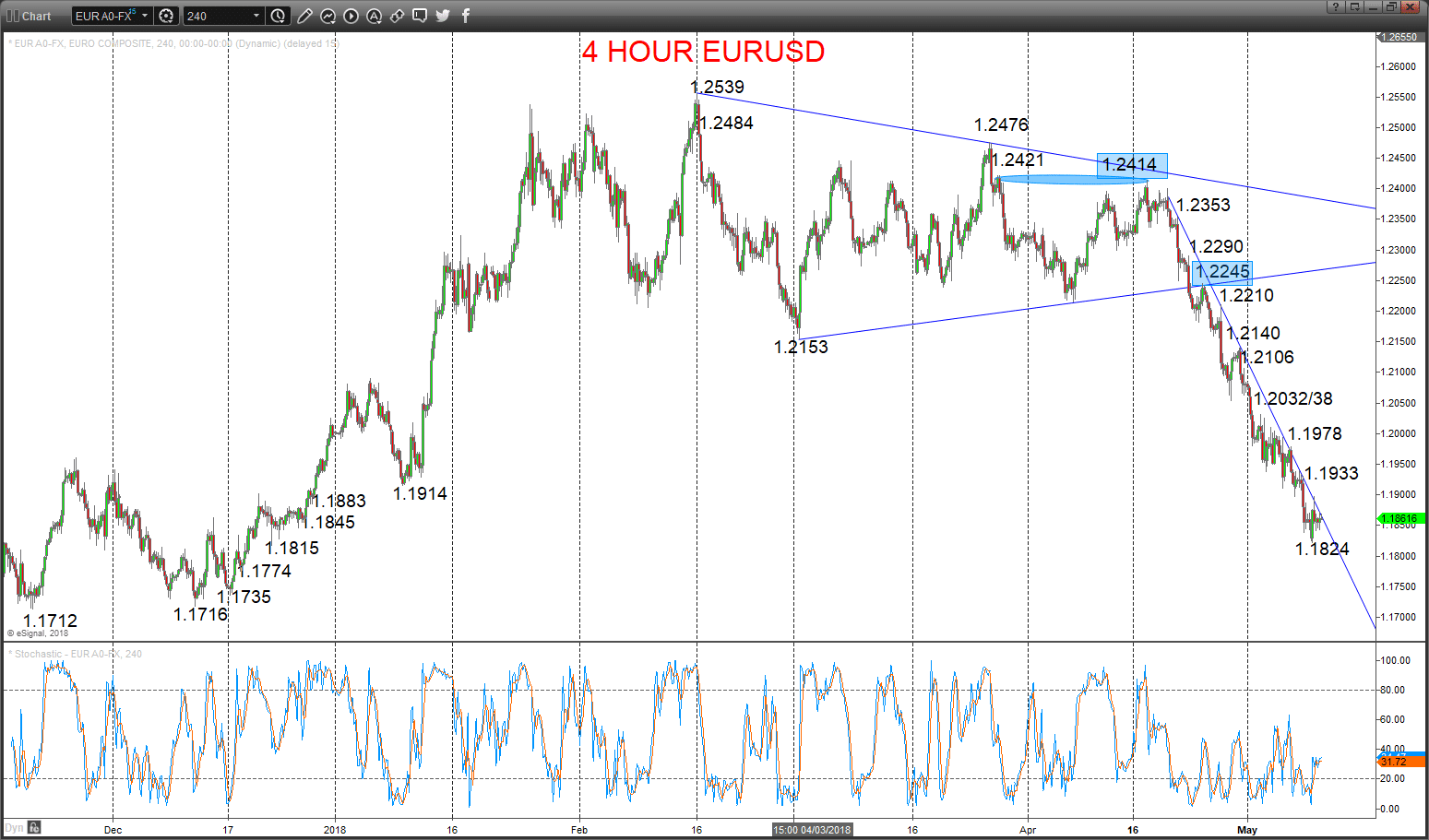

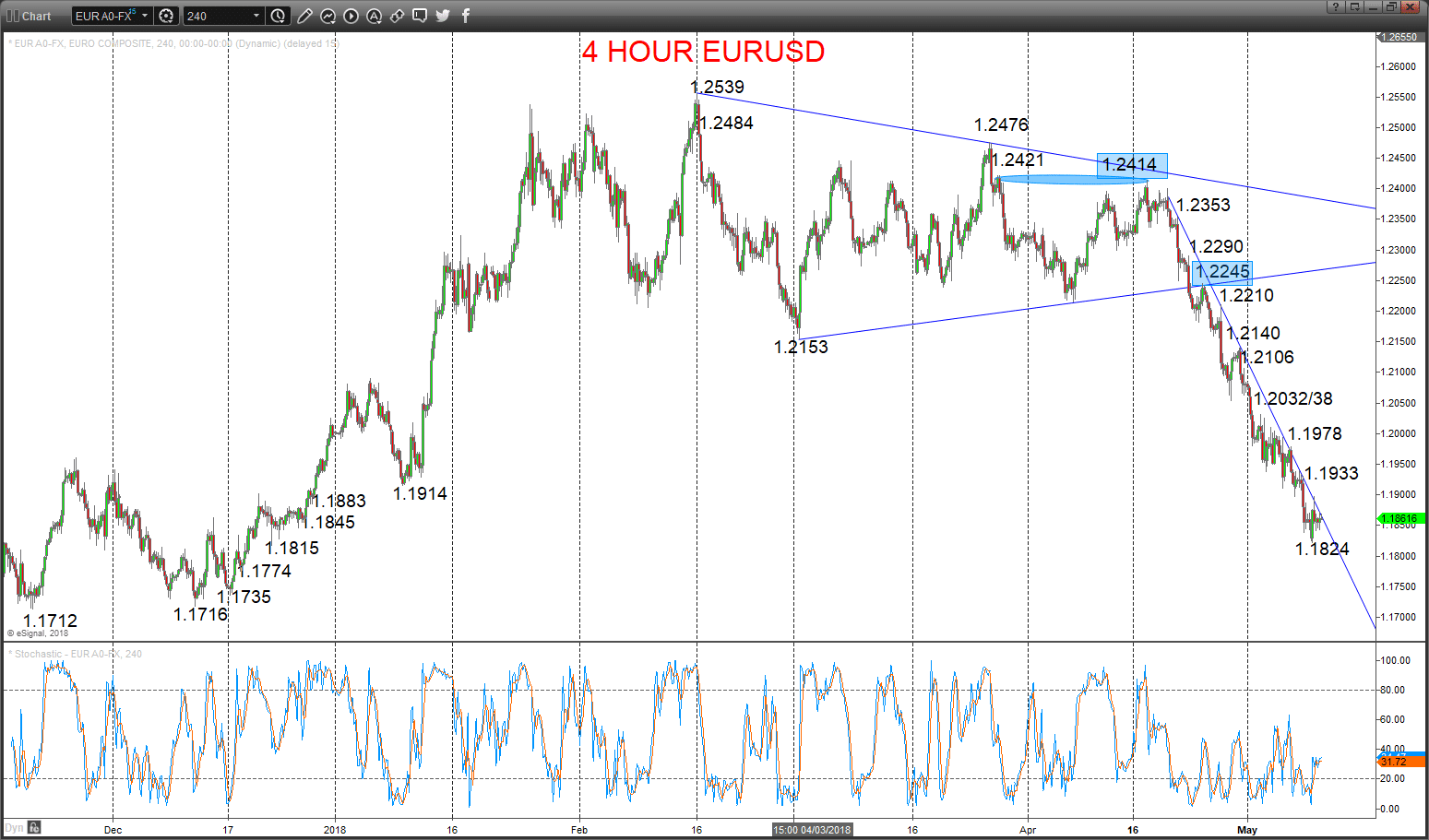

- EURUSD has also suffered losses from the broader US Dollar rally, which has accelerated since the ECB Meeting on Thursday 26th April, which produced a break below 1.2153, that shifted the intermediate-term trend to bearish.

Bearish theme intact into the Bank of England

A Wednesday rebound effort to just prod at initial resistance at 1.3593/99 and then to fail from just above at 1.3607, to sustain the negative tone from the early May plunge through 1.3710 (that completed an intermediate-term Double Top), keeping risks lower Thursday.

The early May plunge through 1.3710 set an intermediate-term bear trend.

For Today:

- We see a downside bias for 1.3485/83, then to key 1.3456 and 1.3434.

- But above 1.3607 targets 1.3666 and maybe aims at 1.3703.

Intermediate-term Outlook – Downside Risks: We see a downside risk for 1.3456.

- Lower targets would be 1.3302/00 and 1.3038

- What Changes This? Above 1.3998 shifts the intermediate-term outlook from bearish back to bullish.

Resistance and Support:

