Both the New Zealand Dollar and the Australian Dollar has reinforced their bullish themes over the past week, with NZDUSD moving to a new cycle high, whilst AUDUSD has probed above the .7648 level, to switch from a broader range theme, to a more bullish outlook into July.

This price action has generally reflected a growing “Risk On” outlook across asset classes in July, reinforce last Friday (8thJuly), by the extremely strong US Employment report for June (with the Non-Farm Payroll data at 287K!).

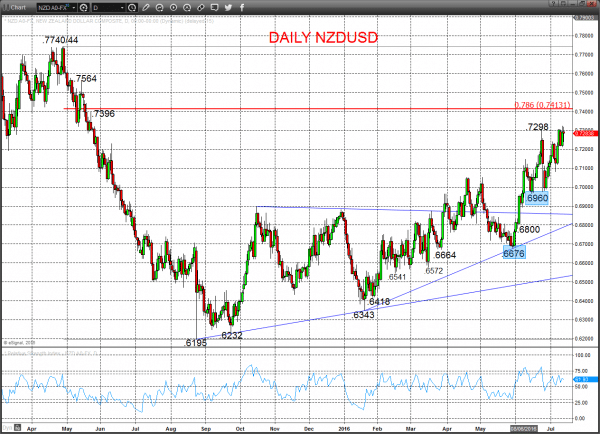

NZDUSD

A firm consolidation Wednesday with a solid dip and rebound to reinforce the Tuesday rebound from a prod just below .7213 support (off of .7212) and the bull tone from Friday (to a new cycle high), to keep a bull bias Thursday .

For Thursday/ Friday:

- We see an upside bias for .7316; break here aims for .7355, then next key level at .7396.

- But below .7234 opens risk down to .7213/12, maybe .7165.

Short/ Intermediate-term Outlook – Upside Risks: A previous shift to an intermediate-term bullish tone above .7054.

- We see a positive tone with the bullish threat to 7298.

- Above here targets .7396/7413 and .7564.

What Changes This? Below .6960 signals a neutral tone, only shifting negative below .6676.7396/7413

Daily NZDUSD Chart

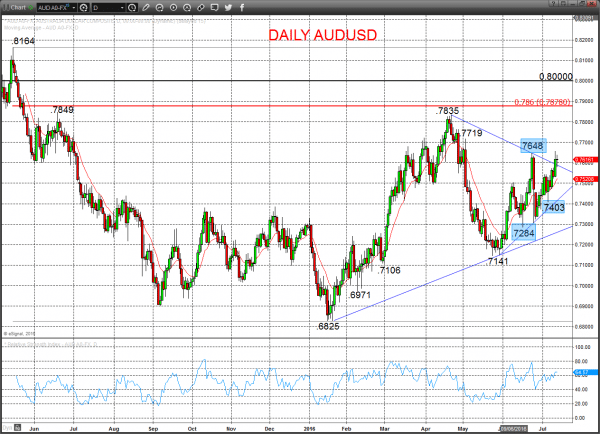

AUDUSD

An intermediate-term bullish shift was signalled Wednesday with the prod above .7648.

Despite the setback from just above .7648 (from .7658), the .7573 level held exactly, and the rebound leaves a bull tone for Thursday.

For Thursday/ Friday:

- We see an upside bias for .7658; break here aims for .7700 and next key level at .7719.

- But below .7573 opens risk down to .7518/10.

Short/ Intermediate-term Outlook – Upside Risks:

- We see a positive tone with the bullish threat to .7719.

- Above here targets .7835/49/78 and .8000.

What Changes This? Below .7403 signals a neutral tone, only shifting negative below .7284.

Daily AUDUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.