A strong tone Wednesday for the Japanese yen, with a USDJPY break lower, through notable support. This has signalled a short-term top and negative tone in the very near term, although the year-end bias remains bullish.

The Australian Dollar, however, has rejected a more bullish base and breakout (for now) with a roll back lower to the Q4 range. Although this points to a near term consolidation, we still see a skewed risk for year-end for a bullish shift above .7385.

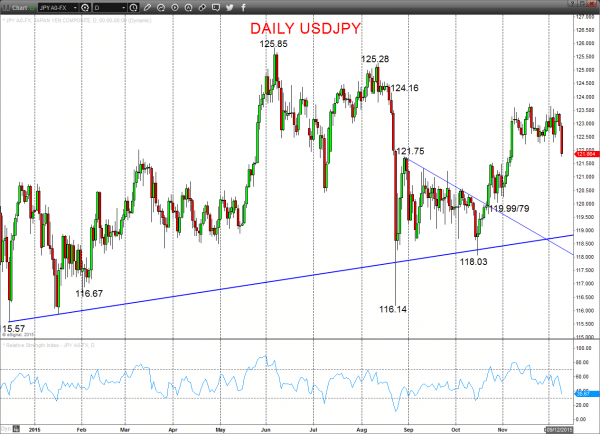

USDJPY

A setback from ahead of 123.67/75 resistance this week, but a Wednesday plunge through our key 122.30/22/18 support, to shift the tone bearish for Thursday.

However, the November surging rally above the 121.75/77 area set a strong base and bullish tone into December.

For Today:

- We see a downside bias for 121.35; break here aims for 120.92/88, maybe 120.22/21.

- But above 122.26 opens risk up to 122.83.

Short/ Intermediate-term Outlook – Upside Risks:

- We see a positive tone with the bullish threat to 124.16.

- Above here targets 125.28 and 125.85.

What Changes This? Below 199.99 signals a neutral tone, only shifting negative below 118.03.

Daily USDJPY Chart

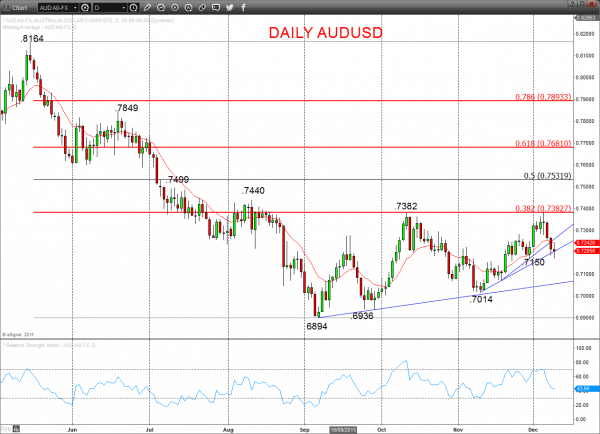

AUDUSD

Another prod lower Wednesday below .7182 to approach .7168, after the setback from the key .7382/83 area, to leaves a bear tone again for Thursday.

Despite the somewhat hesitant prod above the .7382/83 barriers (to .7285 only), we do expect a bullish shift from a broader range theme for December, but need a confirmation above the new .7385 high.

For Today:

- We see a downside bias for .7169/68; break here aims for .7157/50, maybe .7105.

- But above .7270/72 opens risk up to .7342.

Short/ Intermediate-term Range Parameters: We see the broader range defined by .6936 and .7385.

Range Breakout Challenge

- Upside: Above .7385 aims higher for .7440/99 and .7681.

- Downside: Below .6936 sees risk lower for 6894, .6857 and .6645.

Daily AUDUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.