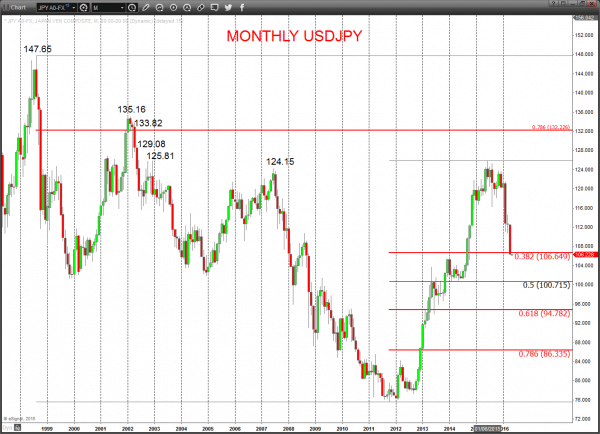

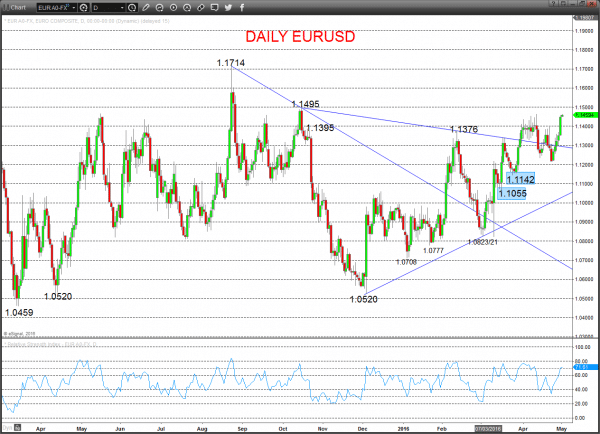

The US Dollar has experienced significant losses in the G3 complex in late April (against EUR and JPY), to leave far more bearish USDJPY and bullish EURUSD set ups into May.

Another aggressive plunge lower Friday after the even more extreme breakdown Thursday shifted the intermediate-term outlook back to to bearish.

Moreover, the lacklustre rebound efforts and the push below a critical long term retracement level at 106.65 leaves the bias again lower for Monday.

For Today:

- We see a downside bias for another long term retracement level at 106.12; break here aims for a key long term swing low from 2014 at 105.20 and maybe 105.00, psychological/ option target.

- But above 107.41 opens risk up to 108.34 and 108.73, which we would look to try to cap.

Short/ Intermediate-term Outlook – Downside Risks: The plunge below 109.22 support has shifted the intermediate-term outlook back to to bearish.

- We see a negative tone with the bearish threat to 106.12.

- Below here aims for long term targets at 105.20, 102.20, 100.75/71 and maybe even 100.00.

What Changes This? Above 111.89 signals a neutral tone, only shifting positive above 113.80.

Monthly USDJPY Chart

An extremely robust upside follow-through Friday to yet another new rebound high, through 1.1398/1.1401 resistances to maintain a bull tone for Monday.

Bigger picture risks of a shift from a bullish intermediate outlook back to a broader range theme (signalled below 1.1142), have been rejected.

For Today:

- We see an upside bias for 1.1465; break here aims for key 1.1495 and 1.1555.

- But below 1.1375/70 aims for 1.1346 and opens risk down to 1.1294.

Short/ Intermediate-term Outlook – Upside Risks: A strong rally through the 10/03 ECB Meeting through 1.1157 shifted the intermediate term outlook to bullish.

- We see a positive tone with the bullish threat to 1.1495.

- Above here targets 1.1714 and 1.1871.

What Changes This? Below 1.1142 signals a neutral tone, only shifting negative below 1.1055.

Daily EURUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.