| 1.3607 | 1.3666 | 1.3703 | 1.3762* | 1.3808** |

| 1.3485/83 | 1.3456** | 1.3434 | 1.3346* | 1.3329 |

4 Hour Chart

Bear trend intact

A prod lower Wednesday to another new bear move low and then a lacklustre bounce contained below 1.1933 initial resistance, sustaining the negative tone from Tuesday’s significant selloff through 1.1883 and1.1845 supports (PLUS the push last week below the key swing low at 1.1914), aiming lower again Thursday.

The latter April plunge through 1.2153 set an intermediate-term bear trend.

For Today:

- We see a downside bias for 1.1824, then for 1.1815, maybe 1.1774 and even 1.1735.

- But above 1.1933 targets 1.1978 and maybe opens risk up to 1.2038.

Intermediate-term Outlook – Downside Risks: Whilst below 1.2245 we see a downside risk for 1.1914.

- Lower targets would be 1.1716 and 1.1553.

- What Changes This? Above 1.2245 shifts the outlook back to neutral; above 1.2414 is needed for a bull theme.

Resistance and Support:

| 1.1933* | 1.1978* | 1.2032/38* | 1.2032/38* | 1.2106* |

| 1.1824 | 1.1815* | 1.1774 | 1.1735* | 1.1716** |

4 Hour Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.