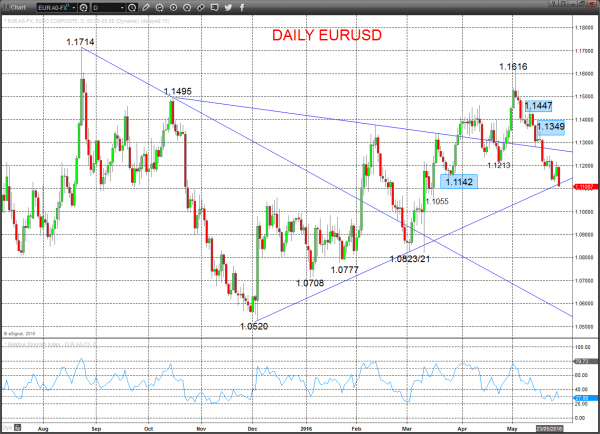

The US Dollar has stayed strong across the major G7 currencies over the past 2-3 weeks, with EURUSD losses from mid-May seeing a weaker tone for the Euro versus the Greenback since the break below 1.1142 (as we have highlighted here previously)!

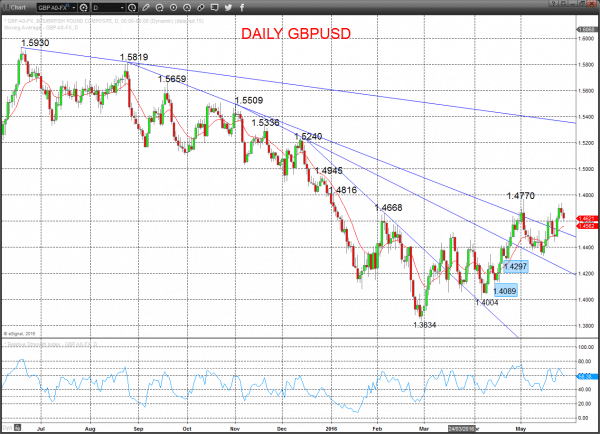

Conversely and despite uncertainty around the “Brexit” vote,, Cable (GBPUSD), continues to defend support levels on setback and probe up through resistances, to maintain an underlying basing structure and bullish tone through late May and now like into early June.

A fading rebound effort Thursday stalling ahead of 1.1227/43 resistances encouraged the plunge lower Friday to a new setback low through 1.1127 to leave a negative bias for Monday.

Furthermore, the previous break down through 1.1142 support produced an intermediate-term bearish shift.

For Monday/Tuesday:

- We see a downside bias for 1.1105/00; break here aims for 1.1055.

- But above 1.1148 aims for 1.1200/17, which we would look to try to cap.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 1.1055.

- Below here targets 1.0823/21 and 1.0777/08.

What Changes This? Above 1.1349 signals a neutral tone, only shifting positive above 1.1447.

Daily EURUSD Chart

A Friday setback from a new recovery high on Thursday (1.4740) ahead of the cycle high at 1.4770, and despite probing below minor support 1.4637, whilst above 1.4584 we see a rebound bias early this week and for Monday.

For Monday/Tuesday:

- We see an upside bias for 1.4689; break here aims for 1.4740 and 1.4770.

- But below 1.4584 opens risk down to 1.4525/20.

Short/ Intermediate-term Outlook – Upside Risks:

- We see a positive tone with the bullish threat to 1.4816.

- Above here targets 1.4945, 1.5000 and 1.5240.

What Changes This? Below 1.4297 signals a neutral tone, only shifting negative below 1.4089.

Daily GBPUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.