The Antipodeans (AUD and NZD) Remain Bullish Versus the US$

Both the AUDUSD and NZDUSD spot rates have maintained their upward paths, that have been evident both throughout 2018 and also re-energized into early September.

This has seen AUDUSD reject the down move that was seen in the second half of August with a recovery effort from ahead of a key support at .7484. The September bias is now for a extension of the 2016 bullish trend (above .7760).

NZDUSD is already hitting new cycle highs for the year and overcoming 2015 resistance levels (more recently .7396 and .7414). This leaves the risk significantly higher for late Q3.

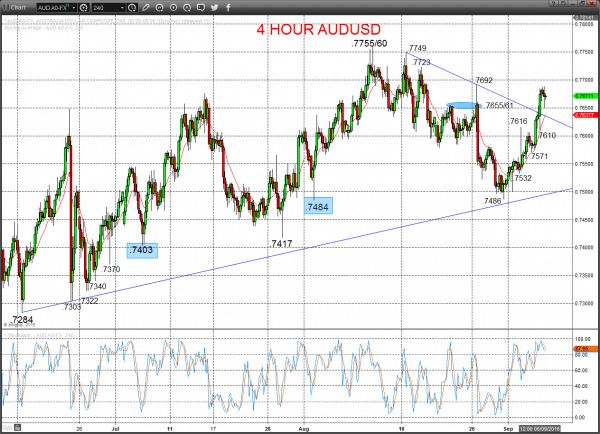

AUDUSD

A surge higher Tuesday through the .7616 and .7655/61 resistances and also the tentative down trend line from mid-August, still building on the late August defence of .7484 (from .7486), to once again set a positive bias Wednesday.

For Wednesday:

- We see an upside bias for .7692; break here aims for .7723.

- But below .7610 opens risk down to .7571.

Short/ Intermediate-term Outlook – Upside Risks: The mid-July new recovery high above .7648 signalled an intermediate-term bullish shift.

- We see a positive tone with the bullish threat to .7760 and .7835/50/78.

- Above here targets .8000 and .8164/66.

What Changes This? Below .7484 signals a neutral tone, only shifting negative below .7403.

4 Hour AUDUSD Chart

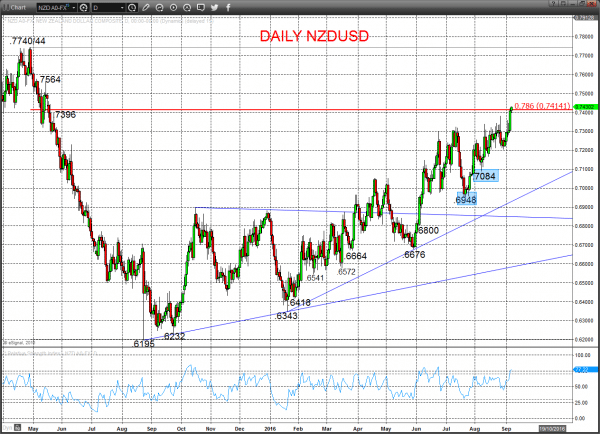

NZDUSD

A Tuesday surge above .7347/60 and the cycle high at .7380, to also overcome 2015 chart resistance at .7396 and probe 2015-16 retrace resistance at .7414.

This reinforces the late August rebound from chart/ retrace support in the .7165/63/44 area to keep a bull bias Wednesday.

For Wednesday:

- We see an upside bias for .7445 and .7458; break here aims for .7500/02.

- But below .7380 opens risk down to .7325, maybe .7293.

Short/ Intermediate-term Outlook – Upside Risks:

- We see a positive tone with the bullish threat to .7396/7413.

- Above here targets .7516/64 and .7744.

What Changes This? Below .7106 eases bull risks; through .7084 signals a neutral tone, only shifting negative below .6948.

Daily NZDUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.