- AUDUSD and NZDUSD currency pairs have posted firm recovery rallies on the second half of June.

- This has reflected two fundamental factors:

- A risk on theme driven by trade negotiation hopes, with global equity markets higher, encouraging a rebound in the Australian and New Zealand Dollars.

- A weaker US Dollar, driven by a more dovish tone from the Federal Reserve at their June 19th meeting, with market chatter for a July rate cut, with talk even for a 0.5% move lower.

- The AUDUSD Forex rate recovery is threatening to shift the intermediate-term outlook to neutral above .6973 (even bullish above .7022).

- The NZDUSD FX rate has already shift the intermediate-term outlook from bearish to neutral, now threatening a bullish move, which would need a push through .6681.

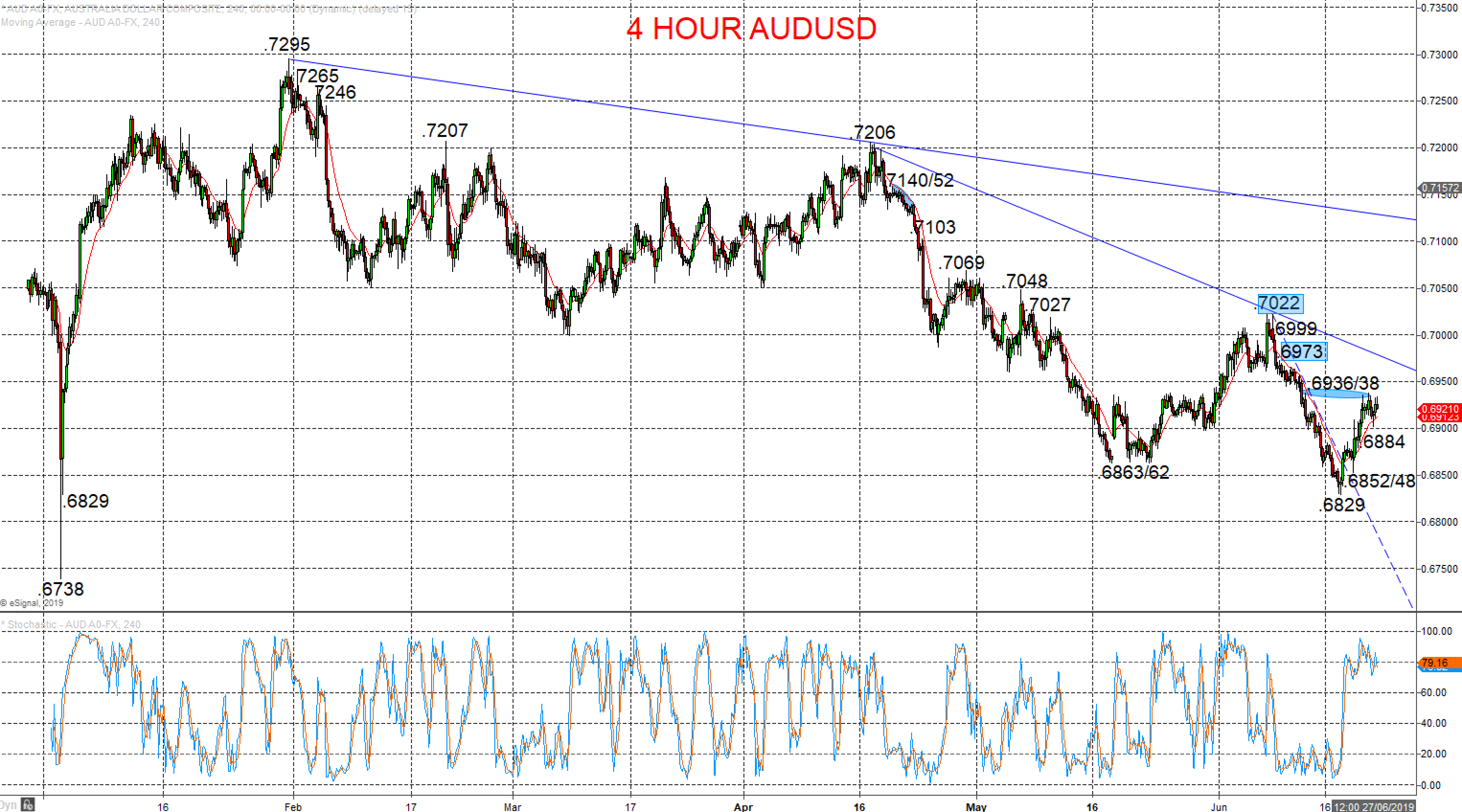

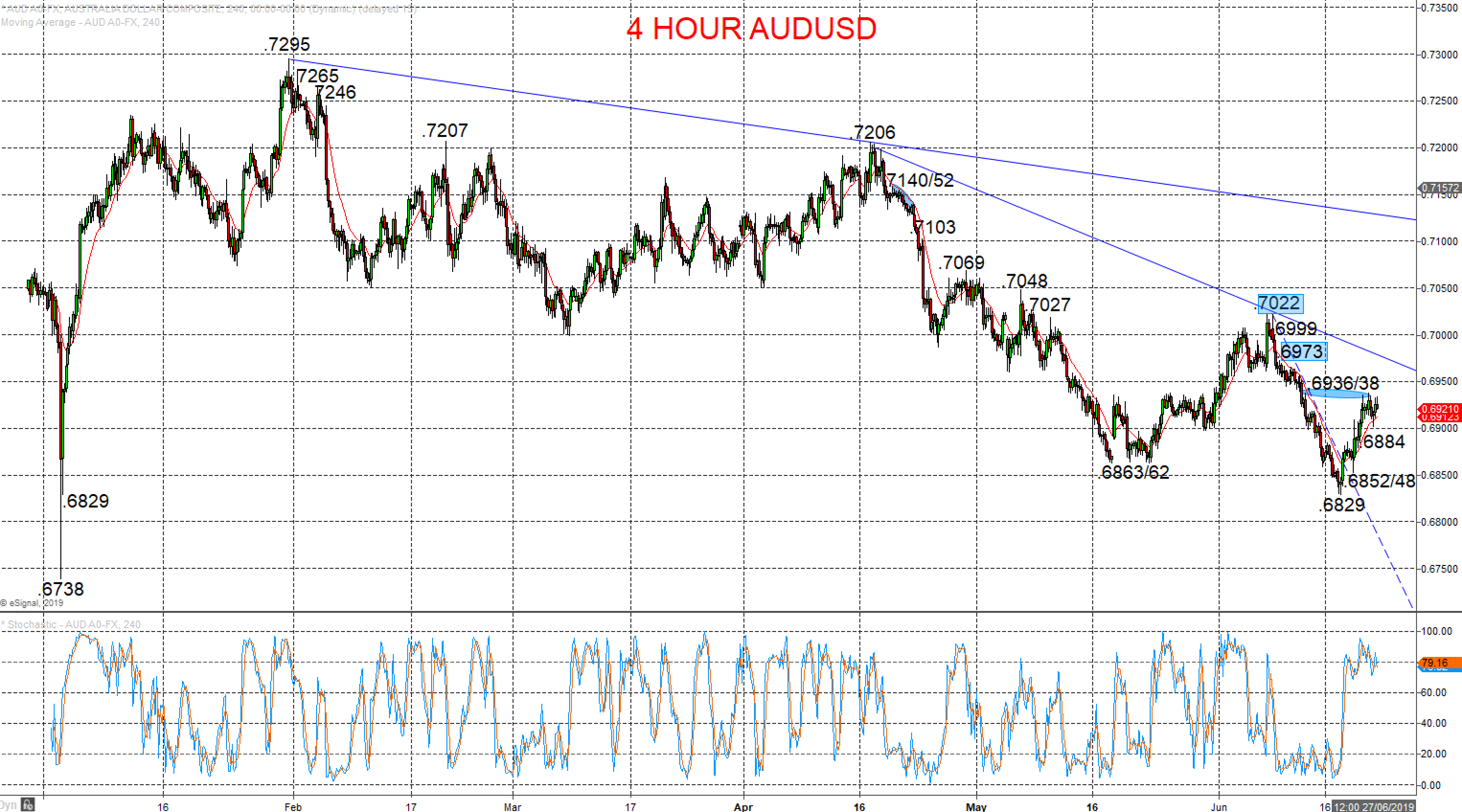

AUDUSD

Upside risks intact

A resilient, sideways con Friday of the Wednesday-Thursday firm advance since the Fed up through 6909 resistance, to stall exactly at our 6938 barrier, retaing upside pressures from last week’s earlier rebound exactly from our .6829 level (support from the very early 2019 flash crash), keeping the threat higher Monday.

The mid-June plunge through .6863/62 lows resumed an intermediate-term bear trend, BUT now with growing risk for an intermediate-term shift back to neutral above .6973 (even to bullish above .7022).

For Today:

- We see an upside bias for .6938; break here aims towards key .6973.

- But below .6884 opens risk down to .6852/48.

Intermediate-term Outlook – Downside Risks: We see a downside risk for .6829 and .6738.

- What Changes This? Above .6973 shifts the intermediate-term outlook back to neutral; above .7022 is needed for an intermediate-term bull theme.

Resistance and Support:

| .6938 | .6973* | .6999 | .7022*** | .7048** |

| .6884 | .6852/48* | .6829** | .6800 | .6771 |

4 Hour Chart

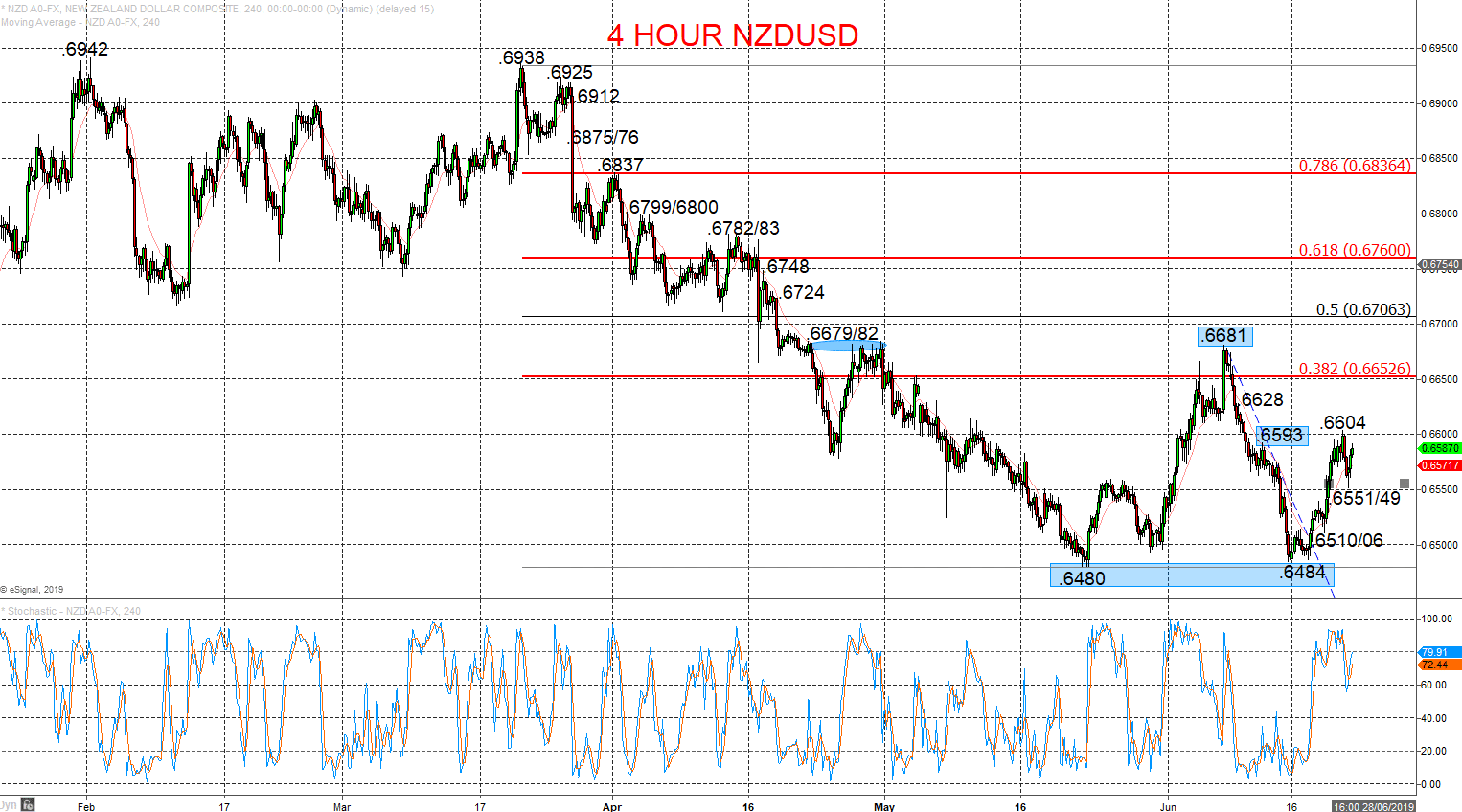

NZDUSD

Risks stay higher after intermediate-term shift to neutral

A dip and a rebound Friday from just above the .6551 support (from .6551) to reinforce Thursday’s surge through the key .6593 level (to neutralise intermediate-term bear forces), to keep the threat higher Monday.

The latter June surge through .6593 set an intermediate-term range, we see as .6681 to .6484/80, BUT with skewed risks for an intermediate-term bullish shift above .7022.

For Today:

- We see an upside bias for .6604; break here aims for .6628, maybe even towards key .6681.

- But below .6551/49 opens risk down to .6510/06.

Intermediate-term Range Breakout Parameters: Range seen as .6681 to .6484/80.

- Upside Risks: Above .6681 sets an intermediate-term bull trend to aim for .6782/83, .6836/37 and .6938/42.

- Downside Risks: Below .6484/80 sees an intermediate-term bear trend to target .6424, 6347 and .6196.

Resistance and Support:

| .6604 | .6628 | .6681*** | .6706* | .6724 |

| .6551/49 | .6510/06* | .6484/80*** | .6455 | .6424* |

4 Hour Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.