Although the US Dollar has been generally strong across major G10 currencies from early to mid-May, recent price action versus the Euro and GB Pound has reflected differing outlooks.

EURUSD pushed last week through a key support at 1.1213 to shift negate the underlying bull theme from late 2015 and to leave risks lower into late May

However, Cable (GBPUSD), has retained a bullish tone (despite a dip Friday), to leave upside pressures through month-end.

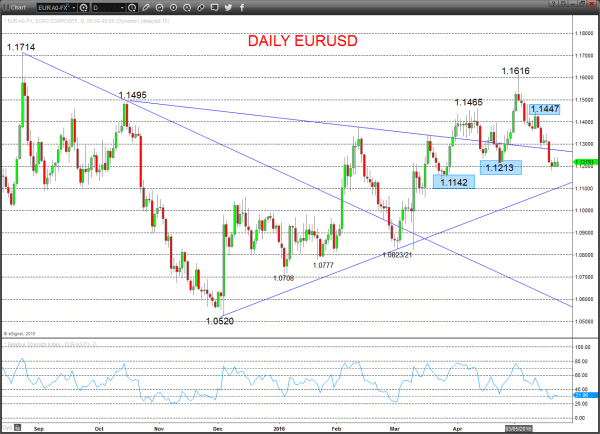

EURUSD

As probe below 1.1213 Thursday produced an intermediate service shift from a bullish to a neutral tone; the risk is now growing for a push through 1.1142 support, which sees a bearish switch.

The low level consolidation Friday, capped below minor resistance at 1.1255 also leaves the bias lower Monday.

For Today:

- We see a downside bias through 1.1177; break here aims for critical 1.1142, maybe 1.1105/00.

- But above 1.1255 opens risk up to 1.1293.

Short/ Intermediate-term Range Parameters: We see the range defined by 1.1447 and 1.1142.

Range Breakout Challenge

- Upside: Above 1.1447 aims higher for 1.1714 and 1.1871.

- Downside: Below 1.1142 sees risk lower for 1.1055 and 1.0823/21.

Daily EURUSD Chart

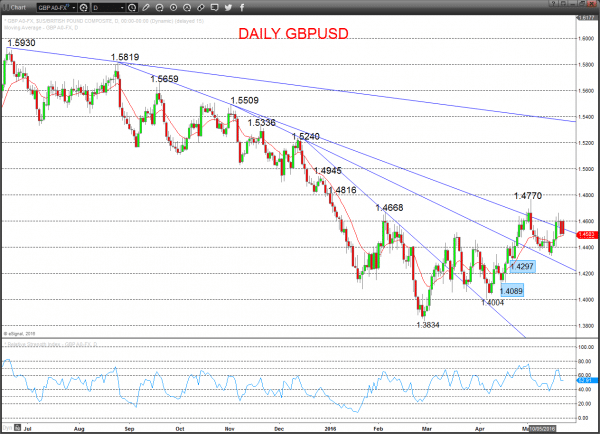

GBPUSD

A probe last week above firm resistances at 1.4531/44 and 1.4572/75 reinforced the intermediate term bullish view, but the setback Friday through 1.4525/20 support shifts the bias back to the downside for Monday.

For Today:

- We see a downside bias for 1.4455/50; break here aims for 1.4399.

- But above 1.4586 opens risk up to 1.4664.

Short/ Intermediate-term Outlook – Upside Risks:

- We see a positive tone with the bullish threat to 1.4816.

- Above here targets 1.4945, 1.5000 and 1.5240.

What Changes This? Below 1.4297 signals a neutral tone, only shifting negative below 1.4089.

Daily GBPUSD Chart

Forextraders' Broker of the Month

BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups. The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners.