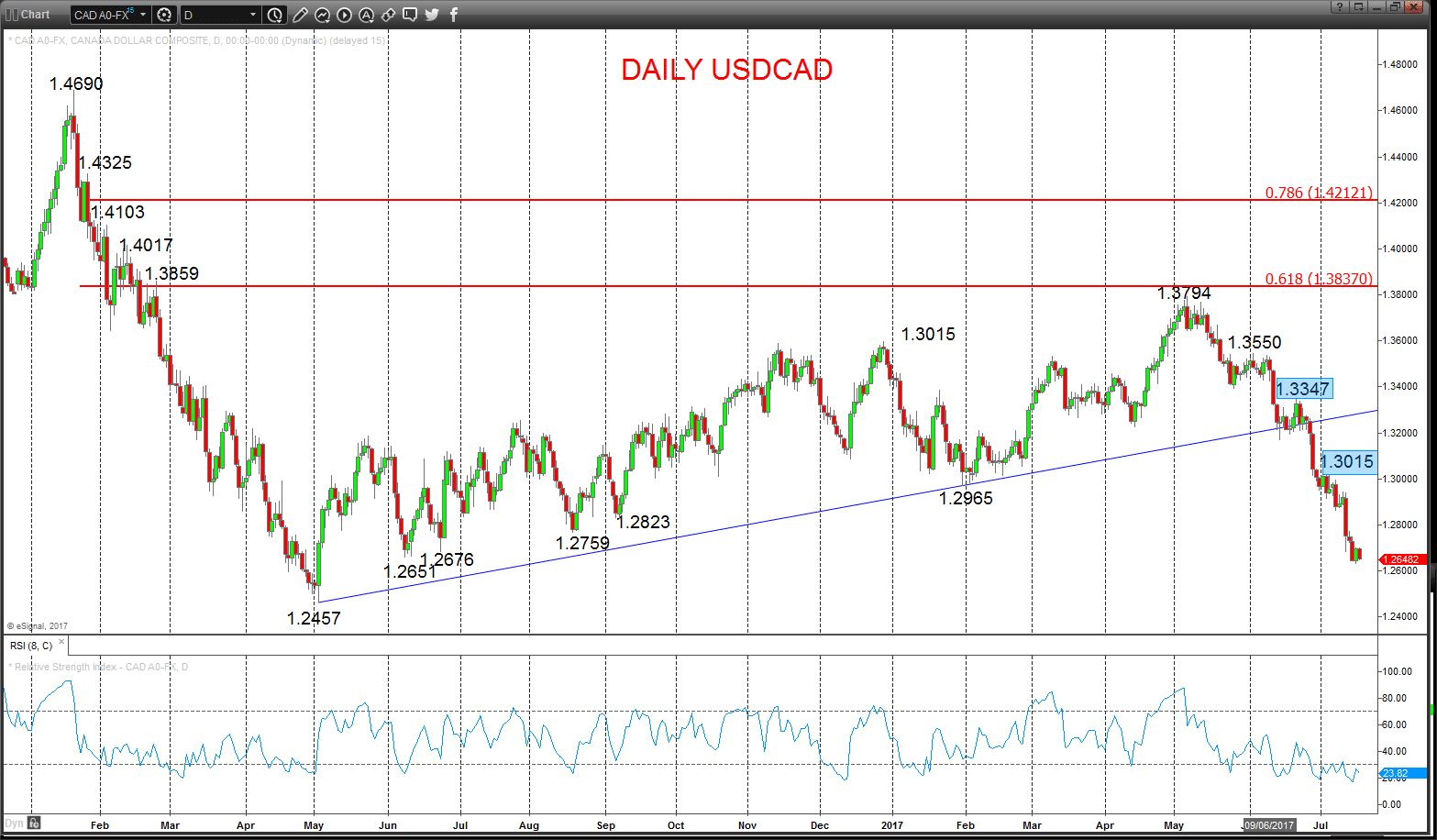

- A July Oil price rebound has reinforced the positive tone for the Canadian Dollar.

- The Bank of Canada rate hike in early July and hawkish comments point to further rate increases, again helping the Canadian Dollar higher (therefore USDCAD lower).

USDCAD – Bearish trend reinforced

Despite a minor bounce effort on Monday, a failure from just above our 1.2695 resistance (from 1.2701) sustains negative pressures from the significant sell-off Friday through key supports at 1.2676 and 1.2651, aiming lower again Tuesday.

Furthermore, this activity reinforces the June push below 1.3219, which signalled an intermediate-term bearish shift.

For Today:

l We see a downside bias down to 1.2610; below targets 1.2555 and 1.2500 psychological/option level.

l But above 1.2701 opens risk up to 1.2771.

Intermediate-term Outlook – Downside Risks:

l We see a negative tone with the bearish threat to 1.2457.

l Below here targets 1.2127, 1.2000 and 1.1919.

What Changes This? Above 1.3015 signals a neutral tone, only shifting positive above 1.3347.

Daily Chart

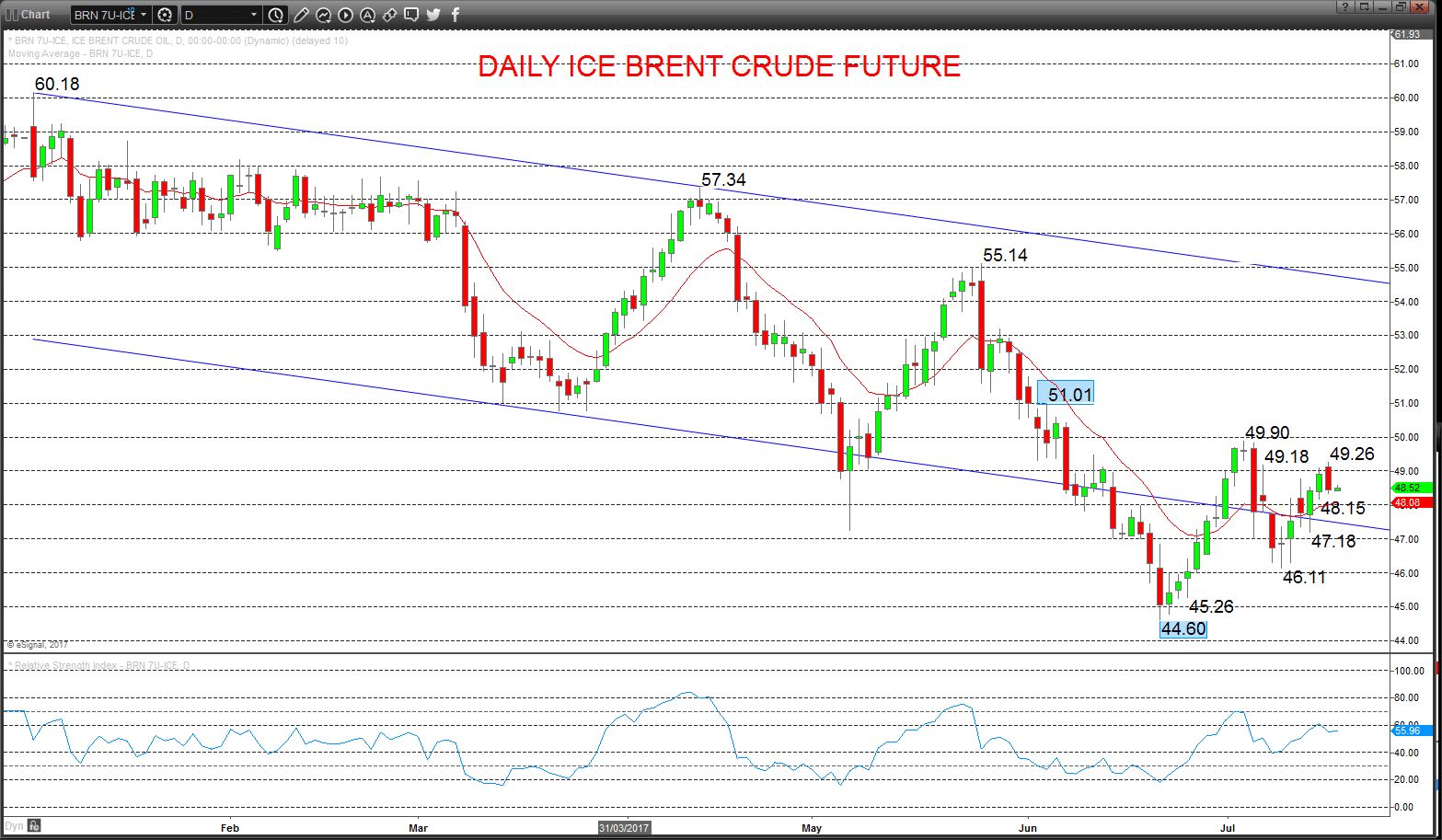

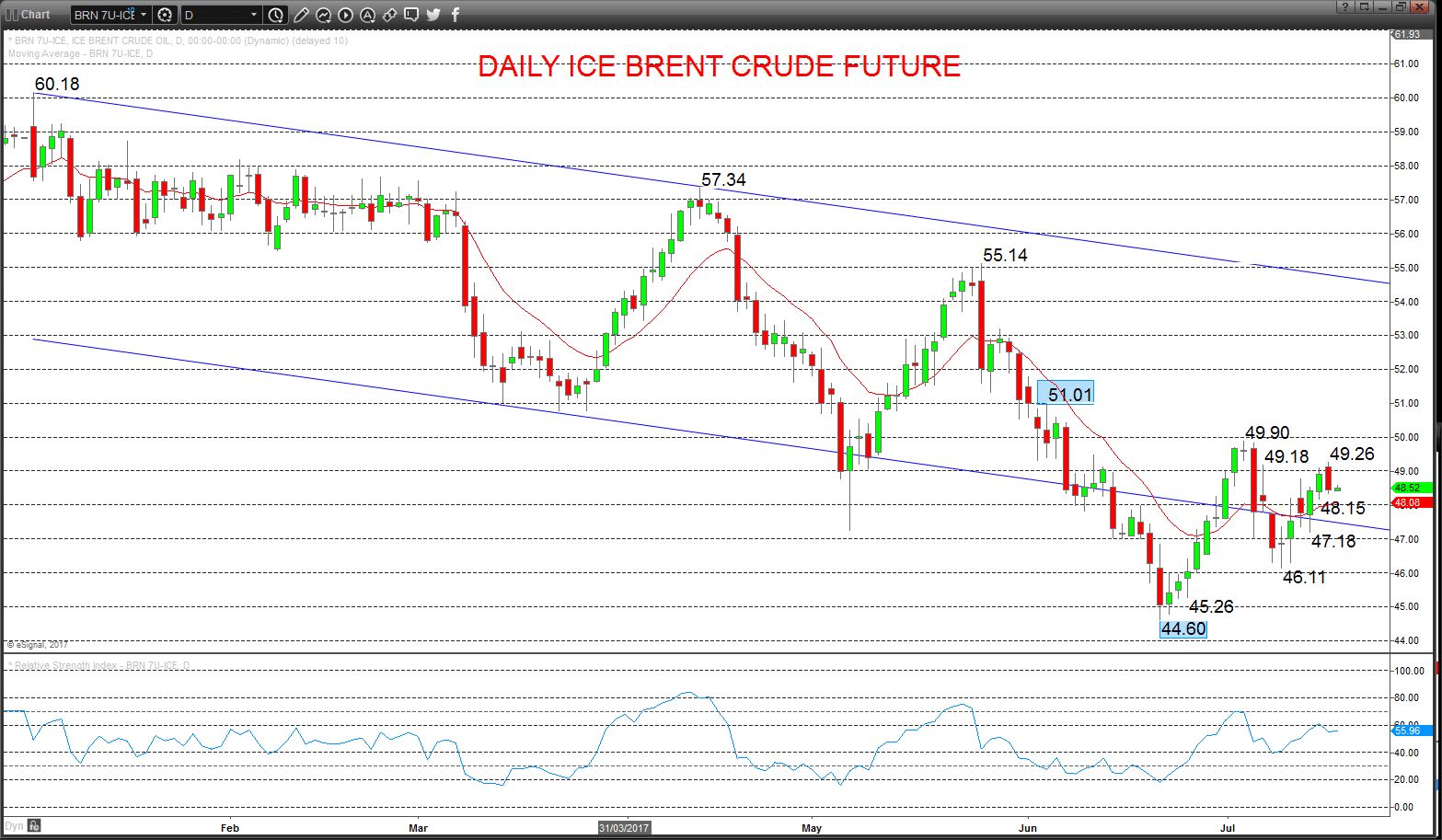

ICE Brent Future – Upside bias

September 2017 Contract

Another push higher Monday above the 49.11/18 resistance area and despite an intraday setback the higher high and higher low for the session maintains upside pressures from the mid-July break above 48.29 and 48.45 resistances, keeping the threat higher Tuesday.

The early July push above 49.49 shifted the intermediate-term outlook from bearish to neutral.

For Today:

l We see an upside bias through 49.26; break here aims for 49.90/50.00.

l But below 48.15 opens risk down to 47.55, maybe towards 47.18.

Intermediate-term Range Parameters: We see the range defined by 44.60 and 51.01.

Range Breakout Challenge

l Upside: Above 51.01 aims higher for 55.14.

l Downside: Below 44.60 sees risk lower for 43.57, 41.51 and 40.00.

Daily Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.