Extremely erratic price action across asset classes on Wednesday through the US election result, with an initial “risk off” move. This saw equity markets suffering significant losses, bond markets moving meaningfully higher, whilst the US Dollar endured noteworthy losses within the G3 currency complex, with a safe haven rally for the Japanese Yen and Euro.

However, a strong intraday turnaround with a move back to “risk on” produced equity market rebounds, a bond market sell-off and a strong US Dollar recovery against both the Yen and Euro.

This leaves the risk for further EURUSD downside and USDJPY upside into November.

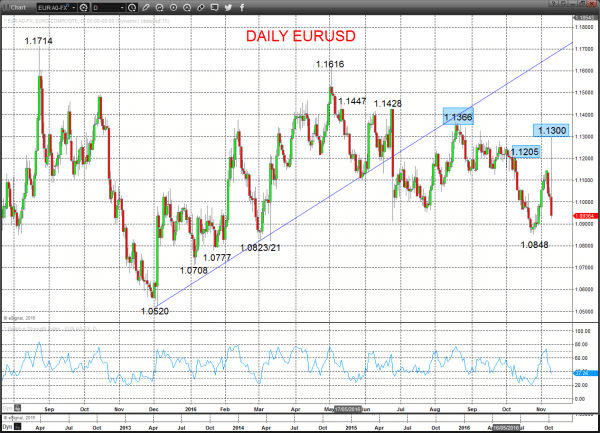

EURUSD

An initial surge higher Wednesday produced a push up through resistance at 1.1205, which shifted the intermediate-term outlook back to neutral.

However, the aggressive sell-off back through 1.0987 has signalled an intermediate-term shift back to her bearish theme and also leaves the risk to the downside into Thursday.

For Today:

- We see a downside bias through 1.0920 for 1.0880 and 1.0848; break here aims for 1.0823/21, maybe as well as 1.0777.

- But above 1.1036 opens risk up to 1.1110.

Short/ Intermediate-term Outlook – Downside Risks:

- We see a negative tone with the bearish threat to 1.0848 and 1.0823/21.

- Below here targets 1.0777/08 and maybe 1.0520.

What Changes This? Above 1.1300 signals a neutral tone, only shifting positive above 1.1366.

Daily EURUSD Chart

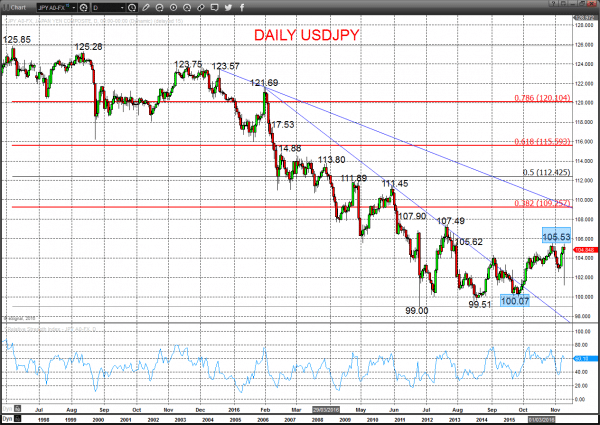

USDJPY

A plunge lower early Wednesday below support at 101.62 signalled an intermediate-term shift from bullish to neutral.

However, the strong rebound from 101.15 through various resistance points from the aggressive sell-off has shifted the bias back to the upside into Wednesday, with also risk of an intermediate-term shift back to bullish, but only signalled above 105.53.

For Thursday/Friday:

- We see an upside bias for 105.47 and key 105.53; break here aims for 106.04 and 106.55.

- But below 104.12 opens risk down to 102.97.

Short/ Intermediate-term Range Parameters: We see the range defined by 105.53 and 100.07.

Range Breakout Challenge

- Upside: Above 105.53 aims higher for 107.49 and 109.26.

- Downside: Below 100.07 sees risk lower for 99.51, 99.00 and 96.57.

Daily USDJPY Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.