On Thursday 23rd April (at 2.45 a.m. UK time) the market sees the release of the HSBC Flash China Manufacturing PMI. Of the Major currencies, this will likely have a notable impact on both the New Zealand and Australian Dollars (being significant trading partners with the Chinese). With the NZDUSD in a bullish phase, but threatening a correction, we look at the key levels to watch.

NZDUSD Downside Correction Risk, but Bullish Trend

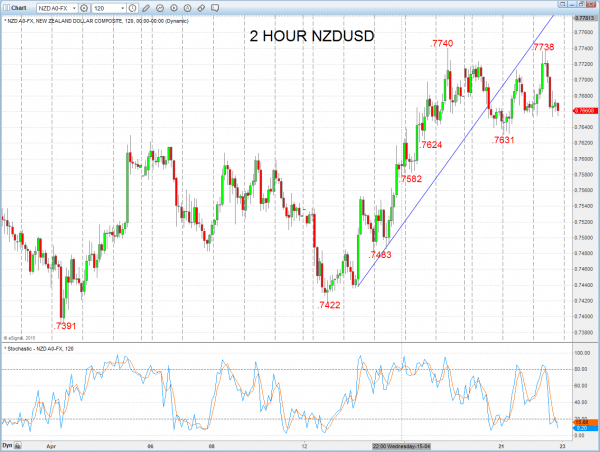

Another erratic consolidation, but the rally and setback again point to a downside correction bias into Thursday after a bearish engulfing pattern Monday and rebound failure Tuesday.

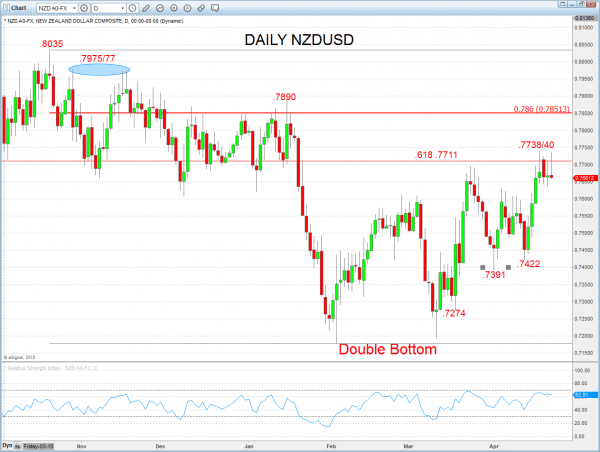

However, the strong rebound last week through the critical recovery high from March at .7697 confirmed the previous Double Bottom for a stronger recovery phase into late April.

For Today:

- We see a downside bias for .7631 and .7624; break here aims for .7582.

- But above .7687 opens risk up to .7724 and .7740, which we would look to try to cap.

Short/ Intermediate-term Outlook – Upside Risks:

- Bigger picture, we see a more positive tone with the bullish threat to .7851.

- Above here targets .7890 and maybe .7975/77.

What Changes This? Below .7483 eases bull risks; through .7422 signals a neutral tone, only shifting negative below .7391.

Momentum: The 8-day RSI, short-term momentum is rising and has scope to go still higher this week.

2 Hour NZDUSD Chart

Daily NZDUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.