Over the last handful of days, the world’s #1 cryptocurrency failed to muster any traction in either direction. Amid a general bear exhaustion, the bulls tried to get something going. The bears then failed to capitalize on their failure and so it went, back and forth. Which way will BTC break out in the near future, and how far is it likely to go bulls- or bears-wise?

The bottom line of all this back and forth is that BTC is still stuck in bearish territory, though the bears are currently too weak to run away with it.

For the bulls to assume any semblance of control, the price would have to rise past the $7,780 mark, according to the technical charts, and it would have to do so in a convincing manner, punctuated by high trading volumes.

Currently trading around the $7,530 mark, the crypto flagship is still nursing a bloody nose dealt by yesterday’s failed breakout attempt. Accompanied by a rising wedge breakdown, the said failure set the stage for a drop all the way to the $7,040 mark, which eventually failed to materialize as well.

Around $7,350, the bears let go, and the bulls have since failed to show up in a meaningful way.

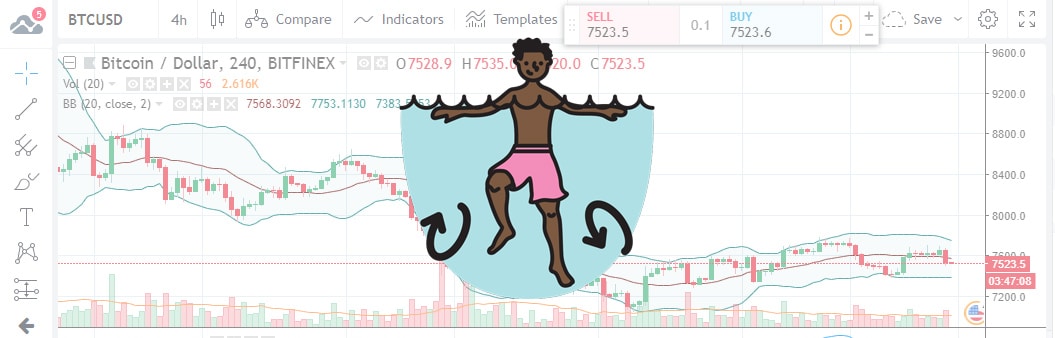

The trouble is that no one seems to know the causes of this bull exhaustion, and thus no one really knows what to make of the current situation. All sorts of speculations are floated, but the fact is that BTC is just in water-treading mode right now, and its next breakout may indeed happen either way.

Technical indicators on the whole do not really “know” what to make of the current situation either. Our preferred momentum indicator, the stochastic oscillator seems stuck in neutral territory as well, after it apparently aimed for the Overbought zone, only to stop short of it, not throwing the bears even the slightest bone.

While overall, technical indicators seem to wave a rather paltry “Sell” flag, the situation is in fact much more ambiguous.

The MAs (some 13 of them) point to Strong Sell, while the Oscillators say “Buy”, though granted only 2 of them really do, as 9 are stuck in neutral.

So what are the likely scenarios that would break the deadlock?

If a high volume break above the $7.78k mark does materialize, it will signal a bullish trend-reversal, which may take the price of BTC past the $8.3k mark, a resistance level defined by the 10-week MA.

If – on the other hand – the price drops below the $7.37k mark, the path will be cleared all the way down to $7,040.

What happens if everything remains range-bound the way it currently is? It’s anyone’s guess really.

What do the news say?

When this degree of indecision reigns, the fundamentals gain additional power to tip the balance one way or the other.

Among the flurry of more or less significant news-bits, a couple stand out.

One of them is about Venezuelans buying up an increasing amount of BTCs, in what can only be described as the second crypto-boom the country has seen in recent years.

Given the hyperinflation that has long plagued the Bolivar, it is indeed hardly surprising that more and more Venezuelans are turning to BTC as a store of value.

Over the last week alone, some 4.9 trillion Bolivars were swallowed up by the BTC markets, an amount obviously not significant enough to elicit an upward move in the price of the crypto-king.

In other news: SolidX Partners Inc. and Van Eck Associates Corp. have filed an “improved” request for a BTC ETF with the SEC, having gleaned some apparently significant lessons from the failure of a similar past filing of theirs.

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.