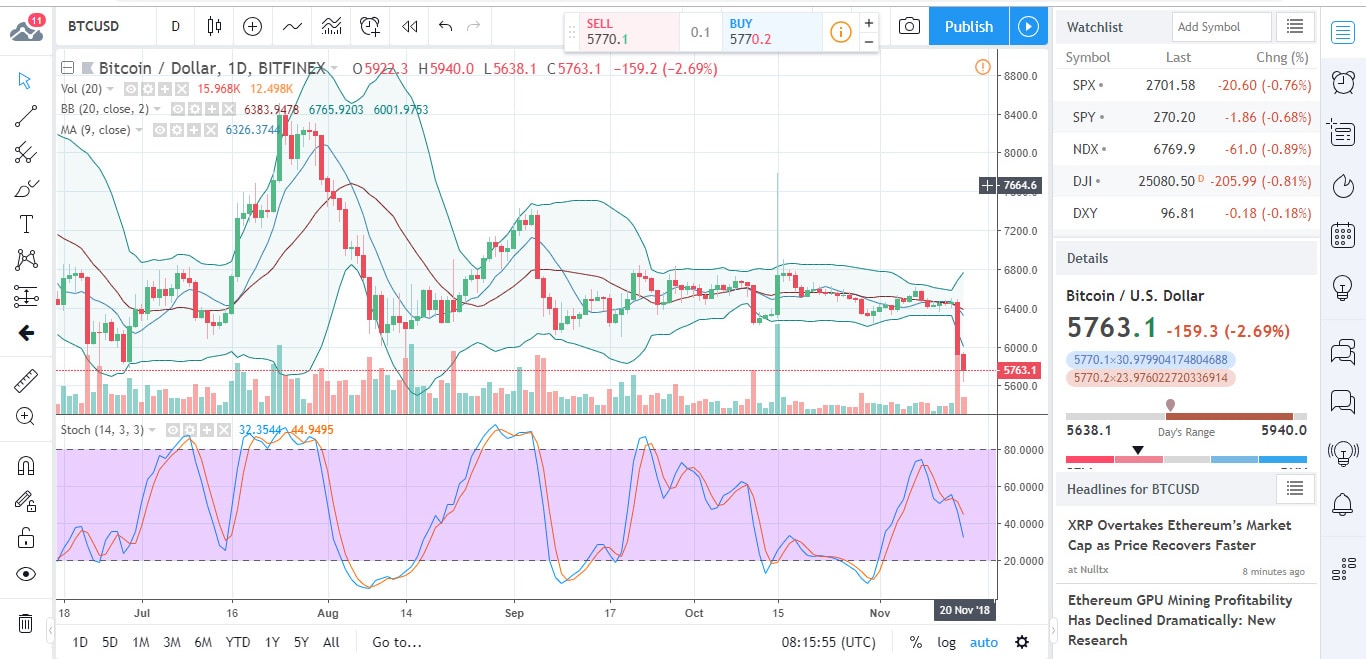

Yesterday, BTC and the crypto markets as a whole, were hit by a massive selloff, one that drove the price of the crypto blue-chip to the lowest point of 2018, while spelling gloom for most other cryptos and digital assets too. What exactly are we witnessing here? Is this the latest turn of the nearly year-long bear market, or is this the dip before the next bull-run?

Yesterday’s dip of more than 12% in the price of BTC was preceded by a “death cross” chart pattern, one that had previously come about back in 2014, bringing similar gloom and doom with it. Indeed, those who figured the bottom had been set at the $6k mark, were quickly proven wrong, as the rout landed the price just below $5.5k at one point.

The move obviously meant that BTC and the crypto markets shed massive value within just a few hours again. The total market capitalization of bitcoin fell below $100 billion, into an area it had last visited in November last year.

The way the total capitalization of the crypto market space was hit was even more spectacular though. From around $210 billion, it now stands at $180 billion. Indeed: the smaller cryptos took an even more massive hit than BTC, once again proving their exceptional vulnerability to such swings.

Yesterday’s selloff was accompanied by a massive increase in trading volumes. In fact, BTC’s trading volume, as defined by the last few months’ worth of action, squarely doubled.

What happens now though? Will the hurting be further compounded in the coming days, or will the price look to recover, drawing in buyers at this exceptionally attractive price-point?

There’s no question about the fact that the $6k level had acted as a very strong support level until yesterday’s meltdown. The bad news is that this support level has now been turned into a – presumably equally strong – resistance. That said, some experts still expect it to be revisited in the coming days.

What about the longer-term prospects though? With the expected launch of Bakkt on the horizon, some expect the weakness in BTC price to carry over to it, and to thus overshadow it to a certain degree. In fact, according to some experts, the market will not bottom out until the end of the first quarter of 2019.

The fundamentals are little messed up to say the least as well. BCH’s upcoming hard fork is now not expected to yield any winners. The infighting will likely hurt both branches of the blockchain and it may act as the catalyst of yet another more general crypto price-drop. Exactly how it will impact the price of bitcoin though is quite unclear at this point.

What we do know is that two of the biggest crypto exchanges, Binance and Coinbase, have announced their support for the hard fork.

Otherwise, most news coming over the crypto grapevine are neutral and not likely to affect BTC price in any shape or form. Most of them are obviously focused on the said BCH hard fork, and that apparently does not mean much for the market as whole.

Everything said and done though, many now feel that the death cross-triggered price drop was the swansong of the bear market and with it, the worst is now indeed behind. It bears pointing out that BTC’s last massive bull run was preceded by a steep drop at the end of a prolonged bear market, one that prompted buyers to start pumping money into the asset.

Are we about to see history repeated?

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.